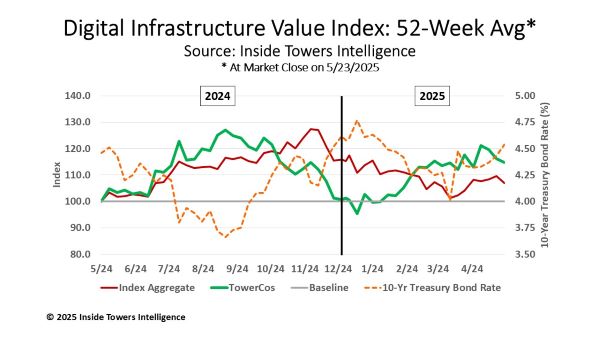

A combination of macroeconomic factors and market drivers are affecting digital infrastructure company stock prices – both positively and negatively – among the 14 companies in the five asset classes (towers, data centers, fiber, cable and diversified infrastructure) in our proprietary Digital Infrastructure Value Index. On-again, off-again trade talks are buffeting supply chains, impacting the cost and pace of network build outs.

Market demand for increased internet access and mobile data consumption continues apace, nonetheless. These are tailwinds that support a cautiously optimistic outlook for steady network investment in 2025, and for the next several years.

Tower companies – American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC) – with increased colocation requests from their mobile network operator tenants, are projecting organic revenue growth of 4-5 percent for 2025, Inside Towers reported. Tower company stocks have grown 10 percent over the past 52 weeks and 14 percent since the beginning of the year. American Tower remains the Index’s most valuable tower company with a market cap of $100 billion.

Data center companies, Equinix (NASDAQ: EQIX) and Digital Realty Trust (NYSE: DLR), along with hyperscalers and smaller data center operators, are seeing increasing capacity and power demand to support AI large learning models. colocation and network interconnection. Over the past 52-week period, data center stocks have grown an average of 17 percent.

With a push for high-speed fiber connectivity and pending M&A closures, stock prices for Frontier Communications (NASDAQ: FYBR) and Uniti Group (NASDAQ: UNIT) have grown around 40 percent in the past year. Lumen Technologies’ (NYSE: LUMN) stock price has nearly doubled on the news of major deals with hyperscalers and selling its Mass Market business to AT&T (NYSE: T).

Cable companies have lost broadband connections to fiber overbuilders, and fixed wireless access each quarter for the past year. Stock prices for Comcast (NASDAQ: CMCSA), Charter Communications (NASDAQ: CHTR) and Cable One (NYSE: CABO) collectively have declined nearly four percent in that period. Comcast is the Index’s most valuable company with a market cap of $129 billion.

Brookfield Infrastructure Partners (NYSE: BIP) and DigitalBridge Group (NYSE: DBRG) are well positioned for growth with a diverse portfolio of digital infrastructure assets. These companies are not infrastructure operators but rather earn their money by investing in infrastructure companies using their own funds and managing funds on behalf of various equity pools. Over the past 52 weeks, Brookfield stock has appreciated over nine percent while DigitalBridge stock declined 15 percent.

By John Celentano, Inside Towers Business Editor

Reader Interactions