Swedish telecommunications giant Ericsson (NasdaqGS: ERIC) Thursday reported 1Q20 revenues of $5 billion at a stout 39.8 percent gross margin and $228 million in net income. 1Q20 revenues were up 2 percent on a year-to-year (YtY) basis compared to 1Q19 but down 25 percent sequentially from 4Q19 revenues of $6.6 billion. On a quarter-to-quarter (QtQ) basis, the 1Q20 figure is down compared to 4Q19 due to seasonality (network investment activity typically ramps through the year) and the impact of COVID-19 worldwide. Net income was down 5 percent on a YtY basis compared to 1Q19.

The company sustained its research and development (R&D) expenses for 1Q20 at just under $1 billion or 18 percent of revenues. This proportion is in line with its annual R&D investment level at 17 percent of revenue and is consistent with other manufacturers in the telecom equipment sector.

Ericsson’s product portfolio comprises four main segments: Networks, Digital Services, Managed Services and Emerging Business & Other. The Networks segment provides products and services for 4G and 5G access and transport, fixed wireless access, cellular IoT and private networks. It is the bulk of Ericsson’s business accounting for 71 percent of 1Q20 sales.

Digital Services includes network automation, core network and cloud infrastructure while Managed Services involves contract management of customers networks. Together these two segments made up 26 percent of 1Q20 sales. The 9 percent balance originated from the Emerging Business segment that is involved in new technology developments such as 5G evolution and beyond, future IoT, cyber physical systems and network security and autonomous networks.

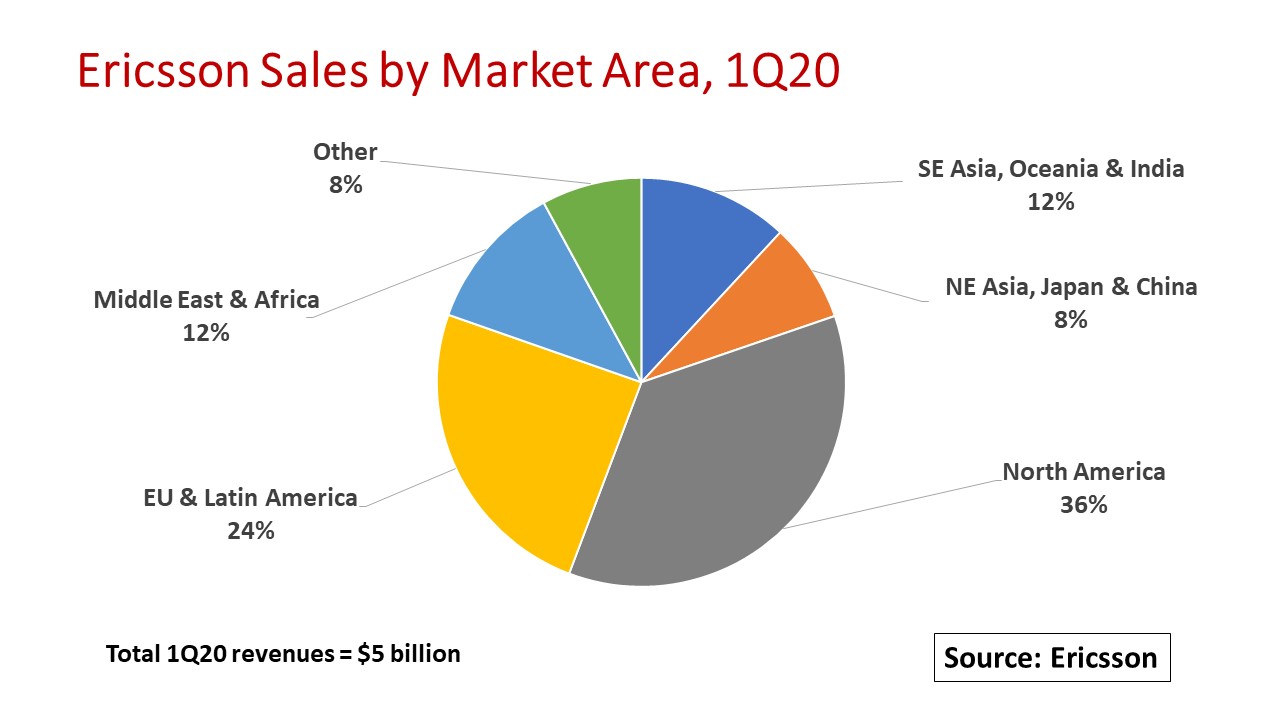

By market area, North America remains Ericsson’s biggest play accounting for 36 percent of 1Q20 revenues. Networks segment sales increased on the strength of 5G momentum among its biggest customers – AT&T and Verizon. Managed Services sales were flat YtY and Ericsson expects to see further declines after 2Q with the loss of its contract with Sprint in the aftermath of the merger with T-Mobile. Europe and Latin America together make up 24 percent of revenues.

European growth in the Networks segment was offset by decline in Latin America where the company had several large deployments in 2019. Managed Services sales declined due to several contract exits. Middle East & Africa accounted for 12 percent of sales with growth in 4G and 5G deliveries in key markets in the region.

In Southeast Asia, (Oceania & India), sales declined in both Networks and Digital Services mainly due to timing delays on several project deliveries and milestones. The company acknowledged that the situation in India remains “challenging.” The Northeast Asia (Japan & China) area saw growth in Networks and Digital Services in Japan but a big decline in 4G deployments in China.

In the face of the global pandemic, Ericsson claims that its business fundamentals remain strong. The company believes that its focused strategy is paying off. To date, Ericsson is the leading global supplier in 5G with 29 live networks across four continents and 86 agreements at the end of March.

The company is advocating for European governments to encourage 5G investments to help restart their economies after COVID-19. Ericsson is maintaining its R&D investments in its market-leading portfolio and believes it is well-positioned for future wins.

Given current visibility in all its markets, Ericsson is holding to its financial targets for 2020, of $23-24 billion in total sales, up from $22 billion in 2019, and growing at 12-14 percent a year to 2022.

By John Celentano, Inside Towers Business Editor

Reader Interactions