DigitalBridge Group (NYSE: DBRG) has nearly completed its “rotation” from managing investments in a diversified real estate portfolio to a digital infrastructure investor and operator. Now the company is set to accelerate its growth with further investments in high growth digital infrastructure markets around the world.

Transitioning to full digital infrastructure has meant selling or divesting properties that the former Colony Capital held in hospitality, wellness, and other real estate-based businesses. At the end of 3Q21, DBRG has achieved, on a pro forma basis, 99 percent of digital assets under management (AUM), representing a rotation of $73 billion in AUM in less than three years. The rotation involved over $40 billion of AUM in digital infrastructure and harvesting roughly $33 billion of legacy AUM.

In September, DBRG reached an agreement to sell its final legacy business, Wellness Infrastructure, for $3.2 billion. When the transaction closes in 1Q22, DBRG’s rotation ‘from diversified to digital’ will be complete.

The rotation to digital infrastructure greatly simplifies DBRG’s business. Fundamentally, DBRG is a global investment firm focused on digital infrastructure in two distinct divisions.

The Digital Investment Management (IM) unit raises capital from limited partners and invests that capital in digital infrastructure companies through its Digital Capital Partners (DCP) funds, DCP I and DCP II. The company generates revenues through investment management fees. The IM team creates a proprietary deal flow for the company based on DBRG’s ability to identify high quality digital infrastructure assets.

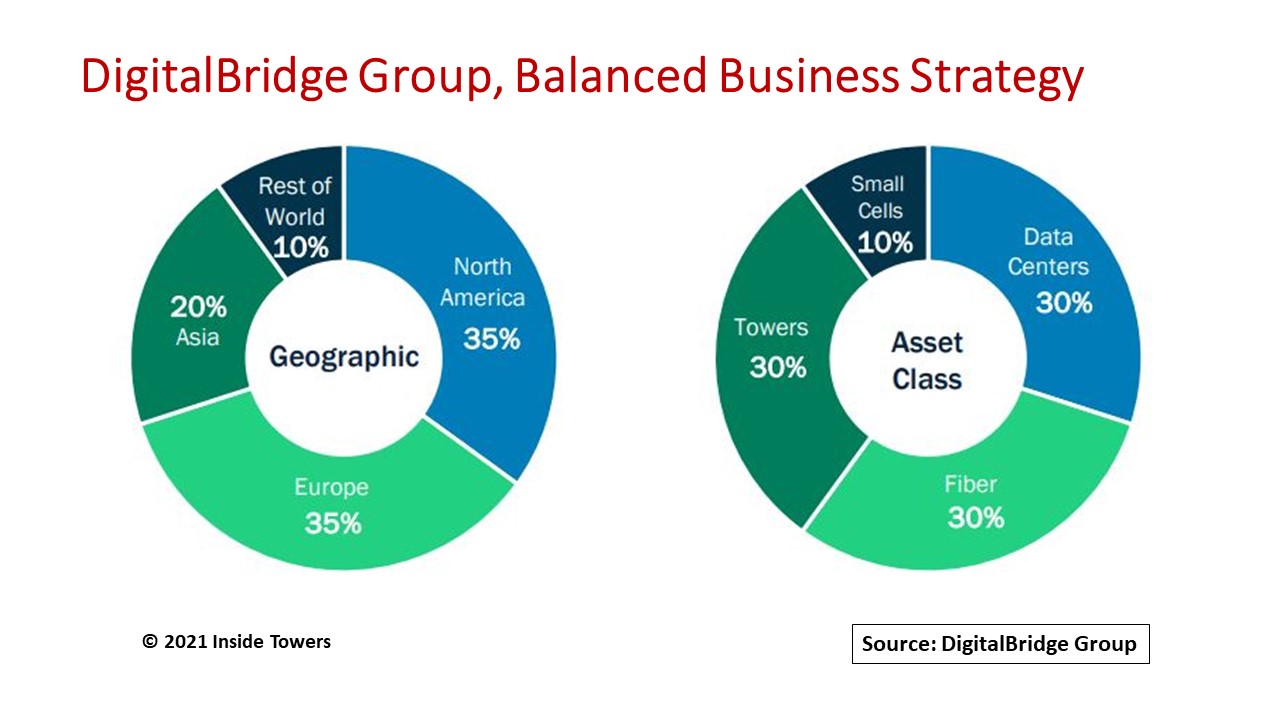

Between the balance sheet and investment management, DBRG has assembled a diverse global portfolio of digital infrastructure assets equating to more than $40 billion in AUM. That portfolio is balanced across digital infrastructure assets and across high growth markets in North America, Europe and Asia.

The company’s 22 portfolio companies include towers, data centers and edge infrastructure, fiber, and small cells, along with two on-balance sheet digital operating companies – Vantage Data Centers and DataBank.

Its Digital Operating unit acquires, expands, and operates digital infrastructure, generally, with operating partners. DBRG takes its proportional share of the operating revenues generated by these companies.

Towers include Vertical Bridge, the largest private tower company in the U.S., and eight tower companies globally with a total of more than 30,000 active towers. With over 100 data centers, Vantage Data Centers operates a global hyperscale data center platform and DataBank offers edge computing in 25 U.S. metro markets. Led by Extenet Systems and Boingo, DBRG operates over 95,000 small cells. With 130,000+ route miles, led by Zayo, DBRG has the largest private fiber footprint in the U.S. and Europe. And in edge infrastructure, the company partnered with Liberty Global to launch AtlasEdge, the first European edge infrastructure platform with 100+ sites after the recent acquisition of Colt Data Centre Services.

With the transition of the company essentially complete, management is focusing on growing the business through targeted investments and expanding and scaling of its portfolio companies.

DBRG has significant investment firepower with capital formation through its second flagship fund, DCP II, that reached commitments of $8.1 billion, nearly twice the volume of its original DCP I fund and 35 percent higher than the original $6.0 billion target. Total Digital Fee-Earning Equity Under Management (FEEUM) increased to $17.2 billion to date, exceeding the company’s full-year 2021 guidance a quarter ahead of schedule.

DBRG expects revenue and earnings growth in its two business segments through strong capital formation momentum in Digital IM and growth in Digital Operating driven by new acquisitions and organic growth.

In its 3Q21 earnings report, the company raised its 2021 guidance for Digital IM Fee revenue to $165-170 million and Digital IM Fee Related Earnings (FRE) to $95-100 million. The company also maintained guidance for its share of Digital Operating revenue of $130-140 million and Digital Operating EBITDA of $55-60 million.

By 2023, the company expects Digital IM revenue and FRE to continue growing as it expands the magnitude and scope of its investment products. DBRG is projecting Digital IM fee revenue of $180-230 million and FRE of $110-140 million.

As well, DBRG sees significant Digital Operating growth by 2023, through re-deployment of $1.5 billion capital from legacy asset monetization, and both organic growth and bolt-on acquisitions at existing platforms. It expects Digital Operating revenue to more than triple to $400-500 million and Digital Operating Adjusted EBITDA of $175-225 million.

By John Celentano, Inside Towers Business Editor

Reader Interactions