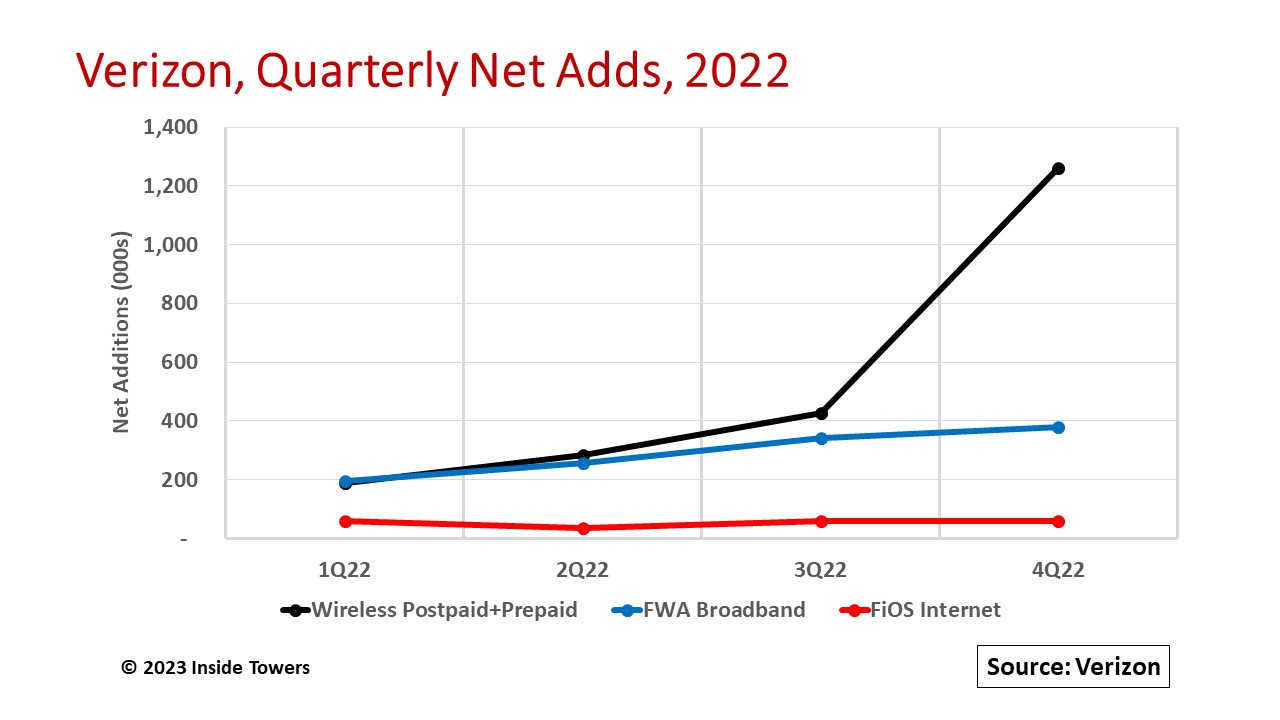

Not to be outdone by its wireless and cable company rivals, Verizon (NYSE: VZ) reported strong 4Q22 results and offered a positive outlook for its 2023 operations. Despite some quarterly gyrations during 2022, one of the more closely watched performance metrics is subscriber net additions. In Verizon’s case, this metric applies to wireless retail comprising postpaid and prepaid subs, fixed wireless access, and wireline broadband under the company’s FiOS-branded fiber-to-the-home service.

For the year, the company had 2.2 million postpaid and prepaid wireless net adds, 1.2 million in 4Q alone, bringing its industry-leading total to 143.3 million wireless retail subscribers. Wireless service revenues for 2022 grew nearly 9 percent year-over-year to over $74 billion, accounting for 54 percent of the company’s total revenues.

Verizon says that its C-band spectrum build out has been the most aggressive deployment plan in its history. Since it began in early 2021, the company is on track to cover 200 million POPs in 1Q23 and is ahead of schedule to reach its 250 million POP target by year-end 2024. It plans to scale C-band quickly in the 330 markets where it will have complete access to the C-band spectrum later this year.

Early C-band deployments have limited bandwidths of 60 MHz or 100 MHz in some early clearance markets. Once C-band is fully accessible in late 2023, Verizon can deploy an average bandwidth of 161 MHz, and up to 200 MHz in certain markets, nationwide.

In 2023, Verizon will deploy its 5G standalone core, giving it the ability to support high speed downlinks and uplinks, and to deliver enhanced 5G capabilities such as network slicing, and voice over 5G.

FWA was a bright spot for Verizon in 2022. The company had over a million FWA net adds to reach more than 1.4 million subscribers by the end of 2022. It says the majority of its fixed wireless net adds are on C-band. Verizon expects FWA take-rates to continue, projecting 4-5 million FWA subs by 2025.

FiOS subscriber growth grew modestly each quarter, adding 216,000 new homes-connected for the year and bringing its total connected homes and businesses to 7.1 million at year-end. Verizon maintained its FTTH build out program, nonetheless, expanding its FiOS footprint by over 550,000 locations in 2022, bringing total homes-passed to more than 17.1 million across its operating territory.

Verizon notes that it is leveraging fiber investments to support both its mobility and broadband plans. It now connects about 50 percent of its cell sites with its own fiber, up from 45 percent in 2021, claiming that using its own fiber yields better backhaul performance and economics.

Verizon expects wireless mobility and nationwide broadband will be the most significant contributors to Verizon’s growth for the next several years. “We believe our network will allow us to maintain our premium position with our wireless mobility customers and provide reliable fixed wireless access services to consumers and businesses across the country,” comments Hans Vestberg, Verizon Chairman and CEO. “This is an example of how we can monetize our multipurpose network by scaling several revenue streams on the same infrastructure to enhance our return on investment.”

He adds that scaling of new business, such as private 5G networks and edge computing will also be a strategic focus for Verizon in 2023 and expects to make appropriate investments to ensure such services make meaningful contributions to future revenue growth.

Verizon’s 2023 guidance projects wireless service revenues to increase 3.5 percent at the midpoint. Aggregate 2023 capital expenditures will decline from $23.1 billion in 2022 to a midpoint level of $18.75. This figure includes $1.75 billion that remains from the $10 billion that Verizon originally budgeted for overall C-band deployments. The company expects its 2024 aggregate “business as usual” capex to level out at $17 billion.

By John Celentano, Inside Towers Business Editor

Reader Interactions