UPDATE DirecTV is terminating its proposed acquisition of EchoStar’s (NASDAQ: SATS) satellite TV business, which includes rival DISH DBS Network, after bondholders voted against a pivotal debt exchange, Bloomberg reported. A group of DISH bondholders rejected an improved offer tabled by DirecTV at the end of October. The acquisition required DISH bondholders to swap their existing debt for new debt in the merged entity but take a haircut of a little over $1.5 billion on the principal amount of the company’s debt. The termination of the deal, which would have created the largest pay-TV provider in the U.S. according to Inside Towers Intelligence, was effective as of midnight on November 22.

DirecTV indicated that the DISH deal termination does not affect private equity firm TPG Capital’s (NASDAQ: TPG) acquisition of AT&T’s (NYSE: T) 70 percent stake in DirecTV, That transaction is expected to close in the second half of 2025.

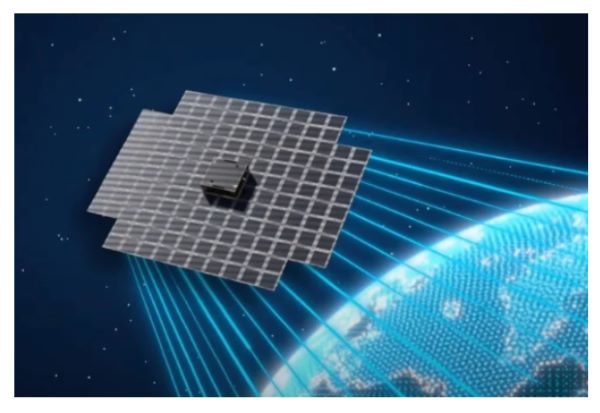

Not being able to jettison the DISH DBS business to focus on its wireless initiative as Echostar had earlier indicated, raises questions about its future. The company has previously said that such a deal would help clean up its balance sheet and give it financial flexibility to focus on building out its 5G network and grow its mobile subscriber base. Other than acknowledging the termination of the DirecTV deal in a SEC 8K filing, EchoStar has not yet commented on its next steps.

By John Celentano, Inside Towers Business Editor

Reader Interactions