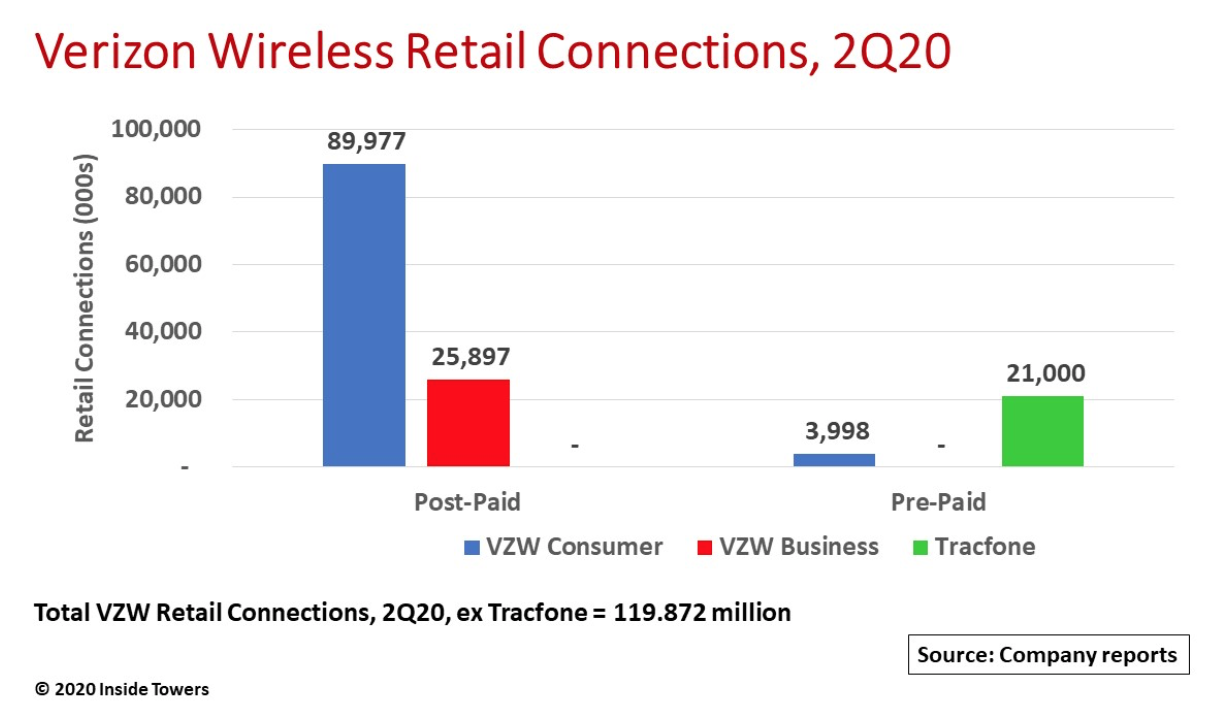

Verizon’s (NYSE: VZ) announcement to acquire TracFone Wireless from América Móvil (NYSE: AMX) came out of the blue. For nearly $7 billion, VZ gains 21 million TracFone pre-paid wireless subscribers.

What is VZ really buying and why now? The deal has several aspects.

The 21 million TracFone subscribers adds substantially to VZ’s current roster of nearly 4 million prepaid connections.

In the process, VZ picks up leading prepaid brands like Straight Talk Wireless and SafeLink Wireless that together account for most of the over 13 million TracFone connections already carried on VZ’s network. The other 8 million being handled by competing carriers also will transfer to VZ.

Pre-paid wireless, also called ‘value’ service, is a monthly flat rate service typically at lower price points and lower gross margins than post-paid services.

As well, VZ absorbs TracFone’s revenue stream that reached $8.1 billion in 2019. Note that the deal will close around mid-2021 and is not expected to be accretive to VZ’s financial results until mid-2022.

The deal also includes over 90,000 retail outlets including Walmart, Target, Best Buy, Dollar General and CVS Pharmacy that sell one or more of TracFone’s nine different brands. By comparison, VZ operates just over 6,900 Verizon-branded retail stores.

This retail channel could be the real gem. TracFone gives VZ significant retail reach and market presence to upsell prepaid subscribers either to postpaid status or other Verizon-branded services such as fixed wireless access or 5G.

Here is what’s puzzling:

On the surface, $7 billion for 21 million subscribers seems rich for relatively modest gains. The closest comp is DISH Network (NASDAQ: DISH) paying T-Mobile (NASDAQ: TMUS) $1.4 billion for 9.2 million Boost Mobile prepaid customers.

Despite VZ CEO Hans Vestberg’s enthusiasm for the deal, TracFone’s contributions appear incremental at best.

Combining both companies’ year-end 2019 results, TracFone accounts for 11 percent of the combined wireless service revenues of $73 billion and 15 percent of the total 140 million post- and pre-paid connections.

Frankly, the deal seems more opportunistic than strategic.

Still, VZ becomes the U.S. market leader in both postpaid and prepaid subscribers. With channels-to-market through some of the country’s biggest retailers, VZ will have a prominent presence in consumer’s minds.

In the end, it’s about cash flow and whether VZ can afford such deals.

VZ just paid almost $2 billion for 3.5 GHz CBRS licenses. Moreover, the company could be the walk-off winner in the upcoming C-Band spectrum auction, likely doling out billions more to shore up its mid-band holdings that are much-needed for competitive 5G deployments.

On top of that, VZ’s annual capital expenditures are $17-18 billion. Of the total, an estimated $8-10 billion is wireless capex used to sustain its vaunted 4G LTE network while racing to build out 5G.

All the while, investors are keeping a wary eye on how VZ is servicing its $106 billion long-term debt, second only to AT&T’s gargantuan load of $153 billion, as of 2Q20.

For now, VZ is managing the cash outlay. It generates cash flows from operating activities in the order of $8-9 billion per quarter.

Did VZ cut a good deal? Time will tell.

If the company can leverage its new dominant post- and pre-paid market position to upsell other higher margin services to a wider consumer audience then maybe it is worth it.

But it will take years before the top-line benefits kick in and the return on investment is realized.

With TMUS mounting a competitive threat, VZ might better focus on becoming the dominant 5G service provider and minimize the incremental plays.

by John Celentano, Inside Towers Business Editor

Reader Interactions