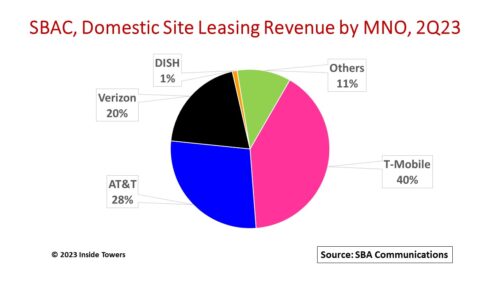

SBA Communications (NASDAQ: SBAC) is a solid performer in 2Q23 despite experiencing a decline in its services business similar to what the other tower companies reported. Domestic site leasing revenues for the quarter were $457 million or 72 percent of the $626 million total. That figure is up over three percent from $442 million in 2Q22, reflecting mainly the contribution of fixed escalators, typically three percent on lease agreements. By contrast, its International site leasing revenues were up 22 percent YoY to $169 million driven by inflation-indexed escalators, energy cost pass throughs, and foreign exchange rates. SBA upped its guidance for full-year 2023 consolidated site leasing revenues to $2.5 billion compared to $2.3 billion in 2022.

Site development revenues declined 27 percent YoY to $52 million as SBA’s big U.S. mobile network operator tenants slowed cell site installation activity. To wit, AT&T and Verizon completed their respective Phase I C-band deployments, T-Mobile wrapped up its Sprint network integration and DISH met its 70 percent population coverage bogey in June. SBA does not expect to change how it handles the services business that includes site acquisition, permitting and site prep activities, with its own staff and contractors. Despite the decline in the quarter, SBA is maintaining its previous FY2023 guidance for site development revenues of $215 million at the midpoint.

In 2Q23, amendment activity accounted for 42 percent of SBA’s domestic bookings and new leases represented 58 percent. The company indicated that Big 4 MNOs – AT&T, T-Mobile, Verizon, and DISH – represented approximately 89 percent of total incremental domestic leasing revenue that was signed up during the quarter.

SBA says that the MNOs remained active with their networks during the quarter. The company acknowledges that execution levels from several MNOs were below its prior expectations. Longer term, however, SBA sees a significant runway for new 5G-related leasing activity based on the number of its sites that remain to be upgraded with mid-band spectrum deployments including C-band, 3.45 GHz, and 2.5 GHz.

Domestic churn was up somewhat during the quarter, primarily due to faster decommissioning of legacy Sprint leases than SBA expected. The company said this situation was the opposite of what it experienced with Sprint site decommissioning in 2022.

SBA announced a new long-term MLA with AT&T, Inside Towers reported. The MLA’s initial term is five years with renewal options and an annual escalator that is “north of three percent,” according to the company.

While the company says it tailors MLA terms and conditions for each MNO, it has tended to set á la carte terms, meaning once a base monthly rental rate is established, then the MNO is charged for each change or modification to its RAD center on an SBA tower. This is different from the holistic, all-inclusive MLAs that American Tower and Crown Castle like to establish. Without providing details, SBA says that it has established a “comprehensive” agreement that will streamline AT&T’s deployment of 5G solutions across its tower portfolio while providing SBA with committed future leasing growth from AT&T for many years.

During the quarter, the company bought nine towers and built two in the domestic market, built another 62 in its international markets, and decommissioned or sold another nine towers. As of June 30, SBA owned a total of 39,426 towers with 22,000 towers in international markets, mainly Brazil, South Africa, and Tanzania, and 17,426 in the domestic market. SBA management says that although it has “no strategic hole to fill,” it continually assesses potential acquisitions for portfolio expansion. Management points out that there are currently few attractive deals on the market.

By John Celentano, Inside Towers Business Editor

Reader Interactions