Verizon Communications’ (NYSE: VZ) business boils down to two key segments: wireless and broadband. Both of these segments have grown modestly over the past three years, both in terms of numbers of subscribers and revenues. The 2024 outlook can be characterized as “steady as she goes” as the company focuses on generating free cash flow and paying down a $150 billion debt tab.

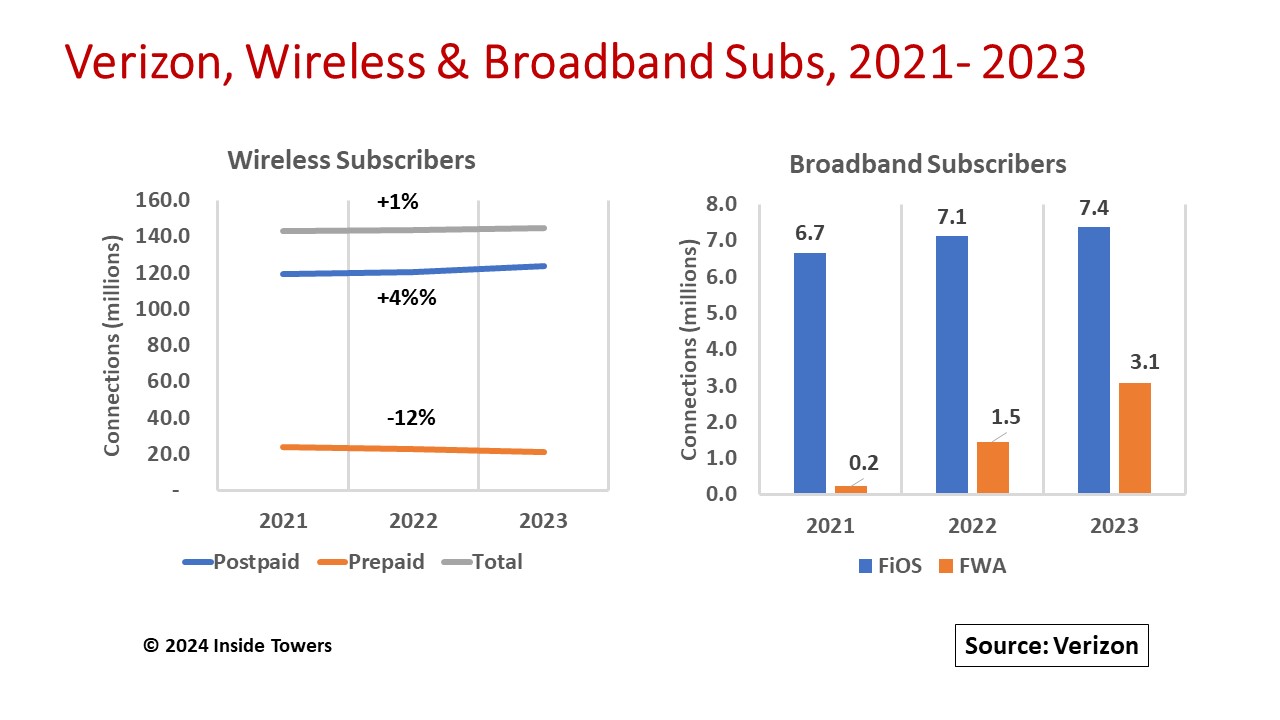

Wireless revenues for 2023 were $90.1 billion, up more than three percent year-over year. Wireless accounted for 82 percent of the company’s total 2023 service revenues of $109.7 billion that were flat compared to 2022. Total wireless postpaid and prepaid connections reached 144.8 million, up just one percent YoY. Postpaid connections, which accounted for 85 percent of the total, grew by four percent YoY but prepaid connections declined by 12 percent, mainly due to losses to competing MVNOs.

Despite low overall retail net additions, revenues grew mainly because of monthly rate increases. The postpaid average revenue per account grew five percent YoY to nearly $155 per month, or an average revenue per user of $43.74, as consumers opted for attractive and flexible price and feature plans, like myPlan.

The company’s broadband business is a mix of wireline broadband comprising its flagship FiOS fiber-to-the-premise network and legacy digital subscriber line service, and 5G-based fixed wireless access. Verizon’s wireline broadband connections totaled 15 million at year-end 2023, up nearly three percent YoY. FiOS is the growth portion, reaching 7.4 million connections or roughly half of all wireline broadband. The company expects to pass another 400,000 premises with FiOS in 2024.

FWA is the bright spot in the company’s broadband growth story. From a standing start in 2022, Verizon reported 3.1 million FWA consumer and business connections at year-end 2023. The company maintained its outlook to reach 4-5 million FWA subscribers by 2025.

Verizon’s 2024 guidance is for total wireless service revenue growth of 2 to 3.5 percent, and an Adjusted EBITDA increase of 1 to 3 percent.

Capital expenditures will be in the $17.0-17.5 billion range which the company says is “business-as-usual” capex. About $9-10 billion of the total 2024 capex guidance will be applied to wireless, according to Inside Towers Intelligence. The 2024 projection is reduced from the $18.8 billion spent in 2023, reflecting the winding down of accelerated incremental spending for C-band deployments in the previous two years, Inside Towers reported.

Verizon points out that 80 percent of the FWA connections are in markets where C-band already is deployed, namely the top 76 metro markets, including NFL cities. With the top markets built out and having received in 3Q23 access to cleared spectrum across the rest of the country, Verizon is planning to roll out C-band in suburban and rural markets albeit at a more measured pace over the next several years. It is densifying urban markets with both C-band and millimeter wave spectrum on small cells.

Reader Interactions