Ronin Revolution Corp., manufacturer of powered ascenders and climbing accessories used by tower climbers, has been acquired by Spartaco Group which owns a portfolio of professional tool companies that serve a diverse set of customers across related verticals.

Ronin Revolution Corp., manufacturer of powered ascenders and climbing accessories used by tower climbers, has been acquired by Spartaco Group which owns a portfolio of professional tool companies that serve a diverse set of customers across related verticals.

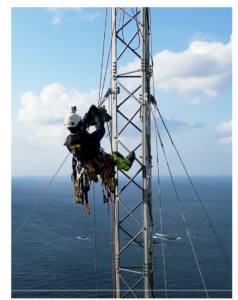

Ronin’s line of powered ascenders, which is also used in the power utility, arboriculture, and military markets, will be added to Spartaco’s portfolio of tools, serving the power and gas utilities, broadband infrastructure, industrial/electrical, vegetation management, and military end segments. Spartaco’s brands include Jameson, Jameson Tactical Lighting, Huskie Tools, TiiGER and Bulldog Bender.

Spartaco’s companies serve complementary industries to Ronin. In particular, Jameson supports telecommunication cable installation and maintenance, featuring equipment for overhead cable placement and underground fiber and cable, in addition to tree care. The Huskie brand serves power utilities with hydraulic cutting and compression equipment.

“To grow this business, our goal was to merge into the right kind of company that understands the tool space,” said Bryant Bertrand, Co-Founder & CEO of Ronin. “We don’t want the Ronin Lift to be seen as a gadget — a technology with only niche uses. We want this tool to be leveraged across widespread applications, by every single worker at-height.”

The merger with Spartaco, which is backed by Platte River Equity, will help Ronin achieve its next stage of growth and scalability so it can reach that broader market with its technology in the coming years.

“We are excited to partner with Ronin to accelerate its growth and expansion,” Mike Reilly, Principal of Platte River Equity, said in a press release. “Ronin’s powered ascenders are a step forward for the safety of at-height infrastructure workers, and we believe that Spartaco is an ideal partner to help them reach their full potential.”

As a part of Spartaco, Ronin will be able to develop additional distribution channels in different vertical markets and set up new sales channels for its product line.

“This is our first opportunity to really push our tool in the marketplace, focusing on specific verticals,” Bertrand said. “What helps from a sales standpoint is having people who understand those markets, channels, and customer needs.”

The acquisition is indicative of Ronin’s longevity. “This gives confidence to larger companies that we will be around for years to come. It will be a lasting company,” Bertrand said.

Ronin released its line of powered ascenders in 2018. Since then, the telecom market has grown to 30 percent of its sales. The product also goes into tree care, wind, mining, oil and gas, concert stage rigging, power utilities, and other big industries. Although the Ronin Lift is still a relatively new technology, these industries are starting to rapidly move and adopt it, according to Bertrand.

“When we got into the telecom industry, it was a small segment for us,” Bertrand said. “Telecom is growing quickly. It has become an extremely large segment, thanks to the work done by NATE, the Communications Infrastructure Contractors Association, and its Safety Equipment Manufacturers Committee, developing best practices for the technology.”

Ronin was founded by Bertrand as a self-funded business. He said that keeping up with rapid growth rates has been a challenge for the small company, especially as it entered additional markets. “When additional technology consumption started happening, and national accounts started coming online, there were a lot of growth requirements that needed support,” Bertrand said.

With a merger comes change. Bertrand clarifies that, even as Ronin grows, some things will not change, like the company’s commitment to safety and its employees.

“We’re a very workers-first, customers-first type of company,” Bertrand said. “We pride ourselves on our customer service and excellence, as well as the safety and the quality of our products. And I want to make sure we continue and even improve that.”

As a part of Spartaco, Ronin will remain independent regarding brand and operations. But it will tap into the company’s resources, moving assembly from Placentia, California, to Spartaco’s facilities in Clover, South Carolina, which increases its scale.

According to Bertrand, companies that adopt powered ascenders within telecom will become the best-in-class organizations because they provide the safest environment to their workers and the best efficiency on the job site. “Using powered ascenders will allow them to deliver the best pricing to their customers because they’re bringing in cutting-edge technology,” Bertrand said. “They will also allow companies to move ahead of the competition in terms of being able to provide services, health, and attraction to the industry for the worker base.”

Even before this merger, Ronin was already doubling in size every year. Bertrand estimates powered ascenders will eventually be a $100 million-plus market annually as soon as the technology is universally recognized as critical to the personal protective equipment space.

“Eventually, this product is regulated and mandated by OSHA,” Bertrand said. “After they realize the safety and efficiency that powered ascenders bring to the industry, they will be no different than helmets and harnesses. And, so at that point, the market will be massive.”

Find more information about Ronin at https://roninpowerascender.com/. Subscribe to the Ronin email list to stay current on Ronin’s offerings.

Reader Interactions