UScellular’s (NYSE: USM) tower segment continued to show steady progress even as the company reported flat year-over-year results in its wireless services business. In its 4Q earnings call, the company reported wireless service revenues for full-year 2022 were $3.1 billion, flat with 2021 level. Adjusted EBITDA declined 9 percent YoY to $952 million. Most of the soft performance was attributed to reduced net adds, moves to premium plans among fewer customers, reduced roaming charges and increased involuntary churn. Nonetheless, ARPU and ARPA both increased 3-4 percent YoY reflecting the migration to higher priced calling plans.

The Chicago-based company operates in parts of 21 states covering 32 million people mainly in small towns and rural communities in the Midwest, mid-Atlantic, Northeast, Pacific Northwest, and northern California. At the end of 2022, UScellular had 5 million postpaid and prepaid connections.

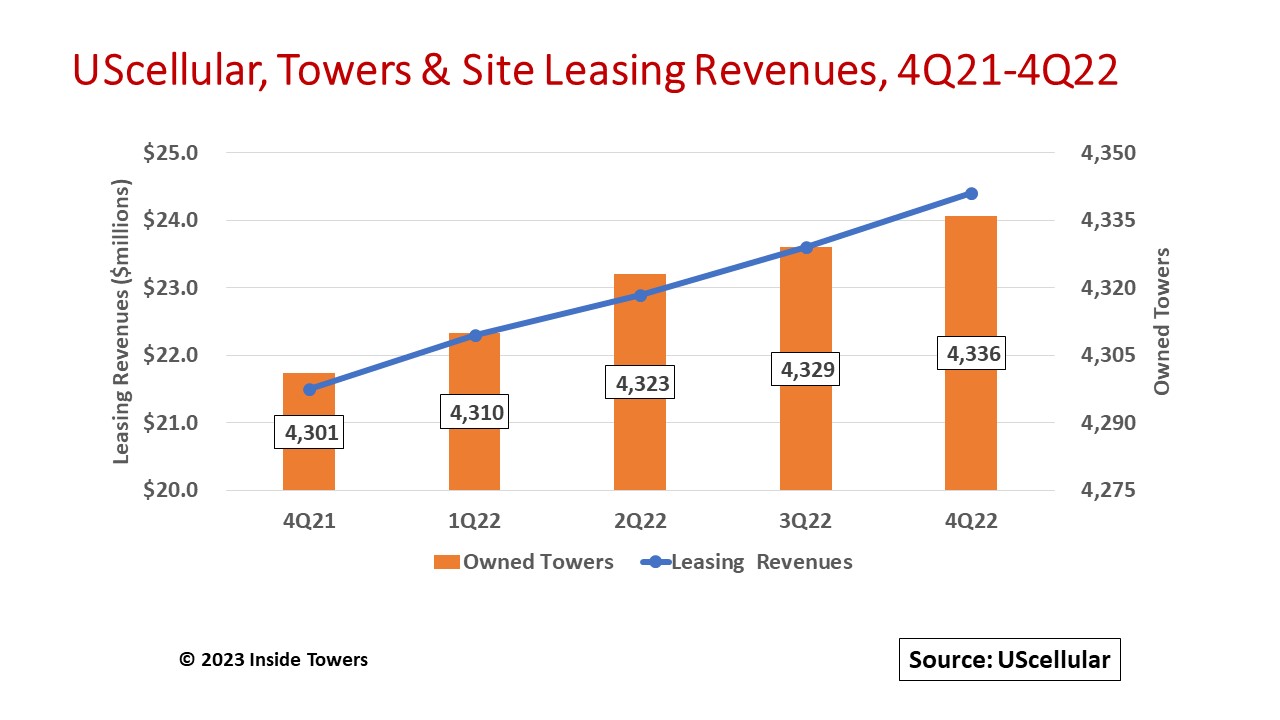

Despite a regional status, UScellular is the largest MNO in the country to still own towers. At the end of 2022, it had 4,336 towers in operation, adding 35 towers during the year. Annual site leasing revenues grew 13 percent YoY to over $93 million.

The company is its own anchor tenant on these towers. With 6,945 cell sites in operation at year-end 2022, though, its own towers support just 62 percent of these cell sites. In those parts of its territory where it does not own towers, UScellular leases space from other tower companies.

As a tower operator, UScellular accommodates other wireless service providers including the national MNOs and regional WISPs operating in its territories. It had 2,401 colocators on its towers at year-end 2022, an average of 1.55 tenants per tower. The company says that compares to an average of 2.3 tenants per tower across the industry, reflecting UScellular’s predominantly small market coverage.

UScellular sees the lower tenancy ratio as a growth opportunity, however, as it expands 5G coverage for both mobility and fixed wireless access services. It says that 5G now covers 50 percent of the population in its operating areas and 85 percent of its cell sites carry 5G traffic. The company began deploying 5G using its low-band 600 MHz spectrum for wide area coverage using a 5G Non-standalone core shared with the 4G LTE network.

Like T-Mobile, UScellular is using excess spectrum capacity on its 5G mobility network to offer FWA services in areas that have little or no broadband connectivity, and for which fiber alternatives are not yet available. The company ended the year with 77,000 FWA subscribers, up from 49,000 at the end of 2021. It will offer FWA from all new 5G cell sites.

It plans to deploy its mid-band spectrum C-band and 3.45 GHz licenses at the end of 2023, once that portion of the 3 GHz spectrum is cleared. Moreover, the company will be activating a 5G Standalone core in 2023, indicating that subscribers should see a marked improvement in wireless performance once those network changes are implemented.

The company has no plans to sell those towers. It believes having access to its own towers at any time to make required network improvements is both efficient and less costly than working with independent towercos.

The company’s 2023 midpoint guidance indicates wireless service revenue of $3.1 billion, flat with 2022, Adjusted EBITDA at $925 million, down 3 percent YoY and capital expenditures of $650 million, down 9 percent from 2022 levels. UScellular suggests that most of the 2023 capex will be spent in the second half of the year when mid-band spectrum deployments get underway, then roll into 2024.

By John Celentano, Inside Towers Business Editor

Reader Interactions