Some very interesting stats are coming out of the recent cycle of 2Q22 earnings calls. It may be too early to call it a trend, but there is a bit of a shift going on as to which carriers will provide broadband services to whom.

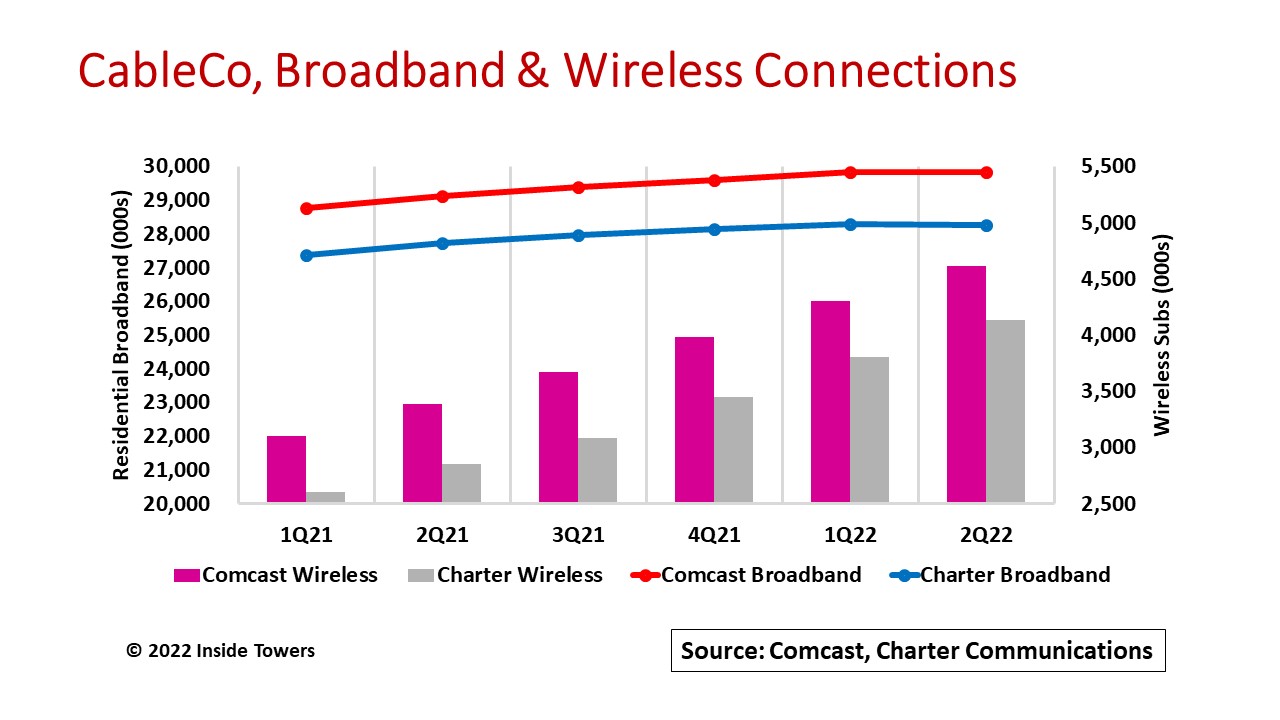

Take the big cable companies. Comcast (NASDAQ: CMCSA) and Charter Communications (NASDAQ: CHTR) dominate the cable business. Comcast reported 32.2 million broadband residential and small business connections at the end of the quarter while Charter came in with 30.3 million. But for the first time in many quarters, both companies reported losses in 2Q22 broadband net additions.

Comcast lost 10,000 while Charter dropped 21,000. These are small numbers compared to the total, but they represent a break in a long string of positive quarterly net adds. To wit, Comcast reported nearly two million net additions for full-year 2020, and another 1.3 million in 2021. Comparatively, Charter added 2.2 million broadband connections in 2020, and 1.2 million in 2021.

In remarks during his company’s 2Q22 earnings call, Brian Roberts, Comcast Chairman, CEO & President cited three factors for the decline. First, fewer people are moving. When people move, Comcast has won its share of new customer acquisitions.

Second, some pandemic-related trends are reversing. During the pandemic, many customers bought home-based broadband solutions. Now consumer behavior is returning to pre-pandemic patterns.

Third, and perhaps most significantly, Roberts acknowledged the impact of increased competition. Telcos like AT&T, Verizon and Frontier Communications are ramping up their fiber-to-the-home deployments, displacing copper-based services, and encroaching on cable’s hybrid fiber-coax architecture. Moreover, Verizon and T-Mobile are pushing fixed wireless access solutions as alternatives to wired internet connections.

Jessica Fischer, Charter CFO, during the company’s earnings call, attributed its losses in part to the discontinuation of emergency broadband benefit (EBB) and a slower than expected uptake of affordable connectivity program (ACP) offers where some subsidized internet customers either discontinued their service after the EBB program ended or did not meet the ACP requirements. To maintain growth and conserve capex, some cablecos, including Charter, are utilizing government funding programs for rural broadband deployments.

But the competitive threat is real. The fiber guys are coming after the cablecos directly in their established markets. AT&T, Verizon, Frontier Communications, and other wireline operators are accelerating their FTTH build programs, with aggressive home-passing targets by 2025, as Inside Towers reported. They are gaining traction. In the quarter, AT&T added 316,000 fiber broadband connections, Verizon reported 30,000, and Frontier Communications had 50,000.

The fixed wireless guys, namely Verizon and T-Mobile, grew their FWA base significantly in the quarter. Verizon added 168,000 connections, reaching 384,000 total FWA subs. T-Mobile’s total jumped to 1.5 million with 560,000 new FWA connections in the quarter.

The cable guys seem to think that FWA is a temporary hit at best, given the reach and performance limitations versus wired broadband. At the same time, cablecos are making investments in upgrading their HFC network to the new DOCSIS 4.0 standard that delivers multi-gigabit per second speeds.

The cablecos are achieving some competitive offsets by growing their respective wireless businesses. Comcast and Charter, for instance, each operate as MVNOs on the Verizon Wireless network. Both companies spent big in FCC Auction 105 to acquire CBRS licenses that cover their cable operations footprint. These companies bundle mobile services with their internet and video services to help retain customers.

Both companies are building out CBRS infrastructure to transition current mobile customers onto their own facilities-based infrastructure. In the quarter, Comcast added 317,000 wireless lines bringing its total to 4.6 million, while Charter gained 344,000 mobile lines for a total of 4.3 million wireless subscribers. Both tallies are tiny compared to the Big 3 MNOs that each have more than 100 million wireless subs, but the competition is growing for high-value customers in key markets where all these service providers operate.

By John Celentano, Inside Towers Business Editor

Reader Interactions