Landmark Infrastructure Partners (NASDAQ: LMRK) is quietly building an infrastructure portfolio that positions it in high growth sectors. The company acknowledges its small scale, noting that its asset portfolio represents “less than 1 percent” of the total U.S. market.

Landmark positions itself as “a growth-oriented real property and infrastructure firm.” It acquires, develops, owns, and manages a diversified, growing portfolio of real property interests and critical infrastructure assets. The company leases these assets to tower companies and wireless carriers, outdoor advertising operators, wind and solar power companies, and data center users.

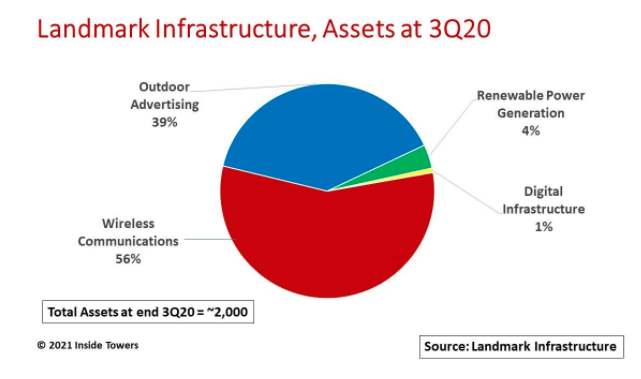

Landmark’s portfolio is a mixed bag of nearly 2,000 available tenant sites diversified across 48 U.S. states and Washington, D.C., Canada, and Australia.

Wireless communications assets account for the lion’s share comprising towers, rooftops, and other structures like water towers along with land under the towers. Major tenants include T-Mobile and Crown Castle. Wireless accounted for about 45 percent of Landmark’s rental revenues through 3Q20.

In September 2020, Landmark entered the data center business acquiring from Sungard co-location sites in two key markets – Toronto, Ontario and Atlanta, Georgia.

The company owns critical infrastructure assets in strategic locations. Much of these investments are in major markets with the top 100 business trading areas in the U.S. accounting for 87 percent of Landmark’s rental revenues from Tier 1 tenants for their essential operations in these markets.

In wireless, it owns underlying operationally critical assets needed to meet growing capacity/coverage requirements for escalating mobile data demands.

Its portfolio of billboards is in key traffic locations. Most of these billboards already have favorable zoning allowances with “grandfather clauses” that ensure they will stay in place for some time.

Landmark owns renewable solar and wind power generation assets situated near key power transmission interconnect points such as substations. Southern California Edison is its biggest utility customer.

Its recent digital infrastructure expansion with data center acquisitions gives it proximity to major urban markets positioned for growth in data consumption.

The company points out that its tenants have made significant capital investments on the assets that Landmark owns. As a result, these assets are difficult to replicate and costly to relocate given the significant zoning, permitting and regulatory hurdles in finding suitable new locations and the time and cost of construction at a new site. Moreover, the vacating tenant must often incur the cost of returning the property to its original condition.

Landmark’s wireless infrastructure assets are attractive to Tier 1 MNOs and towercos although no single tenant accounts for more than 15 percent of revenue.

Despite its diminutive scale, the company realizes stable cash flows. Landmark claims it achieves 97 percent property operating margins and incurs no maintenance capex.

Most of its agreements are on long-lived assets with effective triple net leases, meaning that tenants cover real estate taxes, building insurance and maintenance in return for lower rents.

Landmark is seeing organic growth through contractual rent escalators. Typically, 87 percent of its leases have contractual rent escalators ̶ 79 percent with fixed rate increases at an average annual escalation rate of approximately 2.4 percent and 8 percent tied to the consumer price index.

Revenue growth also comes from lease modifications, revenue sharing, lease-up and renewals. Wireless lease modifications originate mainly from technology upgrades by current tenants. New revenue derives from co-locating additional tenants on existing sites.

By John Celentano, Inside Towers Business Editor

Reader Interactions