SBA Communications (NASDAQ: SBAC) is navigating a steady course on solid gains. The company reported 4Q21 site leasing revenues of $539 million, up over 9 percent compared to 4Q20 and full-year 2021 site leasing revenues of $2.1 billion, up 8 percent on a year-over-year basis. Adjusted EBITDA in the quarter grew to $409 million, a nearly 8 percent YoY increase while AFFO jumped 11 percent to $311 million.

The company indicated that it achieved record results in several categories and that it is well-positioned for continued growth in 2022. SBAC attributed the increase to 2021 lease up activity levels that were ahead of plan in both the U.S. and internationally. Moreover, the company said that the U.S. market came in with the highest level of fourth quarter organic new leasing revenue per tower signed up in the past seven years.

T-Mobile is SBAC’s largest customer, accounting for 40 percent of domestic revenues. T-Mobile drove a lot of activity on SBAC sites as it continued its rapid nationwide 5G deployment utilizing both 2.5 GHz and 600 MHz spectrum. Verizon and AT&T are SBAC’s second- and third-ranked customers, respectively, and together account for 50 percent of SBAC’s 2021 site leasing revenues. Verizon was very active on SBAC’s towers as it ramped up its C-band deployments. AT&T activity was steady through 2021 but SBAC expects more activity from AT&T in 2H22 as the company deploys C-band and 3.45 GHz spectrum simultaneously. SBAC said that DISH continued signing up a large number of new lease agreements throughout 2021 as it deployed its nationwide 5G network in a number of markets around the country, as Inside Towers has reported.

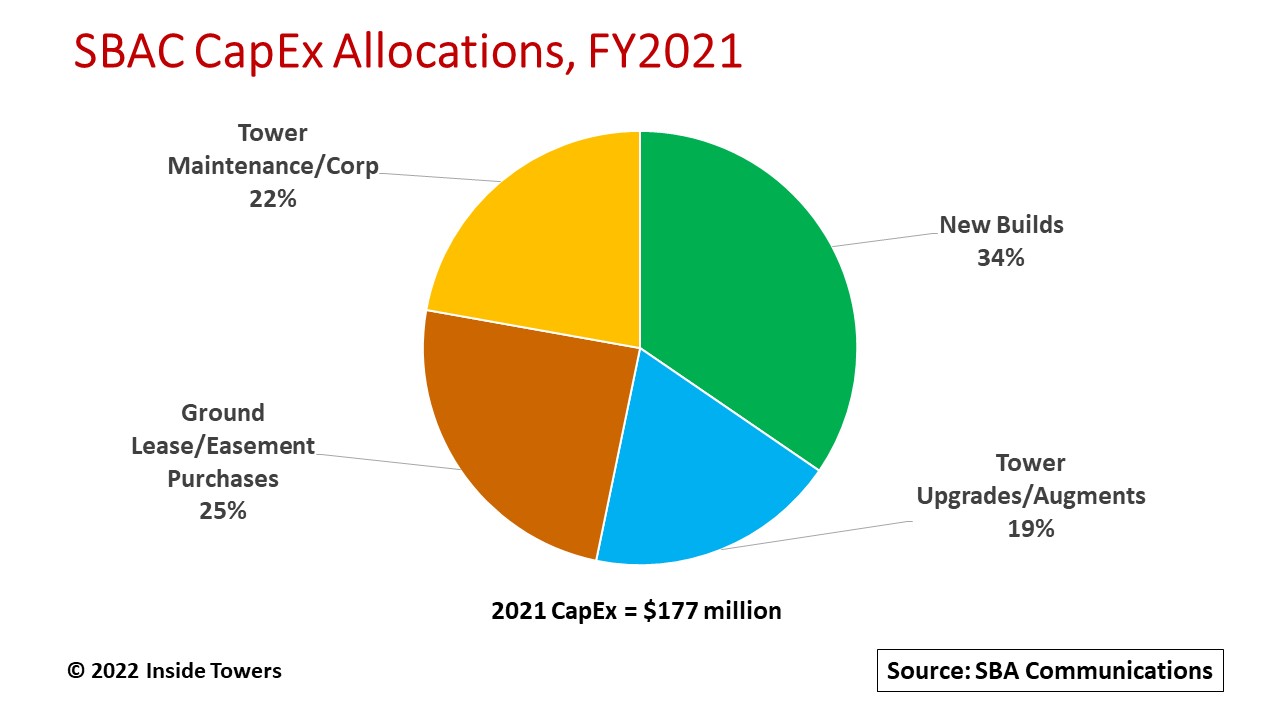

SBAC reported capital expenditures of $177 million for 2021. This figure includes discretionary capex for new builds, tower upgrades and ground lease and easement purchases, along with non-discretionary spending for tower maintenance and corporate operations. In addition, the company spent over $1.2 billion in acquisitions, the biggest portion for over 700 towers it acquired from PG&E early in 2021 and other tower purchases throughout the year, mainly in its Latin American markets.

The company ended the year with a total of 34,177 towers, a net increase of 1,254 towers over 32,923 towers at year-end 2020. In 2021, SBAC acquired 991 towers, with the largest portion coming from the PG&E acquisition. The company also built 335 towers, mainly in international markets. At the same time, SBAC sold or decommissioned 72 towers.

It is interesting to note that of the total tower portfolio, there are 17,356 in the domestic market and 16,377 are in international markets, a 51-49 percent split. Yet the company derives 80 percent of its site leasing revenues from the domestic market. Note as well that the tower count does not include the 1,445 towers that SBAC acquired from Airtel Tanzania in a deal that closed in January.

The company recently commenced operations in the Philippines where it is entering the market on a greenfield basis by constructing its own towers. Management sees opportunities in the country that has multiple mobile network operators and where SBAC believes it can gain a competitive advantage over several incumbent tower companies. Management suggested that emerging markets like Tanzania and the Philippines offer SBAC a lower barrier to entry where it can gain a competitive advantage compared to going into developed markets, such as Europe.

SBAC sees continued growth momentum through 2022. For full year 2022, it provided guidance for leasing revenues of $2.24-2.26 billion, adjusted EBITDA of $1.67-1.69 billion and AFFO of $1.26-1.30 billion. It expects its discretionary capex to be $525-545 million for new tower builds, tower augmentations, site acquisitions and ground lease purchases along with another $45-55 million for tower maintenance and general corporate capex.

By John Celentano, Inside Towers Business Editor

Reader Interactions