In May 2024, Uniti Group (NASDAQ: UNIT), headquartered in Little Rock, AR, announced its merger with Windstream Holdings, Inside Towers reported. This merger combines Uniti’s owned national wholesale fiber network with Windstream’s fiber-to-the-home business, creating what the companies describe as “a premier insurgent fiber provider” that primarily operates in Tier II and III markets.

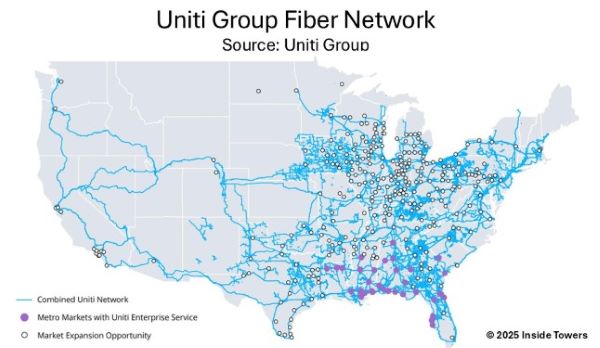

The merged entity will possess substantial fiber assets, with its long-haul fiber network covering 237,000 route miles. The company plans to expand this network to 240,000-245,000 route miles by the end of 2025, and to over 260,000 route miles by 2029. Similarly, Windstream’s Kinetic brand FTTH, which reached 1.6 million homes at the end of 2024, aims to pass over two million homes in 2025 and is projected to service 3.0-3.5 million homes by 2029.

“2024 was a transformational year for Uniti with the announcement of our upcoming merger with Windstream, solid growth across our business segments, and continued efforts to improve and strengthen our balance sheet,” comments Kenny Gunderman, Uniti Group President and CEO. “Strategically, Uniti is uniquely positioned to benefit from emerging themes related to Generative AI and convergence, both of which place premium demand on our mission-critical fiber infrastructure.”

For the full year of 2024, Uniti’s consolidated revenues were $1.2 billion, an increase from $1.1 billion in 2023. Adjusted EBITDA was $940 million, and AFFO attributable to common shareholders stood at $359 million. Capital expenditure amounted to $355 million, marking a 15 percent decrease year-over-year.

Uniti’s two main business units have distinct focuses. Uniti Leasing leases communications infrastructure to telecommunications carriers and service providers. The business unit contributed $881 million in revenue or approximately 75 percent of the total and $851 million in Adjusted EBITDA, roughly 91 percent of the total, for the full-year 2024. Uniti Leasing’s net success-based capital expenditure for the year was $243 million, including $231 million allocated for growth capital improvements (GCI). Uniti Group has a partnership with Windstream for GCI, where Uniti invests in Windstream’s FTTH deployments.

Uniti Fiber is responsible for providing various infrastructure solutions such as lit backhaul services, enterprise and wholesale services, E-Rate and government services, dark fiber, and small cells. For 2024, the unit contributed $286 million in revenue and $112 million in Adjusted EBITDA. Uniti Fiber’s net success-based capital expenditures for the year totaled $69 million.

The company’s mid-point guidance for 2025 includes consolidated revenue of more than three percent to over $1.2 billion, consolidated Adjusted EBITDA of $976 million, and consolidated success-based capex of $270 million.

By John Celentano, Inside Towers Business Editor

Reader Interactions