Even as Canada joins the other members of the Five Eyes intelligence alliance — the U.S., the United Kingdom, Australia and New Zealand — to ban Huawei and ZTE, the OEMs are doing quite fine. Thank you very much.

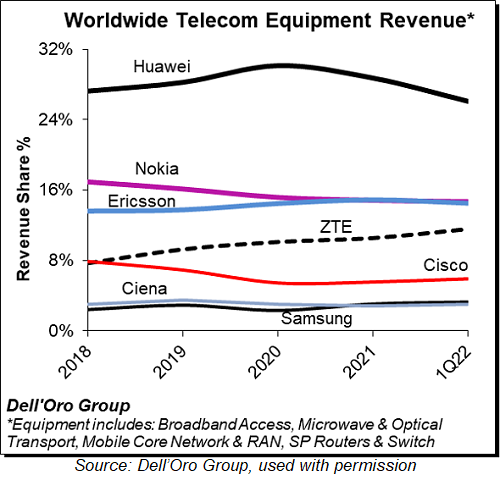

ZTE’s first quarter telecom equipment revenue share approached 12 percent in the quarter, up roughly four percentage points since 2018, and Huawei, although diminished, still garners 24 percent of the market, according to Dell’Oro Group’s 1Q22 Total Telecom Equipment Market report, authored by Stefan Pongratz, VP RAN Analyst. The publication covers telecommunications infrastructure programs, including broadband access, microwave and optical transport, mobile core network, RAN, and SP router and ethernet switch.

“Following three consecutive years of steady share advancements, ZTE started the year on a solid footing, primarily driven by share gains in Broadband Access,” the report reads.

Dell’Oro Group also noted the resiliency of Huawei in the face of being banned from acquiring U.S. components in May 2020. “Huawei has done a remarkable job supporting its customers and maintaining its leadership position,” the report reads. “At the same time, diverging trends between existing and new footprints are putting some downward pressure on Huawei’s revenue share.”

The closest competitors to Huawei are Ericsson and Nokia, which both came in at 16 percent at the end of 1Q22.

Preliminary readings suggest the overall telecom equipment market advanced 4 to 5 percent year-over-year in the quarter, which is down from 8 percent in 2021. Dell’Oro noted that global telecom equipment revenues are projected to increase 4 percent in 2022 and record a fifth consecutive year of growth, underpinned by “robust demand for wireline-related equipment and modest growth in wireless.”

“Even with the unusual uncertainty surrounding the economy, the supply chains, the war in Ukraine, and China’s zero-COVID-19 policy, the Dell’Oro analyst team remains relatively upbeat about the short-term prospects,” the report reads. “It is important to keep in mind that the severity of the risks and the visibility vary across the telecom equipment segments.”

Drilling down, the regional dynamics were mixed in the quarter. Revenue growth in North America of 13 percent and modest mid-single-digit expansion in Europe, Middle East & Africa offset weaker growth numbers in the Asia Pacific region. At the same time, the vendors were relatively stable in the quarter with the top seven suppliers accounting for 80 percent of the overall market.

By J. Sharpe Smith, Inside Towers Technology Editor

Reader Interactions