London-based IHS Holding Limited (NYSE: IHS), operating as IHS Towers, reported 1Q24 organic revenue growth of 35 percent year-over-year. However, that growth was negatively impacted by foreign exchange headwinds, particularly the devaluation of the Nigerian naira, in the company’s largest market. As a result, total 1Q24 revenues were $418 million, down by 31 percent YoY and Adjusted EBITDA dropped 45 percent YoY to $185 million.

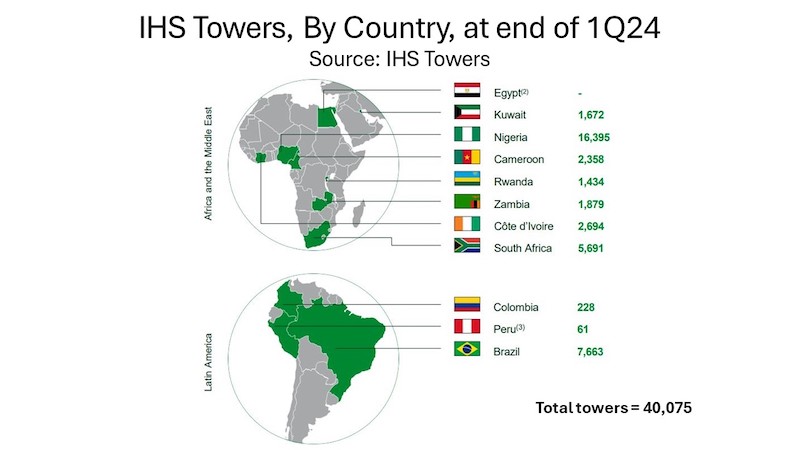

IHS Towers’ commercial business is progressing, nonetheless. In the quarter, the company built 216 towers, including 158 in Brazil, across its markets in Africa, the Middle East and South America, bringing its total portfolio to 40,075. It says that Brazil, its second largest market, is one of its fastest growing. The company added 270 tenants and 523 lease amendments along with signing a new 3,950 tenant multi-year roll-out agreement with Airtel in Nigeria, which included a three-year contract extension, Inside Towers reported. IHS Towers also renewed its master lease agreements with MTN in Zambia for another 10 years and extended its MLA with MTN South Africa for another two years until 2034.

Capital expenditures in 1Q24 were $53 million, compared to $153 million for 1Q23. The $100 million decline across Nigeria, Sub-Saharan Africa and the Middle East and North Africa regions, was partially offset by a small increase in Latin America.

The decrease in Nigeria was due mainly to a Project Green reduction. LatAm capex increased with new site builds, tower augmentations and maintenance, partially offset by decreases in fiber investments, corporate expenses and land purchases.

IHS Towers’ expects full-year 2024 organic revenue YoY growth of approximately 49 percent. With adjustments for FX rates, the company’s midpoint guidance for revenue is $1.715 billion, down 19 percent compared to 2023 revenues and Adjusted EBITDA of $945 million, down 14 percent YoY. It is budgeting $350 million in capex for approximately 850 build-to-suit sites with roughly 600 sites in Brazil. Capex guidance includes about $10 million for Project Green as it winds down.

Project Green is IHS Towers’ carbon reduction roadmap for lowering Scope 1 and 2 kilowatt-hour emissions by 50 percent by 2030, with a planned investment of $214 million by 2024. Through the end of 1Q24, the company invested $206 million in Project Green.

In its 2023 Sustainability report, the company said that it reduced Scope 1 and Scope 2 KwH emissions intensity by approximately 6 percent compared with 2022, and an estimated 11 percent reduction since 2021. At the end of 2023, IHS Towers reported that 48 percent of its sites were powered with hybrid systems that combine diesel generators with solar and/or battery systems.

Commenting on the company’s previously announced strategic review, Sam Darwish, IHS Towers Chairman and CEO said the company is considering several options that inlcude:

- increasing operating profitability and cutting capex to increase cash flow;

- exiting non-strategic or non-performing markets with a goal of raising $500 million to $1 billion over the next 12 months. To wit, IHS Towers completed the sale of its Peru subsidiary with 61 towers to SBA Communications (NASDAQ: SBAC) on April 30, 2024; and,

- allocating increased cash flow and disposal proceeds to reduce debt, buy back shares and introduce a dividend policy.

By John Celentano, Inside Towers Business Editor

Reader Interactions