For more in-depth wireless infrastructure analytics and insights, subscribe to Intelligence by Inside Towers

On the final trading day of the summer, infrastructure company stocks reflected, as they have all year, a negative investor sentiment in the face of inflation and high interest rates. As of the close of business on Friday, our Wireless Infrastructure Value Index, a composite of the 12 infrastructure stocks, had an aggregate market capitalization of $375 billion. That figure is down more than 4 percent over the prior week’s level of $392 billion, representing a market cap loss of over $17 billion for the week.

The Index comprises a mix of 12 publicly-held companies: three tower companies – American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC); five data center companies – Equinix (NASDAQ: EQIX), Digital Realty Trust (NYSE: DLR), Cyxtera Technologies (NASDAQ: CYXT), Iron Mountain (NYSE: IRM), and Switch (NYSE: SWCH); two fiber companies – Lumen Technologies (NYSE: LUMN) and Uniti Group (NASDAQ: UNIT); and, two digital infrastructure companies – Brookfield Infrastructure Partners (NYSE: BIP) and DigitalBridge Group (NYSE: DBRG).

The top five companies including the Big 3 tower companies (AMT, CCI, SBAC), and the leading data center companies (EQIX, DLR) accounted for $316 billion or 84 percent of the total market cap. That figure was down one percent from the $330 billion in the prior week.

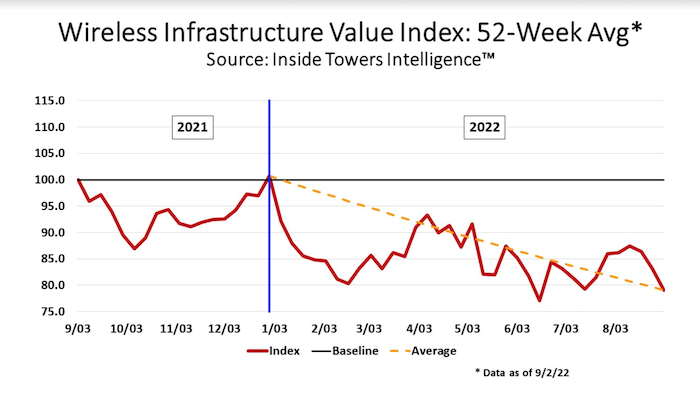

Over the 52-week period prior to our publish date, the stock prices of these 12 companies collectively have declined more than 13 percent. For the week ending September 9 compared to the prior week, market caps for towercos were down 4 percent, data centers dropped 5 percent, fibercos declined 8 percent and infracos were down 5 percent.

The Index has been in a nosedive since the beginning of 2022. Aggregate stock prices of the 12 companies that make up the Index have declined at a compounded average of nearly 1 percent a week. From a high of 100.7 on December 31, the highpoint for 2021, the Index has been on a downward-sloping roller coaster, dropping to 79.1 at the market close on September 2.

Despite the stock market jitters, the secular trends and drivers for the infrastructure business have not changed. In fact, the underlying business prospects of these companies are sound. To wit, in their 2Q22 earnings calls, all the North American mobile network operators either confirmed or revised upward their network capital expenditures for 2022. Many international MNOs echoed similar commitments to upgrade and expand their networks to 4G and 5G.

The rationale for continued high capex levels holds true in all markets because the number of mobile devices being used is increasing and mobile data usage by those devices continues to escalate. In response, the MNOs must continue to expand their network coverage and capacity or risk losing market share, and investor confidence. Consequently, the infrastructure companies that support them are responding in kind.

Consider the string of announcements on which Inside Towers has reported since the beginning of the year:

- Crown Castle – in January, expanded its T-Mobile strategic relationship with a long-term tower and small cell agreement.

- American Tower – last week, announced a new long-term agreement with Verizon; in July, private equity firm Stonepeak invested in American Tower’s data center business.

- Equinix – in January, expanded its European presence with its tenth data center in Paris; entered Africa with the MainOne acquisition in April; in May, expanded in Latin America, acquiring four data centers in Chile.

- Digital Realty – in August, acquired Teraco data centers in SouthAfrica. Unveiled numerous data center capacity and service expansions in Europe, the Middle East and Southeast Asia since the beginning of 2022.

- Lumen Technologies – rolled out a number of new fiber and edge service expansion in Europe and Latin America.

- DigitalBridge Group – with Brookfield, acquired Deutsche Telekom’s GD Towers in July; Invested in EdgePoint Infrastructure towers in the Philippines in June. Along with IFM, acquired and is taking private Switch in May. In March, acquired Telenet towers in Belgium; shared ownership of some of its primary holdings like DataBank with outside investors.

All this activity points up the fact that these companies are taking steps today to position themselves well for growth and profitability over the long term, despite the short-term stock market hits.

By John Celentano, Inside Towers Business Editor

Reader Interactions