Verizon Communications (NYSE: VZ) yesterday announced a $20 billion all-cash deal to acquire Frontier Communications (NASDAQ: FYBR), the largest pure-play fiber internet provider in the U.S. This acquisition will significantly expand Verizon’s fiber network, enhancing its mobility and broadband services nationwide. Hans Vestberg, Verizon CEO, said in a conference call with financial analysts, that the deal positions Verizon to offer differentiated services that combine mobility, fixed wireless access and “best-in-class” fiber.

Under the terms, Verizon will acquire Frontier at $38.50 per share, a 43.7 percent premium over Frontier’s 90-day volume-weighted average price as of September 3, 2024. The company says that the deal will be accretive in revenue and Adjusted EBITDA on the day the deal closes, expected in about 18 months pending shareholder approval. Verizon anticipates the acquisition will boost its service revenue and Adjusted EBITDA growth while creating at least $500 million in annual cost synergies by year three through enhanced scale, distribution, and network integration.

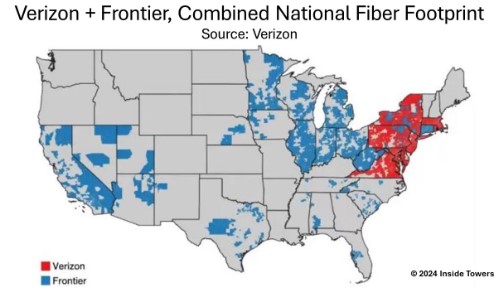

Moreover, Vestberg expects that the transaction will be approved by regulators. “We are very confident that this will go through, but we also expect that the process will be thorough,” he told CNBC, pointing out that Frontier’s network is “not overlapping at all” with Verizon’s FiOS footprint.

Verizon said the combination will integrate Frontier’s cutting-edge fiber network with Verizon’s portfolio of fiber and wireless assets, including its FiOS fiber offering. The company said a converged wireless and fiber offer drives higher revenues per account and reduces wireless churn by about 50 percent and fiber churn by around 40 percent.

Over the last four years, Frontier has invested $4.1 billion upgrading and expanding its fiber network, and now derives more than 50 percent of its revenue from fiber products. Frontier’s 2.2 million fiber subscribers across 25 states will combine with Verizon’s approximately 7.4 million FiOS connections in nine states and Washington, D.C.

In addition to its 7.2 million fiber locations passed at the end of 2Q24, Frontier is committed to its Building Gigabit America plan to build out another 2.8 million fiber locations by the end of 2026, Inside Towers reported. The combined networks will enable Verizon to reach 25 million premises across 31 states and Washington, D.C.

Verizon reaffirmed its full-year 2024 guidance of wireless service revenue growth of 2.0 percent to 3.5 percent, Adjusted EBITDA growth of 1.0 percent to 3.0 percent, Adjusted EPS3 of $4.50 to $4.70, and aggregate wireless and wireline capital expenditures between $17.0 billion and $17.5 billion.

Parts of this story were reprinted from yesterday’s Bulletin issued at 8 a.m.

By John Celentano, Inside Towers Business Editor

Reader Interactions