IHS Holdings, parent company of IHS Towers, in its Form F-1 filing with the SEC, shared operating and financial data, as of June 30, 2021, for an initial public offering (IPO) with a listing on the NYSE as “IHS.”

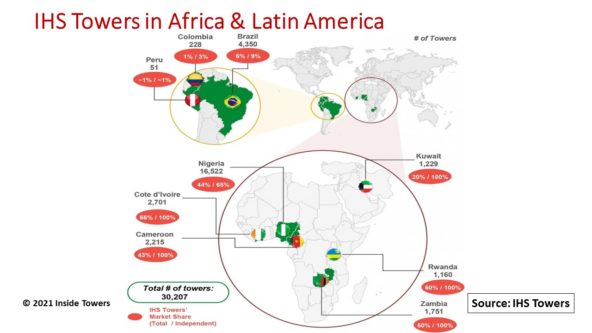

The company owns and operates 30,207 towers across three continents and nine countries: five in Africa (Nigeria, Côte d’Ivoire, Cameroon, Rwanda, Zambia), three in Latin America (Brazil, Colombia, Peru), and Kuwait in the Middle East.

The total tower count comprises 28,300 owned towers and roughly 1,900 towers that it manages with a license to lease (MLL). Nigeria is the largest single market with 16,522 towers or 55 percent of the total followed by Brazil with 4,350 towers or 14 percent of the total.

IHS claims to be the fourth largest “independent, emerging market-only” tower operator globally behind American Tower, Cellnex and SBA Communications, and ahead of Phoenix Tower International and Helios Towers. Indus Towers (India), Vantage Towers (Europe) and Crown Castle (USA) all have more towers but are categorized differently as single-market or quasi-independent tower operators.

IHS serves the leading mobile network operators in each of its operating regions: MTN, Orange, Airtel and 9mobile in Africa; Claro, TIM, and Telefonica in Brazil; and Zain in Kuwait. These key customers accounted for 92 percent of IHS’ total 45,487 tenants, as of June 30, yielding an average of 1.51 tenants per tower.

IHS leases the ground under 92 percent of its sites. Ground lease costs extend for a fixed duration, typically 10- to 15-year terms. The average remaining life of its ground leases is 7.9 years.

IHS Towers was founded 20 years ago, building telecommunications towers for MNOs in Nigeria. Several years later, it launched a managed services operation providing MNO-owned towers with maintenance, security, and power supply resources. By 2009, IHS began owning towers and leasing space to MNOs in Nigeria through its colocation operations.

A series of tower acquisitions outside of Nigeria followed in the next several years and culminated in milestone transactions in Nigeria to acquire a total of 10,966 towers from MTN Nigeria and 9mobile. The company continued its build-or-buy expansion in various African countries, then ventured into Latin America in 2020.

Today, IHS is the largest tower operator in six of its nine markets and is the only independent tower operator of scale in five of these markets.

As a telecom infrastructure company, IHS engages its MNO tenants through long-term MLAs, typically, 5 to 15 years, with specified renewal intervals. As of June 30, the average remaining length of MLAs with its key customers, who represent 92 percent of its tenants, was 6.3 years. Across all its MLAs, the aggregate contracted tenant lease revenue is $9.8 billion with an average remaining lease term of 7.4 years.

IHS’s MLAs typically include revenue escalators linked to local inflation rates, limited customer termination rights and, in certain cases, foreign exchange and local currency fluctuation risk buffers along with pass-through costs for energy and backup generator fuel.

The outlook for wireless service demand across IHS’s regional markets is positive. The company expects wireless devices to grow from 609 million in 2020 to 684 million by 2025, at a 3 percent CAGR. In many of these developing countries, wireless connectivity is the only viable means of communications. Beyond voice and data communications, wireless service supports economic development, education, health care, commerce, and public safety.

MNOs realize that tower sales and lease back with companies like IHS Towers can free up capital to invest in their networks, many of which are operating 2G, 3G and 4G systems with 5G still on the horizon.

IHS Holding estimates that between 2020-2025, its African markets will require over 22,000 new towers with another 19,000 in Latin America, to support growing wireless carrier tenancies.

At year-end 2020, IHS Holding reported $1.4 billion in revenues, up 14 percent on a year-over-year basis. At current run rates, full-year 2021 revenues will be about $1.5 billion, representing a 9 percent CAGR since 2018. Similarly, Adjusted EBITDA could reach $980 million by year-end 2021, representing a 21 percent CAGR in the same period.

The company has not yet set a target share price range for its IPO, just an interim target capital raise goal of $100 million.

By John Celentano, Inside Towers Business Editor

Reader Interactions