Verizon (NYSE: VZ) achieved a mixed bag of results in 1Q23, adding broadband customers while losing postpaid phone and prepaid subscriber net adds. Total revenue from services and wireless equipment sales was $32.9 billion, down 2 percent year-over-year from $33.6 billion in 1Q22. Of that total, wireless service revenue from consumers and businesses grew 3 percent YoY to $18.9 billion. Adjusted EBITDA was $11.9 billion, down 1 percent YoY.

Overall capital expenditure for the quarter came in at $6.0 billion. That figure includes most of the remaining $1.75 billion of C-band-related spending factored into the company’s 2023 capex guidance of $18.25-19.25 billion. As the C-band program concludes, Verizon expects “a step down” in the pacing of overall capex throughout the remainder of the year.

Nonetheless, Verizon was able to generate a significant volume of cash. The net result of cash flow from operations and capital spending is free cash flow for the quarter of $2.3 billion, up from $1.3 billion in 1Q22. But the company is still challenged in how to best allocate that cash. It is saddled with servicing a massive total debt load of over $153 billion while paying out an annual dividend of nearly $11 billion.

Verizon acknowledges that it must continue to add new customers to achieve its revenue and profit goals. The closely watched subscriber net add metrics were inconsistent, however. Retail postpaid net additions were 633,000, up substantially over the 269,000 added in 1Q22. At the same time, retail prepaid net adds continue to slide, losing 351,000 in the quarter compared to a loss of 80,000 in 1Q22. The company also had a loss of 127,000 retail postpaid phone net adds.

Total wireless retail postpaid and prepaid connections at the end of the quarter were an industry-leading 143.3 million, up slightly from 143.0 million in 1Q22. That total reflects a combined YoY increase of 1.5 percent on postpaid subs but a 6.1 percent decrease in prepaid subs.

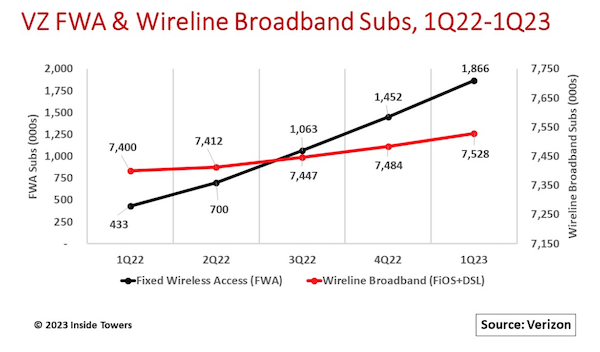

Fixed wireless access is a bright spot. FWA for business and consumer subscribers grew to 1.9 million, up sequentially from nearly 1.5 million at the end of 2022, and well up from 433,000 in 1Q22. The company says that customers are seeing the value of FWA for broadband connectivity, especially among businesses. FWA consumer net adds actually leveled out quarter-to-quarter, coming in at 256,000 compared to 262,000 in 4Q22. But Verizon added 726,000 business subs in 1Q23, up from 568,000 in 4Q23.

The company continues to see growth in FWA as it builds out its 5G Ultra-Wideband service with C-band (3.7-3.98 MHz) mid-band spectrum. At the end of the quarter, Verizon covered 200 million people with C-band, primarily urban and suburban areas. Initial deployments used 60 MHz bandwidth, but Verizon can increase that bandwidth to 160 MHz, and up to 200 MHz in some markets, adding FWA capacity as needed.

Most of that first phase C-band deployment is in the top 60 to 70 markets where the 3.7 GHz spectrum was first cleared by satellite companies, Inside Towers reported. The company points out that it has C-band licenses for 330 markets that encompass small communities and rural areas. It expects to extend C-band to these markets in late 2023 and into 2024, once the remaining portion of the C-band spectrum is cleared. Still, Verizon previously stated it expects FWA service to top out at 4-5 million subscribers.

Wireline broadband subs comprising Verizon’s fiber-based FiOS internet and legacy copper-based digital subscriber line (DSL) service reached 7.5 million subscribers, up 2 percent YoY. Within that tally, FiOS internet subs accounted for 95 percent of the total, adding 67,000 in 1Q23, a 3 percent YoY increase, while DSL subs declined 21 percent.

By John Celentano, Inside Towers Business Editor

Reader Interactions