AT&T (NYSE: T) has a mixed bag of business with a lot to unpack. The company reported 1Q21 consolidated revenues of nearly $44 billion, up 3 percent from the same period a year ago. Of that total, service revenues excluding equipment sales were $39 billion. Consolidated Adjusted EBITDA was $13.6 billion, down 5 percent from 1Q20.

CapEx

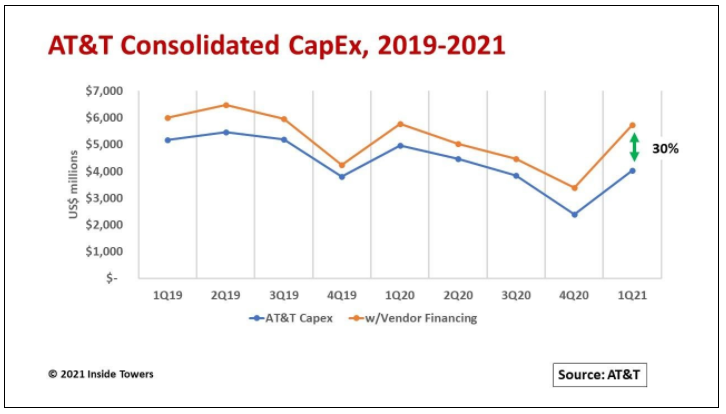

Aggregate capital expenditures for 1Q21 were $4 billion, down 19 percent on a year-over-year basis. This amount was funded by the company itself from free cash flow. However, AT&T increasingly is leaning on its equipment vendors to help finance its wireless and wireline network builds. (Gross capital investment is the sum of cash capex plus amounts paid to vendors for financing-related capex that is not taken from free cash flow.)

Gross capex for 1Q21, including vendor financing and FirstNet reimbursements, totaled $5.7 billion, essentially flat on a YoY basis. Note that the proportion of vendor financing more than doubled from an average of 13 percent from 1Q19 through 3Q20 to 30 percent in both 4Q20 and 1Q21.

In its 1Q21 earnings call, the company raised its gross capex outlook to $22 billion, of which $18 billion would come from its own coffers, suggesting 18 percent of vendor financing.

If the past two years are any indication, AT&T’s quarter-to-quarter capex is unpredictable. Its network investments tailed off dramatically in the second half of each year. Historically, capex is back-end loaded. (see, Is AT&T Underinvesting in Its Networks?)

That said, AT&T is focusing its investments in three growth areas: wireless, fiber and HBO Max.

Mobility

In 1Q21, the company’s Mobility segment generated $14 billion in service revenues, over one-third of total service revenues, but grew less than one percent on a YoY basis. Mobility’s Adjusted EBITDA for the quarter was $8 billion and contributed roughly 60 percent of AT&T’s total Adjusted EBITDA.

Mobility has a tough time boosting the top line. Postpaid and prepaid retail connections grew close to 4 percent YoY to more than 96 million while connected devices grew 20 percent from a year ago to 83 million. Total subscribers and connections reached 186 million, up 10 percent from 1Q20.

But postpaid ARPU declined 3 percent YoY to just under $50 a month. Unlimited plans and competition are retarding wireless service revenue growth. AT&T is trying to break out of that cycle with premium bundled services.

Nonetheless, AT&T continues to build its 5G network for both nationwide and market-specific applications. Since it acquired roughly 80 MHz of C-band spectrum nationwide, AT&T plans to cover markets across the country in that band.

AT&T paid more than $27 billion for C-band licenses at auction along with its spectrum clearing cost contribution. The company indicated it will invest $6-8 billion in incremental capex for C-band deployments over the next several years. Including C-band, AT&T’s spectrum holdings now total 1285 MHz across low-, mid-, and high-band frequencies, giving it a lot of latitude for 5G applications.

Though the company does not break out capex allocations, we estimate AT&T’s wireless capex, at over half of the total, in the $8-10 billion range for full-year 2021, exclusive of vendor financing.

Fiber

Fiber is a foundation technology for AT&T. The company is using its fiber network to connect to its own cell sites where its fiber routes are close by. More importantly, AT&T sees business and consumer fiber connectivity as a growth driver.

Since 1Q20, AT&T has added an average of 260,000 fiber connections a quarter, connecting to 5.2 million homes at the end of 1Q21. This figure represents a 37 percent penetration of more than 14 million homes passed. In 2021, the company plans to increase its current fiber footprint by expanding to over 3 million customer locations in more than 90 metro areas.

WarnerMedia

AT&T’s WarnerMedia segment is another growth driver and one on which AT&T has placed a big bet. Now it’s gaining traction. Overall, WarnerMedia segment’s operating revenues in 1Q21 were $8.5 billion, up 10 percent from a year ago.

The Direct-to-Consumer model that encompasses its flagship HBO Max and HBO programming is paying off. DTC subscription, content and other revenues reached $2 billion in 1Q21, up 29 percent YoY.

Domestic HBO Max and HBO subscribers reached 44 million in 1Q21, up 34 percent YoY, while global subscribers exceeded 64 million, an increase of 19 percent from 54 million in 1Q20. Since beating its earlier subscriber growth projections, AT&T now plans to reach 120 million HBO Max and HBO subscribers worldwide by 2025.

AT&T is in a challenging financial position.

In the aftermath of the C-band auction, long-term debt ballooned to $161 billion. With the top line growing only at single-digit percentages, the company must jettison non-performing and non-strategic assets and reduce operating costs while creating new revenue streams.

Still, with over $10 billion in cash it throws off each quarter, AT&T can fund its capital investments, service the debt and maintain a consistent dividend payout.

By John Celentano, Inside Towers Business Editor

Reader Interactions