Inside Towers Intelligence excerpt. Subscribe for more in-depth analysis and insights

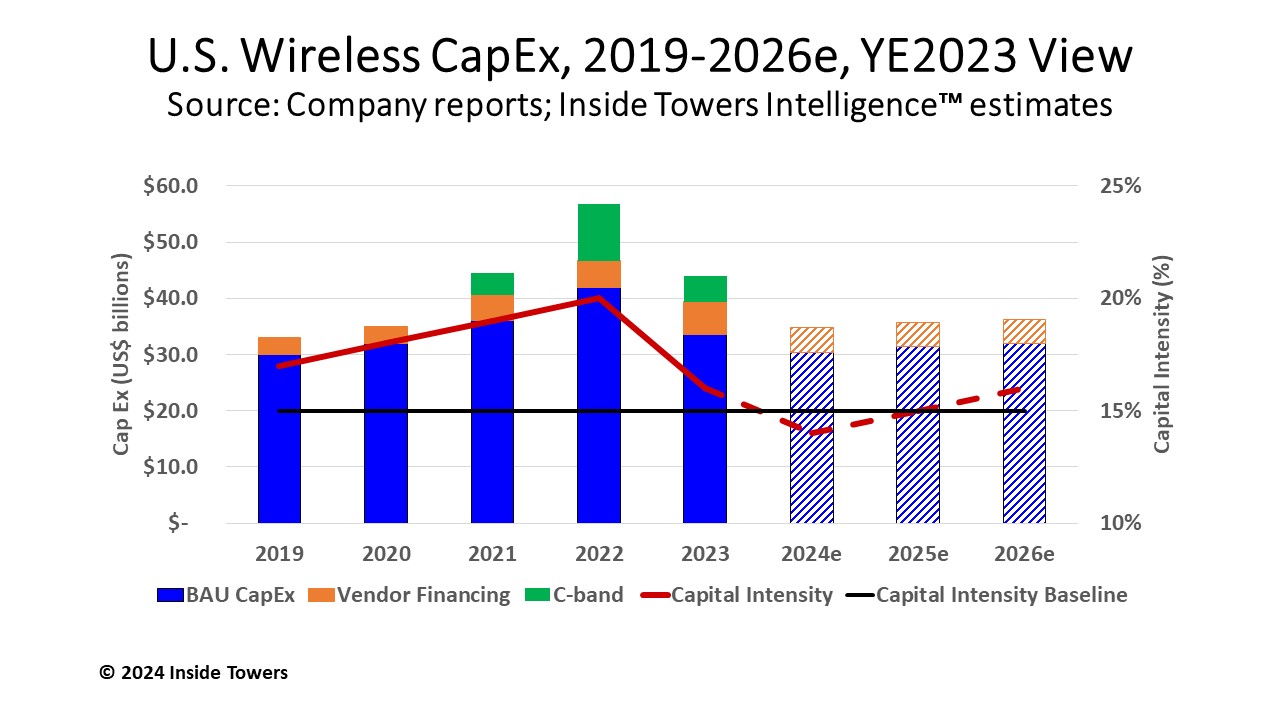

A colleague asked me recently, “When will wireless carrier spending get back to normal?” I knew what he meant but I gave him an honest answer, “This is normal!” The U.S. wireless industry has been through an extraordinary period of growth and expansion. In 2021 and 2022, aggregate capital expenditures levels among the U.S. national and regional mobile network operators alike reached unprecedented levels.

This spike in wireless infrastructure spending was driven by the confluence of three one-time occurrences that were layered on top of what Verizon calls “business as usual” or BAU capex. This referenced BAU capex was already elevated above prior year levels once the 5G build got underway in earnest. Continuing the ramp from 2021, network construction took off in 2022.

First, Verizon (NYSE: VZ) and AT&T (NYSE: T) committed a combined $10 billion on top of their BAU capex for C-band Phase I deployments in the top 46 PEAs where they hold licenses. At the same time, T-Mobile (NASDAQ: TMUS) accelerated the integration of the Sprint network, with its capex peaking at $14 billion. On top of that, DISH Wireless (NASDAQ: SATS) more than doubled its annual spending each year to roughly $2.6 billion to meet its population coverage goals in 2022 and 2023, Inside Towers reported.

Once these goals were met, aggregate capex abruptly slowed down. Consequently, wireless capex for the next several years will be at more normal levels, albeit at higher levels than in previous network build cycles.

The outlook is still positive, though. Even at reduced capex levels, there is much network expansion to be done. 5G is still being deployed, with more mid-band and high-band spectrum to be activated on macrocells and small cells. Rip & Replace activity has a high priority among some lawmakers, but still awaits full funding from Congress. Certainly, government funding programs will stimulate more work. Moreover, burgeoning artificial intelligence applications are expected to drive the need for substantially more network capacity for years to come.

The chart shows annual wireless-only cash purchases and vendor financing of property, equipment and capitalized engineering and installation (E&I) services, and interest during construction for both mobile and fixed wireless access applications, and MNO-funded inbuilding systems, for national and regional MNOs and WISPs.

The data does not include spectrum purchases, investments in fiber or other digital infrastructure, or expenditures for private networks. Also not included is the tower companies’ capex to acquire, build, or augment existing sites. Funding from BEAD or other government programs is not included in the projections. All of this activity is additive to planned network investments and construction.

A deep-dive analysis of U.S. wireless capex is the feature article in the upcoming 2024 Vol 1 issue of Inside Towers Intelligence. The report will show capex details among each of the public MNOs based on their recently reported full-year 2023 results and 2024 guidance. The analysis will also show a breakdown of how capex is allocated to RAN, Core, ancillary network gear and E&I services components.

Moreover, the report includes an in-depth discussion of the potential impact of AI on telecom infrastructure along with several contributed articles from industry experts.

For more information, or to subscribe, visit: insidetowers.com/intelligence.

By John Celentano, Inside Towers Business Editor

Reader Interactions