Stop me if you heard this before – roughly 80 percent of all mobile calls originate or terminate inside buildings. Credit this widely cited metric to the former AT&T Antenna Systems Group (ASG) that extended AT&T’s network into very large venues like sports facilities, airports and convention centers. Quality cellular connections inside commercial buildings is imperative for all mobile users and the venue owners.

Implementing and operating an in-building wireless (IBW) system involves significant technical and economic challenges, however. Every building has a different size and shape. Materials like steel, concrete and energy-efficient glass all inhibit RF transmissions both from outside and within buildings. More important, the carriers own the cellular frequencies.

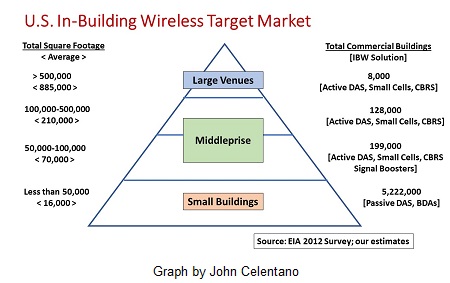

The DOE Energy Information Administration’s (EIA) latest Commercial Buildings Energy Consumption Survey (CBECS) shows there are 5.6 million U.S. commercial buildings comprising 87 billion square feet of space for all types of use. Yet IBW penetration remains stubbornly low due to the high deployment costs and restricted access to frequencies.

Wireless carriers already address the Large Venue tier of 8,000 structures that average nearly a million square feet (sf). IBW systems are either active distributed antenna system (DAS) or small cells, depending on the size and layout of the facility. Wireless carriers fund these IBW deployments. Often, one major carrier handles the initial installation and others onboard once the system is in service.

By contrast, the low-end Small Buildings tier accounts for 94 percent of the total or 5.2 million buildings averaging 16,000 sf. Most are too small to warrant their own IBW system. Small businesses, retail stores and professional firms generally rely on signals from the nearest macrocell coming inside. Where better indoor coverage is needed, a low-cost bi-directional amplifier (BDA) or passive DAS brings in signals from outside.

The IBW sweetspot is the so-called Middleprise, involving two tiers totaling 327,000 buildings in the 50,000 to 500,000 sf range. Middleprise appeals to equipment vendors and contractors because of the sheer numbers that support a myriad of vertical applications – enterprise, hospitality, education, healthcare, hi-rise residences and industrial sites, either as standalone buildings or multi-building campuses.

Carriers have stated they are unwilling to invest in all these Middleprise buildings. Instead, they leave it to the building owners and their neutral host partners such as tower companies or systems integrators to pay for IBW systems that transport carrier frequencies. Therein lies the problem.

IBW installations in such large facilities are expensive, running $1-2 per sf, depending on the IBW system, whether an active DAS, small cells, or a Private LTE network for which they must obtain licenses in non-carrier frequency bands. Moreover, negotiating with multiple carriers to access their frequencies for in-building is a lengthy and arduous process.

Citizens Broadband Radio System (CBRS) in the 3.5 GHz band offers a new solution. “We see CBRS in the mix as having the reliability of cellular with the easy-to-deploy method of WiFi without spending millions of dollars for spectrum,” says Alessandro Feitosa, SVP-WiFi, IT & Analytics at Altanta, GA-based Connectivity Wireless, a systems integrator and neutral host operator. “We’ve applied for GAA [General Authorized Access] licenses and are working with partners testing CBRS in lots of applications in several venues.”

Feitosa points out that with CBRS, venue owners can establish Private LTE networks to complement a DAS and WiFi system in that same facility. “Carrier customers’ smartphones can incorporate programmed SIMs so they can roam on to the Private LTE network. This helps offload traffic from the carrier network to the cheaper private network. At the same time, the venue owners could sell capacity to the carrier in a third-party operator (3PO) model. DAS or WiFi plus CBRS now becomes contract infrastructure.” Feitosa expects more mixing and matching of CBRS, cellular DAS and WiFi depending on the location, cost and use cases. “WiFi will still be part of 80 percent of use cases. In large venues where DAS is installed, CBRS is complementary. They are all frienemies!”

CBRS likely will stimulate new Middleprise IBW deployments at lower overall costs and in shorter time-frames than traditional systems. These systems can deliver robust services to users and create potential new revenue sources for the building owners and their neutral host partners.

By John Celentano, Inside Towers Business Editor

Reader Interactions