Not so long ago, telephone, cable and wireless companies stayed in their lanes. Not anymore! All these carriers now offer overlapping mobility and broadband connectivity services and are competing with each other, both nationally and on a market-by-market basis. Moreover, with more mobile phones than people, according to Inside Towers Intelligence, the U.S. market is saturating. So, network operators are playing take away.

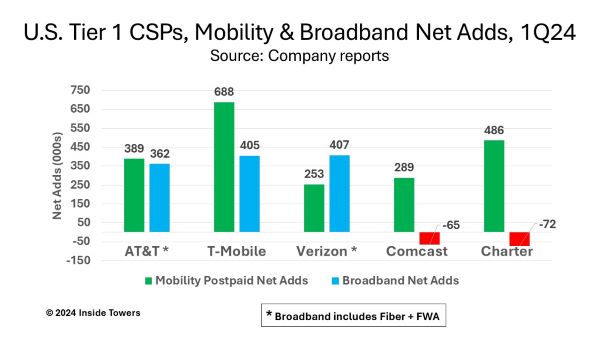

T-Mobile (NASDAQ: TMUS) outperformed its peers in mobility postpaid net adds and fixed wireless access broadband connections in 1Q24, but its year-over-year counts declined. Postpaid net adds were 688,000, down nine percent YoY. Total retail postpaid and prepaid subscribers reached 120.9 million. The company added 405,000 FWA subs, down from 523,000 in 1Q23, to reach 5.2 million at the end of the quarter. T-Mobile says it is still on track to reach 7-8 million FWA subscribers by 2025 albeit at a slower 400,000 per quarter pace until then.

AT&T (NYSE: T) is adding mobility and broadband customers, but at a markedly slower pace as competitors encroach on its customer base. Its 389,000 mobility net adds in the quarter were down 28 percent from 542,000 in 1Q23 and down 60 percent compared to the 965,000 added in 1Q22. Fiber net adds of 252,000 were down seven percent YoY. The company ended the quarter with 106.7 million retail postpaid and prepaid subscribers. AT&T added 110,000 new FWA subscribers in the quarter to grow its base to 203,000. The company says it is taking a more strategic approach to marketing its Internet Air FWA service than its peers.

Verizon (NYSE: VZ) reported 253,000 postpaid net adds in the quarter, a decline of 60 percent from 633,000 in 1Q23. With 144.8 million at the end 1Q24, the company still has the largest retail postpaid and prepaid subscriber base. Verizon’s broadband connections are a combination of its FiOS FTTH and FWA. The company added 54,000 residential and business FiOS connections in 1Q24, down from 67,000 a year earlier. FWA net adds were 354,000, down from 393,000 in 1Q23.

The big cable companies, Comcast (NASDAQ: CMCSA) and Charter Communications (NASDAQ: CHTR) are scrambling to curtail broadband customer losses to competing FTTH and FWA services. Comcast reported 65,000 net broadband losses in the quarter compared with 5,000 net adds in 1Q23 and 264,000 net adds in 1Q22. Similarly, Charter lost 72,000 internet net connections in 1Q24 compared with 76,000 net adds a year ago and 185,000 net adds in 1Q22. Charter garnered 486,000 mobile net adds to reach nearly 8.3 million subscribers. Similarly, Comcast grew its wireless subscriber base by 289,000, for a total of 6.9 million.

Both cablecos are Verizon MVNOs and have attracted customers from the MNOs by offering bundled mobility and internet access at attractive prices. Both companies own 3.5 GHz CBRS Priority Access Licenses that cover their respective territories, Inside Towers reported. The idea was to build and operate their own wireless infrastructure and reduce wholesale rates they pay Verizon. However, both cablecos are taking a capital light approach to deploying their respective CBRS PALs and have shown a limited commitment to installing cell sites.

By John Celentano, Inside Towers Business Editor

Reader Interactions