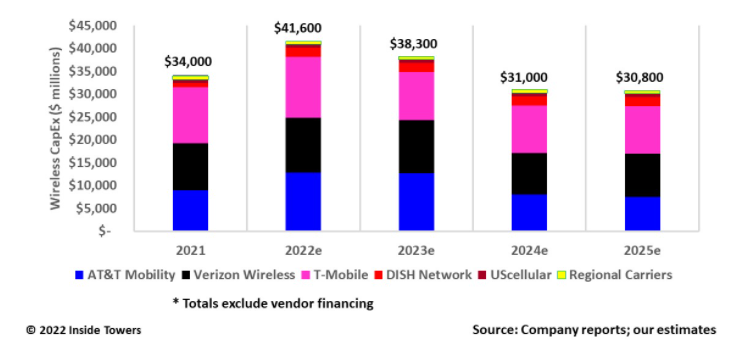

U.S. mobile network operators are already at a high level of capital expenditures as they build out their respective 5G networks on a national and regional scale. The aggregate wireless capex is expected to peak in 2022, reaching an all-time high of $41.6 billion, then moderate down to $30-31 billion a year by 2025. By comparison, 4G LTE capex levels topped out at about $25 billion a year.

Much of the differential is due to significant incremental investment by Verizon Wireless (NYSE: VZ) and AT&T Mobility (NYSE: T) for their respective C-band and 3.45 GHz spectrum deployments. This investment is on top of the capex already planned for 5G among all the MNOs, involving mainly macrocells on towers. Network densification using small cells is not expected to ramp up in earnest before 2024-2025 and beyond.

Both Verizon and AT&T are underway with their C-band Phase I deployments that went live on January 19, as Inside Towers reported. Verizon committed $10 billion over three years for activating all of its C-band licenses across the country. The company spent $2.1 billion on C-band in 2021, and is planning to spend another $5-6 billion in 2022, with the remaining $2.4-2.5 billion in 2023, as it approaches the December 2023 C-band Phase II deadline.

AT&T invested nearly $1 billion in 2021 for C-band but expects that to jump to $5 billion in each of 2022 and 2023, as it rolls out both C-band and 3.45 GHz licenses it won in Auctions 107 and 110, respectively. Dual band radios available from its prime vendors like Ericsson will be available in the second half of 2022. AT&T expects its mid-band capex to be backend loaded in 2H22 and into 2023.

T-Mobile US (NASDAQ: TMUS) invested $12.3 billion in 2021, up 12 percent year-over-year, as the company pushed its network expansion with Extended Range 5G at 600 MHz and Ultra Capacity 5G at 2.5 GHz. Capex guidance for 2022 at $13.0-13.5 billion with C-band deployments are baked into that projection. Moreover, TMUS is pulling into 2022 all the Sprint site decommissioning activities that were scheduled for 2022 and 2023. After that, it expects to moderate its network investments into the $10-11 billion a year range through 2025.

DISH Network (NASDAQ: DISH) significantly increased its 2021 network capex to $1 billion. DISH is planning 2022 network capex of $2.5 billion as it steps up its market-by-market deployments to cover 20 percent of the population by the June 2022 deadline, and 60 percent by June 2023. DISH expects to spend its budgeted $10 billion in capex through 2025, to cover 75 percent of the U.S. population.

UScellular (NYSE: USM) reduced 2021 capex to $780 million from $940 million in 2020 as the company moderated its 5G network buildout to a more market-focused approach across its 23-state operating area. USM plans to build out its 100 MHz of mid-band spectrum in C-band, CBRS 3.5 GHz, and 3.45 GHz at roughly a $750 million a year capex run-rate in 2022 and for the next several years.

Several dozen regional wireless carriers including C Spire, Carolina West Wireless and Union Wireless are expected to have an aggregate capex of around $600-700 million a year as they upgrade and modernize their networks to 5G.

The level and pace of MNO capex is not immune to the country’s overall economy. The national MNOs have long-term supply contracts with negotiated prices that help offset price increases. But supply chain delays, higher fuel costs and rising labor rates could modulate the pace of these respective network builds.

By John Celentano, Inside Towers Business Editor

Reader Interactions