Rogers Communications (NYSE: RCI) reported 2Q20 earnings as its first full quarter of operations since the COVID-19 pandemic became significant in March. The impact was material.

Rogers is Canada’s largest wireless, cable, and media conglomerate. Total service revenues in 1H20 were US$4.3 billion, down 10 percent on a year-to-year basis compared to C$6.5 billion in 1H19.

Of the three operating segments, Wireless is dominant, accounting for 60 percent of full-year 2019 revenues. Cable made up another 26 percent while Media contributed the remaining 14 percent of the total.

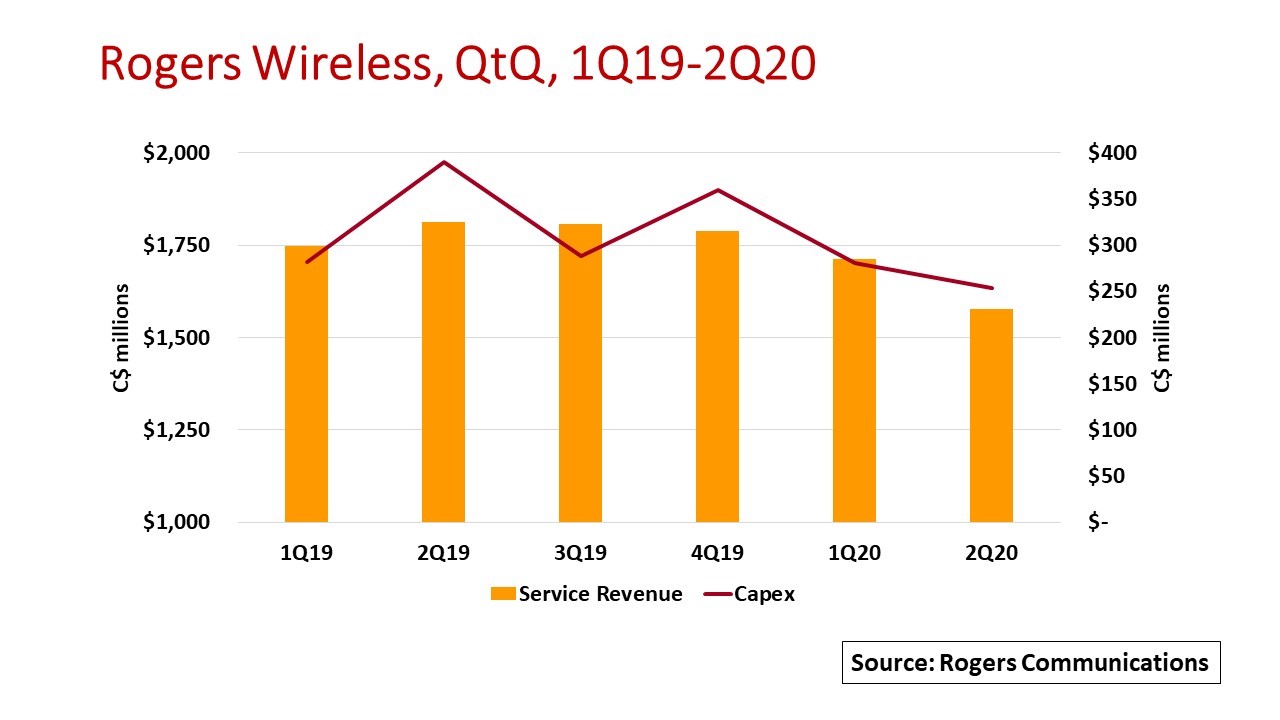

Rogers Wireless’ 2Q20 service revenue of US$1.19 billion declined 10 percent compared to US$1.3 billion in 2Q19. For the first six months of 2020, service revenue of US$2.4 billion was 8 percent lower than the US$2.6 billion garnered in 1H19.

The company attributed the Wireless service revenue decline to two main factors: a significant drop on roaming revenue due to global travel restrictions that were imposed when COVID-19 hit, and lower data overage charges as a result of continued adoption of Rogers’ Infinite unlimited data plan that it offered in late 2019. Rogers Wireless is the first wireless service provider in Canada to offer unlimited data plans.

As a result, Wireless’ 1H20 capital expenditures through were US$399 million, down 20 percent from US$501 million in 1H19, a sharp deviation from historical spending patterns where 2Q capex increases.

Capital investment intensity has dropped in 1H20 to 16 percent from nearly 19 percent a year ago due to lower capex, partially offset by lower service revenue. Still, these investment levels reflect ongoing network expansion.

Cable operations have held up well through the pandemic. With stay-in-place and work-from-home mandates in effect, Rogers Cable’s 5.2 million subscribers relied heavily on the fast internet access, WiFi calling and home entertainment services that Cable provides. Cable’s 1H20 service revenues were US$1.4 billion, down just 2 percent from the same period a year ago.

Rogers Media has been hit hard. The Media segment has extensive sports TV broadcast rights and is a major owner in the Toronto Blue Jays Major League Baseball team. With sporting events suspended, the company has lost both Blue Jays’ game-day revenue and advertising dollars as big advertisers cut their promotional spending. In 1H20, Rogers Media revenues declined by 33 percent to C$708 million, down from US$820 million in 1H19.

In its 2Q20 earnings call, Rogers’ management offered no forward-looking guidance for financial performance and capex given the uncertainty of when and how the Canadian economy would recover. Management expects some modest sequential improvements into 3Q and through year-end 2020 as the economy revives, however.

The company reaffirmed “full steam ahead” on 5G.

Rogers Wireless’ was the first Canadian wireless carrier to launch 5G in major cities across Canada in late 2019. The company is steadily expanding its 5G footprint by leveraging its 20 to 40 MHz spectrum in low-band 600 MHz that covers 100 percent of the Canadian population.

The company continues to augment its 4.5G LTE network with 24 MHz of 700 MHz spectrum that covers 95 percent of Canadian POPs and mid-band AWS (1.7/2.1 GHz) in key population areas in Quebec, Ontario and British Columbia.

With Ericsson as Rogers Wireless’ “single vendor” for 5G, the company is taking advantage of Ericsson’s dynamic spectrum sharing platform to deploy 5G on both 600 MHz and existing 4G/4.5G frequency bands. This capability allows Rogers Wireless to launch 5G services faster in specific 4G/4.5G markets while it plans for 5G in dedicated spectrum.

Along with low-band 600 MHz, Rogers Wireless will build out 5G using mid-band 3.5 GHz spectrum. The company confirmed its intent to add to its already significant spectrum holdings.

Rogers will bid for 200 MHz licenses in the 3450-3650 MHz band in the rescheduled spectrum auction that Innovation, Science and Economic Development Canada (ISED Canada) will now conduct in June 2021.

By John Celentano, Inside Towers Business Editor

Reader Interactions