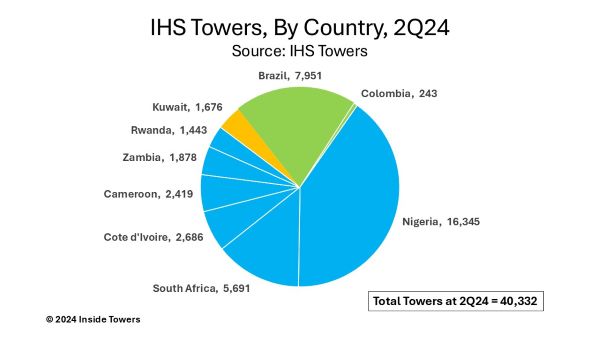

IHS Holdings Ltd. (NYSE: IHS), based in London and operating as IHS Towers, at the end of 2Q24, had in service 40,332 towers across nine countries in Africa, Latin America and the Middle East. That figure is up by 1,034 towers from 2Q23. In the quarter, the company reported that it built 207 towers including 136 in Brazil, its second largest market. IHS Towers’ 2Q24 report shows that Nigeria is its biggest market accounting for 40 percent of its tower portfolio and over 60 percent of its revenues.

Revenue for 2Q24 was $435 million, down 20 percent from $546 million in 2Q23. Adjusted EBITDA came in at $251 million, also down by 12 percent year-over-year. Nonetheless, IHS Towers’ underlying business is performing well. Besides new tower additions, tenancies grew over three percent YOY to 60,382 for a tenancy ratio of 1.5x. Lease amendments were up 13 percent YoY to 38,692. That growth was bolstered by recent renewals and extensions of all tower Master Lease Agreements covering approximately 13,500 tenancy contracts until December 2032 with MTN Nigeria, its largest mobile network operator customer, Inside Towers reported.

Nigeria is both a boon and a bane for IHS Towers. Though still its most attractive market, the company’s revenue has been hurt by the devaluation of the Nigerian naira. The currency has slumped more than 70 percent against the U.S. dollar since a new government under President Bola Tinubu came to power in May 2023, and began implementing foreign-exchange and other economic reforms.

IHS Towers said in March that it is working with advisers including JPMorgan Chase to evaluate strategic alternatives for the business across its portfolio and capital allocation priorities. The company is exploring a potential sale of its businesses in Rwanda and Zambia, its two smallest markets in Africa, Bloomberg reported. Sources suggest that the company plans to evaluate bids from potential buyers for its operations in the two countries, with some proceeds from any disposals likely to be used to pay down debt.

In a statement, the company said that despite the currency devaluation in Nigeria, “we believe in the underlying strength of our business and believe our equity is undervalued given Africa’s perceived place in the global markets.”

The company’s full-year 2024 midpoint guidance includes revenue of nearly $1.7 billion compared to $2.1 billion for 2023. This revenue guidance implies organic growth of approximately 48 percent, including the positive impact of the MTN Nigeria renewals and extensions. Adjusted EBITDA guidance is $910 million, down from $1.1 billion in 2023.

Projected capital expenditure of $330 million includes roughly 850 built-to-suit sites across its portfolio, of which 600 are in Brazil, and $10 million of remaining investment in Project Green, the company’s sustainability project.

By John Celentano, Inside Towers Business Editor

Reader Interactions