This is an abbreviated excerpt from the latest issue of Intelligence by Inside Towers

Subscribe today for access to industry hard data and critical insights.

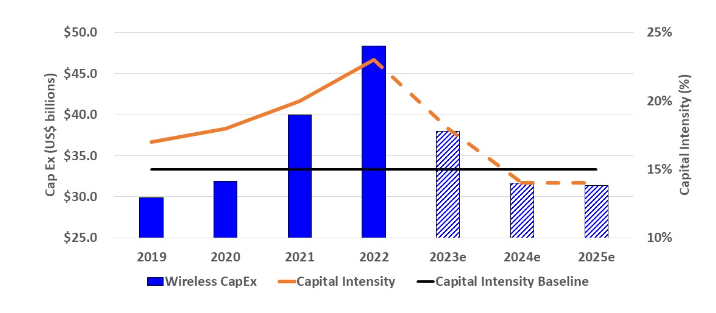

The past two years have been a phenomenal period in the U.S. wireless industry. Mobile network operator capital expenditure reached an all-time high of $48.3 billion in 2022. Since 2019, MNO capex has grown from $29.9 billion at a 17 percent CAGR. That growth is being driven by fast track 5G coverage and capacity buildouts to meet escalating mobile data demand. Furthermore, 5G build outs were enabled by new C-band (3.7-3.98 GHz) spectrum deployments in 2021 and 2022. For the next several years, wireless capex will decline to prior year levels. This drop was not unexpected, however, as our year-ago analysis showed.

There are two main reasons for the decline. First, Verizon (NYSE: VZ) and AT&T (NYSE: T) completed most of their first phase C-band deployments. That investment was incremental to the two companies’ overall planned 5G expansion activities. Secondly, T-Mobile (NASDAQ: TMUS) said it effectively completed at the end of 2022 the merger of its network with the acquired Sprint network. With that network integration largely complete, T-Mobile indicated that its ongoing network investments would settle down to a steady-state level. The aggregate capex decline should not be interpreted entirely as a negative, though. There is a lot more work to be done.

In their 4Q22 earnings calls, the tower companies shared that around 50 percent of the towers covered under MNO MLAs had 5G cell sites installed on them. This means MNOs for several more years will continue making cell site investments to reach their nationwide coverage and capacity goals. Certainly, there is much work to be done in closing the Digital Divide and for ‘Rip & Replace’ of untrusted RAN equipment, with billions in government funding to support those activities yet to come onstream. In companion areas, interest is growing in private networks, mobile edge computing, Open RAN and even 6G that all require increased investment.

Here’s what the numbers include – MNO actual and projected annual capex through 2025 for the Big 3 MNOs, UScellular (NYSE: USM) and other regional carriers, and WISPs. This data encompasses Engineering, Furnish, and Install capex (equipment and capitalized services) for RAN, Core and related ancillary equipment and support systems. Verizon refers to this as ‘Business as Usual’ or BAU capex. T-Mobile calls it ‘run rate’ capex, meaning regular annual investments. (The full report includes separate charts for capex by MNO and capex allocations by product and services.)

On top of their BAU capex, Verizon and AT&T each spent around $5 billion a year in 2021 and 2022 to build out C-band and 3.45 GHz spectrum.

Here’s what’s not included – the significant amounts the MNOs spent to acquire spectrum in FCC auctions, and money for mobile devices and user equipment. Importantly, the chart does not include any government funding such as the $42.5 billion Broadband Equity, Access, and Deployment and the $20.4 billion Rural Digital Opportunity Fund programs. At this juncture, any meaningful government funding is not likely before 2024.

The chart also does not include any vendor financing. AT&T is the outlier as the only MNO to use vendor financing in a meaningful way, nearly $5 billion in 2022.

Lastly, while the Big 3 MNOs have divested their towers and no longer invest in their own passive infrastructure, UScellular is the exception and still owns its own towers. Related tower capex is included in the company’s overall capex number.

For more information or to subscribe to access the full report and additional analysis: https://insidetowers.com/intelligence/.

By John Celentano, Inside Towers Business Editor

Reader Interactions