The tower market in India may see a significant slowdown as the country’s leading mobile network operators, Reliance Jio and Bharti Airtel, near completion of their respective 5G network expansion and scale back on capital expenditure, Economic Times reported. As a consequence, demand for new tower leasing is likely to decline and tower companies are likely to see flat to slow growth in the next five years. With India’s third largest MNO, Vodafone Idea, ongoing 5G rollouts and 4G coverage expansion are likely to create short-term demand, according to analysts.

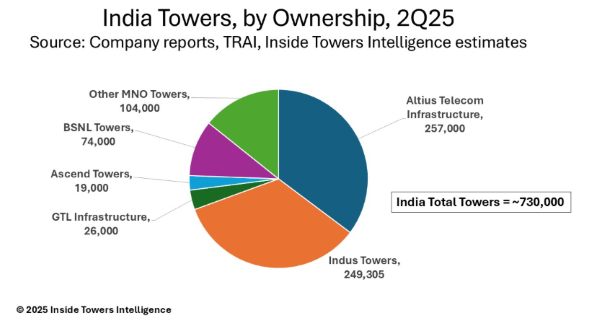

Out of the nearly 730,000 telecom towers in India – the second largest in the world after China, according to Inside Towers Intelligence – about 257,000 are run by Brookfield Asset Management (NYSE: BAM)-backed Altius Telecom Infrastructure Trust (formerly Data Infrastructure Trust), which counts telecom market leader Reliance Jio as its largest tenant. Indus Towers (NSE: INDUS), which is majority owned by the country’s second-largest telecom operator, Bharti Airtel, currently reports 249,305 towers. Other major tower companies include GTL Infrastructure, with 26,000 towers, Ascend Telecom, with about 18,600 towers and BSNL Towers, the infrastructure arm of state-owned MNO BSNL, with around 74,000 towers.

India’s telecom sector capex has materially declined since 2022-23, when 5G rollouts started. While Reliance Jio was most aggressive in the first two years of rollout, Bharti Airtel’s capex was calibrated over four years. Meanwhile, Vodafone Idea, which has just started its 5G rollout and 5G network expansion, is unlikely to move the needle on tower additions to that extent.

Net additions of 5G base transceiver stations (BTS) that make up roughly half of India’s network capex, according to Inside Towers Intelligence, also nosedived, to 8,000 in just the third year of 5G rollouts, down from 141,000 in FY2023.

Analysts expect a lull for India’s tower companies in the next five years, as significant new tower builds or BTS additions are likely only when telecom operators buy new spectrum bands to deploy 6G.

“5G is being deployed only on two spectrum bands – 700 MHz and 3300 MHz – implying industry BTS per tower should start stabilizing,” ICICI Securities said in a research report. The analysts estimate that, until new spectrum becomes available for 6G, existing 4G spectrum will be re-farmed for 5G along with 5G BTS replacements of 4G on the same sites. The likely result is that the number of BTSs per tower will remain unchanged for the next several years.

By John Celentano, Inside Towers Business Editor

Reader Interactions