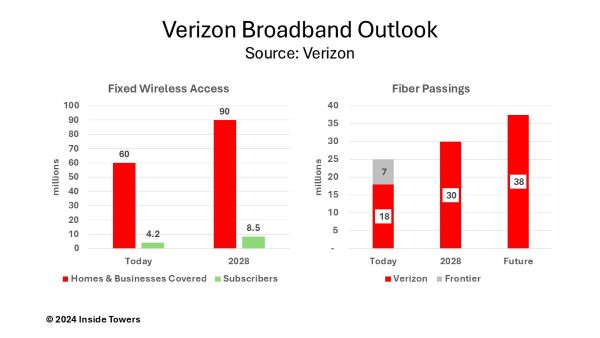

Mobility and broadband are the two pillars of Verizon’s (NYSE: VZ) growth strategy, according to Hans Vestberg, Verizon Chairman and CEO. In its 3Q24 earnings call, the company reported that its fixed wireless access business is performing well and achieved its 2025 goal of 4 million to 5 million subscribers, 15 months in advance. Verizon reported 4.2 million FWA consumer and business subscribers at the end of the quarter, up 57 percent on a year-over-year basis.

Vestberg says the company “leads with mobility” and sees an opportunity to expand its 5G Ultra Wideband service with C-band and millimeter wave spectrum on macro cells and small cells. The company expects its 5G UWB service to cover 70 percent of the U.S. population by the end of 2024, and is targeting its footprint coverage to reach 80-90 percent by 2025. Using the same 5G mobility spectrum, Verizon expects its FWA service to cover around 90 million homes and businesses by 2028, up from 60 million today. By that point, the company is now projecting 8 million to 9 million FWA subscribers.

In parallel, Verizon is rapidly expanding its fiber footprint both organically in its primary Northeast states operating territory and by leveraging its major acquisition of Frontier Communications (NYSE: FYBR), Inside Towers reported. At the end of 3Q24, Verizon’s FiOS system passed 18 million premises and Frontier reported 7 million passings on its own network. By 2028, the company expects its combined operations to reach 30 million passings and at some point, in the future, 35-40 million passings.

Verizon Wireless’ business is holding up albeit in slow growth mode. The company finished the quarter with 144.7 million retail postpaid and prepaid connections, up less than one percent on a YoY basis. Retail postpaid net additions in the quarter were 349,000, compared to 542,000 in 3Q23.

Wireless service revenues for the quarter were $19.8 billion, up nearly three percent YoY. Consolidated wireless and wireline service revenues were $28 billion compared to $27.5 billion in the year-ago period. Adjusted EBITDA was $12.5 billion, up two percent YOY and free cash flow for the quarter was $6.0 billion.

The company maintained its previous capex guidance of $17.0-17.5 billion for 2024, but raised its outlook for 2025 capex to $17.5-18.5 billion. Verizon says it has more work to do to build out its 5G network, particularly with C-band and mmW licenses in suburban and rural markets.

The company is looking at other network infrastructure growth opportunities including private networks, broadband distribution in multi-tenant dwelling units, and edge infrastructure applications.

By John Celentano, Inside Towers Business Editor

Reader Interactions