Lumen Technologies (NYSE: LUMN) is excited about getting its Quantum Fiber platform in front of more customers. “We are positioning our Quantum Fiber platform for a major acceleration. Our robust symmetric, all-digital experience is resonating with customers. Quantum will help drive revenue growth and lower the operating costs for our Mass Markets segment, improving the profitability and durability of the business,” remarked Jeff Storey, Lumen President and CEO during the company’s 4Q21 earnings call.

Performance for 4Q21 and full-year 2021 was down across the board on a year-over-year basis, attributed to COVID impacts, business and residential dislocations, and supply chain issues.

Overall revenues were $19.7 billion, down 5 percent. Business accounted for 72 percent of total revenues and Mass Markets the 28 percent balance. Adjusted EBITDA was flat at $8.4 billion. Free cash flow was $3.6 billion, up 29 percent due to reduced capital expenditures on legacy copper infrastructure. 2021 capex was $2.9 billion, down from $3.7 billion in 2020.

Management sees 2022 as a transformative year. The company will close by 3Q22 on the two major divestitures announced in 2021, one involving its incumbent local exchange carrier (ILEC) operations in 20 U.S. states, and the other, its Latin American operations, as Inside Towers reported. Lumen garners over $10 billion on the two deals.

With streamlined operations, Lumen is focusing on driving growth with both domestic and international Business customers, and the Mass Market customers it retains across its 16-state ILEC operations.

Neel Dev, Lumen CFO commented, “We have significantly stepped up our investments and growth initiatives for Enterprise and scaling our Quantum Fiber business.”

The company is making significant investments in its 450,000 route-mile long haul fiber network and edge computing facilities. Lumen claims that over 95 percent of all U.S. Enterprises are within 5 milliseconds of its network, thereby enabling a range of high speed, real-time applications.

Of its $3.2-3.4 billion capex guidance for full-year 2022, Lumen is allocating $1 billion towards Quantum Fiber that delivers nearly 1 Gbps symmetrical connectivity to homes and small businesses. At year-end 2021, it reported 4.5 million broadband connections, including 2.6 million fiber connections. Copper-based broadband connections are declining steadily.

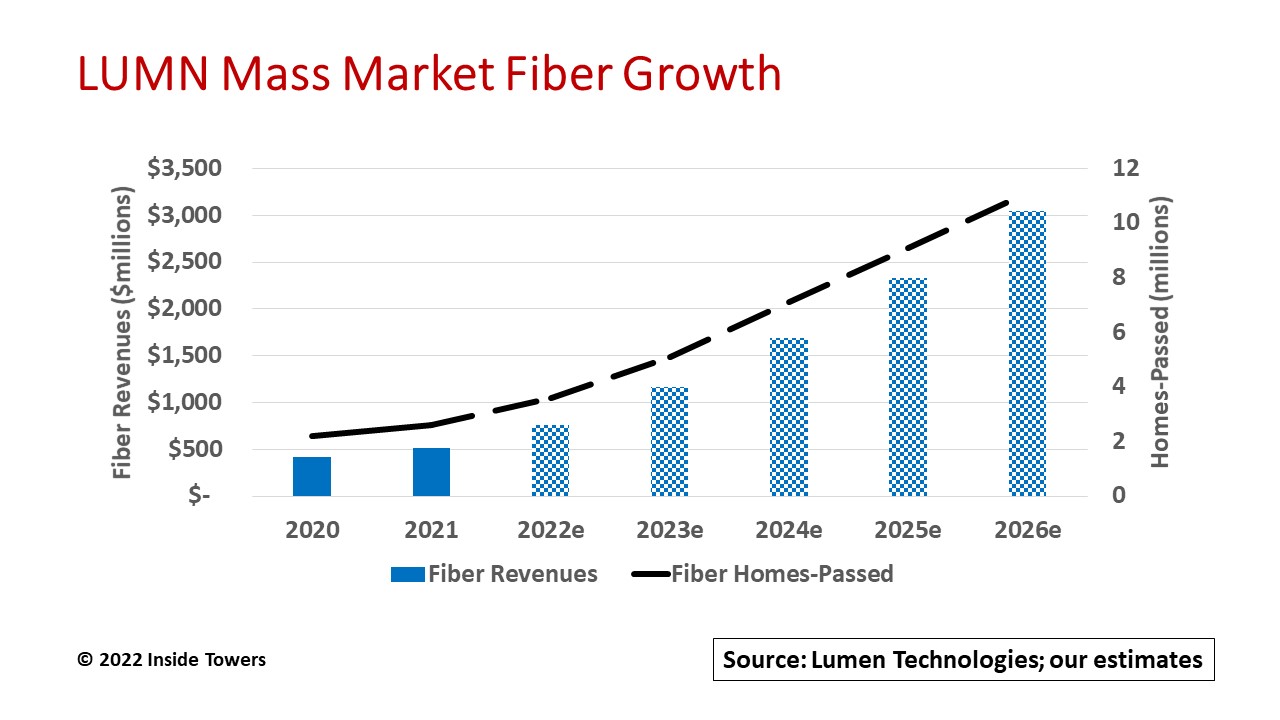

Across its 16-state region, Lumen has roughly 21 million addressable home and small business locations. Its goal is to pass 12 million of these locations with Quantum Fiber over the next 5-6 years. In 2021, it deployed Quantum Fiber at a pace of 400,000-500,000 passings a year. The company expects to ramp up to a one million a year pace throughout 2022, then accelerate to a 1.5-2.0 million homes-passed run-rate going into 2023.

Even with a relatively small footprint and limited marketing activities, Quantum Fiber has reached 29 percent penetration, meaning the proportion of homes-passed that bought a connection. With a concerted promotional program, Lumen believes it could achieve penetration rates of over 40 percent. The combination of a growing base of homes passed, higher penetration rates and increased ARPU is expected to drive a significant new Mass Market revenue.

“Incumbency provides us a meaningful cost advantage, as we build and launch new Quantum markets and drive penetration gains. Our expectation for long-term penetration is fully supported by the strength of the product, as well as the performance in our existing Quantum markets,” Storey said. “As we pivot from micro targeting to a market-based approach, we expect to be able to attract and retain new and existing customers to our superior product capabilities much more aggressively. The opportunity for Quantum is significant.”

By John Celentano, Inside Towers Business Editor

Reader Interactions