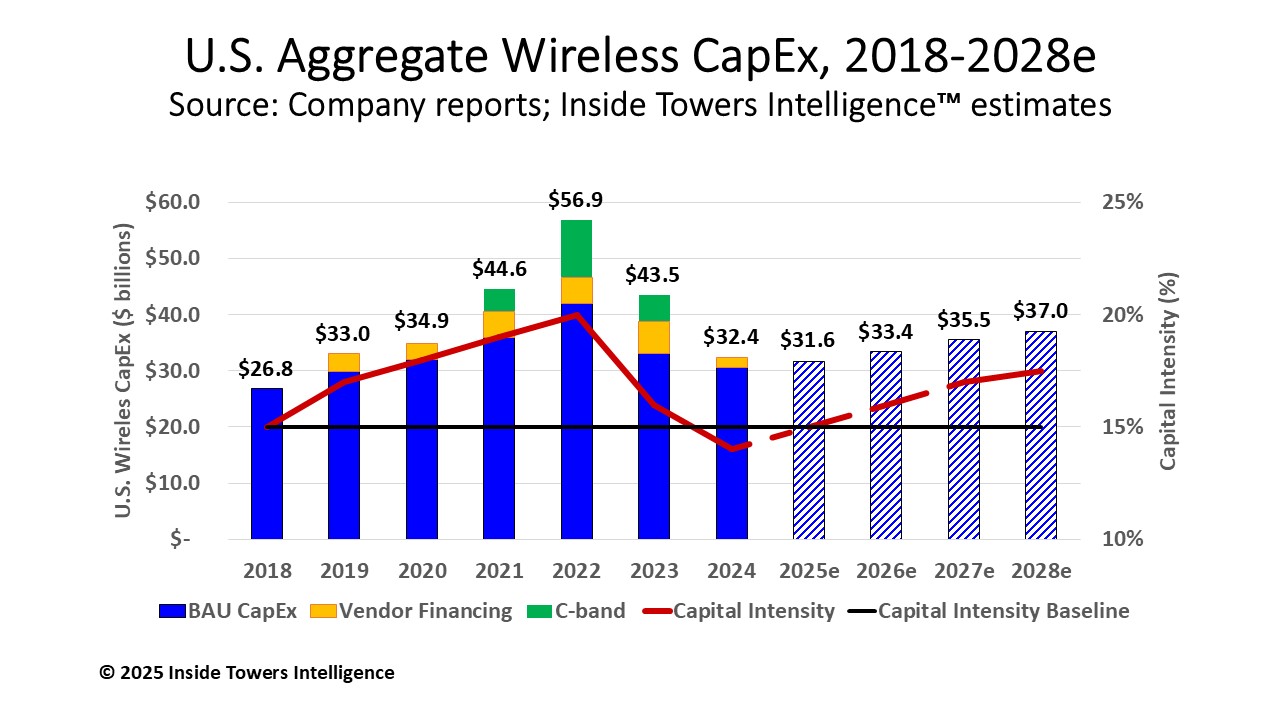

The numbers are in! It looks like capital expenditure among the U.S. mobile network operators and wireless service providers hit its low point in 2024. Aggregate capex came in at $32.4 billion. That’s down 26 percent from $43.5 billion in 2023, which itself came off a historical peak of $56.9 billion in 2022. Excluding incremental spending by Verizon (NYSE: VZ) and AT&T (NYSE: T) for early C-band deployments, and vendor financing that AT&T has been using, the business-as-usual (BAU) capex for 2024 was down just eight percent year-over-year.

From the guidance provided by the MNOs in their 4Q24 earnings calls, it looks as though the wireless capex, at least in the U.S., is coming off the bottom of the trough. Aggregate BAU capex among the Big 3 MNOs, EchoStar’s (NASDAQ: SATS) Boost Mobile, UScellular (NYSE: USM) , the regional carriers and WISPs is expected to be up three percent YoY to nearly $32 billion in 2025, according to Inside Towers Intelligence estimates.

Expansion and upgrade activity is expected to stimulate continued network investment over the next several years, albeit at a measured pace. Inside Towers Intelligence estimates the market will grow at a four percent CAGR through 2028, reaching $37 billion. Note that these numbers are for wireless-only and exclude AT&T and Verizon investments in their respective fiber networks.

Consider some of the market drivers. First and foremost, the MNOs still have a lot of spectrum licenses to deploy, particularly in high-value mid-band frequencies – C-band, 3.45 GHz, 2.5 GHz and CBRS. Many of these licenses are approaching FCC ‘use it or lose it’ deadlines following the auctions that first made the spectrum available dating back to 2020.

More than that, the MNOs need to expand their coverage in suburban and rural markets where they hold large blocks of mid-band spectrum. The tower companies have corroborated this activity, indicating that through the end of last year, they were receiving more requests for colocations, meaning new cell sites on towers and fewer requests for amendments to cell sites on existing towers.

We still don’t know the full impact on artificial intelligence (AI) on wireless infrastructure. Certainly, there is massive investment going into data centers around the country for AI training on large language models. At some point towards the end of the current forecast, the AI training will turn to AI inference. When that happens, AI inference will become widely used for data analysis and predictions by users on mobile devices. At the same time, we are likely to see MNOs making greater use of AI in the RAN to manage their networks autonomously.

The forecast does not reflect some other multipliers. Not included is the capex that public and private tower companies spend each year to build new towers, and modify or upgrade existing sites. That could add another $1 billion a year.

Also not included is spending for the ‘Rip & Replace’ program, both for reimbursement for work already done and for work to be completed, as Inside Towers reported. Furthermore, T-Mobile’s (NASDAQ: TMUS) acquisition of UScellular will likely stir up some network integration activity for a short period. Plus, T-Mobile has committed to build out cell sites on another 2,000 UScellular towers as part of the deal. Finally, any inflow from government programs like BEAD, which likely will still move forward, is also not included.

By John Celentano, Inside Towers Business Editor

Reader Interactions