Verizon Communications (NYSE: VZ) is hanging in there. The company’s 2Q23 results showed progress on financial and operational fronts, despite macroeconomic and competitive headwinds. Verizon reported consolidated 2Q23 revenues of $32.6 billion, down nearly four percent year-over-year. Of that total, though, wireless service revenues grew by four percent YoY to $19.1 billion. Consolidated net income was $4.8 billion, down over 10 percent YoY, mainly due to higher interest expenses. Adjusted EBITDA was up one percent to $12 billion. Free cash flow for the first half of 2023 was $8 billion.

Capital expenditure for the quarter was $4.1 billion, down from $4.7 billion in 2Q22. The decline reflects the completion of C-band Phase I build outs. To date, Verizon has activated C-band in roughly 70 PEAs of the 406 PEAs nationwide where it has licenses. Phase I licenses covered mainly urban markets. Once satellite operators clear the spectrum, Phase II build outs will get underway toward the end of 2023, and carry on into 2024. Most of this second tranche of C-band licenses are in suburban and rural areas where the company plans to offer both mobility and fixed wireless access services. For 2023, Verizon is maintaining its capex guidance of $18.25-19.25 billion that includes the remainder of the incremental $10 billion allocated for C-band spectrum activation. Verizon expects network investment to settle down to “business-as-usual capex” of $17.0-17.5 billion in 2024.

The company recorded 612,000 wireless retail postpaid net adds while losing 304,000 prepaid net adds. Prepaid losses are attributed to subscriber conversions to postpaid and switching to competitors. The company ended the quarter with a league-leading 143.2 million retail postpaid and prepaid connections, up from 142.8 million in 2Q22.

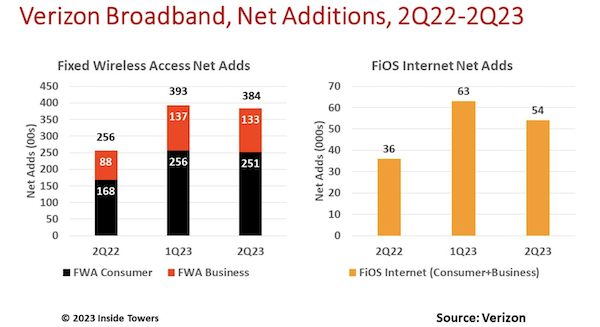

Wireless and fiber broadband connectivity continue to be growth areas. The company added 384,000 FWA subscribers in the quarter, compared to 256,000 in 2Q22 and 393,000 in 1Q23. Verizon ended the quarter with 2.3 million consumer and business FWA subscribers. The company is still targeting 4.0-5.0 million FWA subs by 2025.

Fiber-based FiOS internet net adds for 2Q23 were 54,000, up 50 percent from 36,000 in 2Q22, but down 14 percent from 63,000 in 1Q23. The company says that FiOS net adds vary quarterly depending on the number of subscribers that take the service. Verizon ended 2Q23 with 7.2 million Consumer and Business FiOS internet connections compared to 7.0 million YoY.

Private networks are a target market. Verizon announced recent wins with the U.S. Department of Veteran Affairs and the Cleveland Clinic. Hans Vestberg, Verizon Chairman & CEO says, “The total addressable market of private wireless is expected to grow significantly, and Verizon is well positioned to capture meaningful share.”

Tony Skiadas, EVP & CFO, commented on the lead-sheath cable issue that Inside Towers reported. “We still have some legacy lead sheath cable in our copper network. As a result of the age of this infrastructure and the history of the industry, records are incomplete as to exactly how much of the cable at our network has lead sheathing,” he said. “To give you a sense of the scale of the infrastructure we are talking about, our copper network [comprises] less than 540,000 miles of cable, roughly half of which is aerial, and lead sheath cable makes up a small percentage of our copper network. This number excludes the network elements previously owned by MCI and XO Communications because we are still reviewing the historical records of those companies.”

By John Celentano, Inside Towers Business Editor

Reader Interactions