T-Mobile (NASDAQ: TMUS) has completed its integration of the Sprint network. In 3Q22, the company decommissioned redundant Sprint sites, upgraded “keep sites” to 5G and brought them on air, and continued with new 5G site builds. Neville Ray, T-Mobile President-Technology comments, “We’ve effectively completed our network integration. … really pleased to have the vast majority of all of that work behind us. And now we can move on with continued expansion of coverage and performance in 5G.” All this activity created a lot of tower lease churn that American Tower said negatively impacted its U.S.-Canada region organic tenant billings growth by four percent, as Inside Towers reported.

The T-Mobile-Sprint merger closed on April 1, 2020. At the time, the company laid out its strategic initiatives to combine the two networks and their operations, expecting full network integration to take approximately three years. Its three-point network integration strategy was to: deploy the Sprint 2.5 GHz spectrum on the New T-Mobile anchor network, migrate Sprint customers onto the New T-Mobile network, and decommission legacy Sprint network sites.

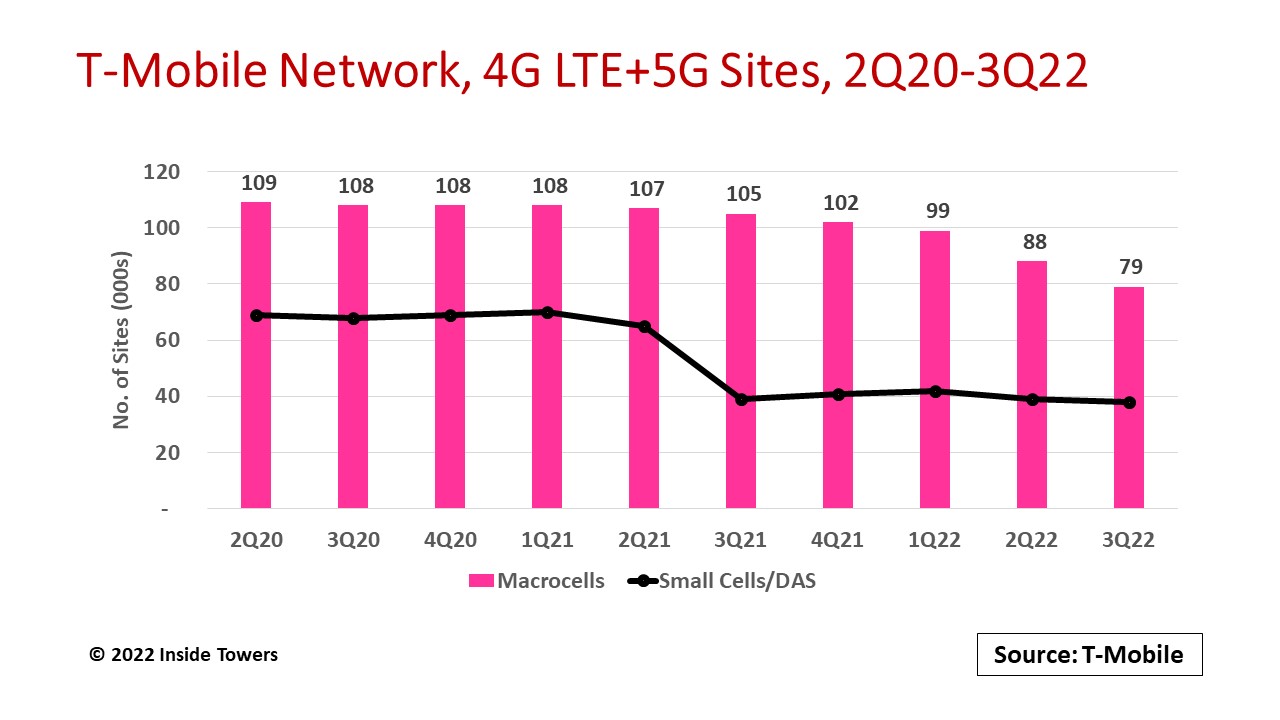

At the end of 1Q20, T-Mobile’s network had roughly 67,000 macrocells and 26,000 small cell/distributed antenna system sites. Once merged in 2Q20, the combined T-Mobile-Sprint LTE+5G network covered 327 million POPs with approximately 109,000 macro cells and 69,000 small cell/DAS sites.

T-Mobile commenced 5G deployments in mid-2019, using millimeter wave spectrum in select cities. In December 2019, T-Mobile launched America’s first nationwide 5G network, including prepaid 5G with Metro by T-Mobile, on 600 MHz spectrum covering more than 65 percent of the U.S. population. Once T-Mobile gained Sprint’s 2.5 GHz spectrum, 5G deployments took off.

Now just over two years after the merger, T-Mobile is well ahead of schedule, and mostly has completed its network integration. At the end of 3Q22, the company’s integrated infrastructure assets comprised 79,000 macrocells and 38,000 small cell/DAS sites. That’s a reduction of 30,000 macrocells and 31,000 small cell/DAS sites while beefing up the remaining sites to 5G in that timeframe.

T-Mobile’s 5G Extended Range operating at 600 MHz now reaches 97 percent of all Americans, while its 5G Ultra Capacity operating at 2.5 GHz and millimeter wave frequencies covers 250 million POPs. The company serves 111.8 million postpaid and prepaid subscribers, up 5 percent YoY. Importantly, from a standing start in mid-2020, its 5G Home Internet fixed wireless access broadband connectivity service topped 2.1 million customers with 578,000 net additions in the quarter.

All this network activity is paying off. T-Mobile reported 3Q22 service revenues of $15.4 billion, up four percent YoY. Core Adjusted EBITDA grew 11 percent YoY to $6.7 billion and Cash from Operating Activities was up 26 percent YoY to $4.4 billion. The company says 3Q22 was its busiest quarter since the close of the Sprint merger, in terms of how many sites it modernized and upgraded with mid-band 5G. It recorded the highest capex levels in its history in 3Q22 at over $3.6 billion and raised its full year 2022 capex midpoint guidance by $200 million to $13.7-13.9 billion.

Based on the continued strength of the integration execution, T-Mobile raised its merger synergies guidance range to $5.7-5.8 billion in 2022 including approximately $2.4 billion of SG&A expense reductions, over $2.0-2.1 billion of cost-of-service expense reductions achieved through network efficiencies, and about $1.3 billion of savings related to avoided network site builds.

Completing the network integration is not the end of T-Mobile’s coverage and capacity expansion efforts. It is adding more spectrum, increasing 2.5 GHz channel bandwidth from 120 MHz to 200 MHz at existing and new sites, and adding PCS 1900 MHz band to those sites. The company is expanding its 5G Home Internet fixed wireless access footprint by adding more small cells.

Moreover, T-Mobile says that delivering 5G services is becoming more efficient as it moves to full 5G Standalone operation. Ray adds, “We have more sites and more spectrum coming online as we move through the future months and years for the company.”

By John Celentano, Inside Towers Business Editor

Reader Interactions