SBA Communications (NASDAQ: SBAC) says it has not been materially affected by COVID-19 in 1Q20 although construction and regulatory slowdowns are evident. Still, the company reported solid results.

Compared to 1Q19, top-line site leasing revenue was $492 million, up 9 percent. Site development revenue declined 40 percent to $29 million, mainly due to slowdowns in obtaining permits and approvals from local government officials who are all on lockdown.

Site leasing operating profit was up 10 percent though net income suffered a substantial loss due to foreign exchange (FX) rate fluctuations particularly with Brazil, Canada and South Africa. Adjusted EBITDA was $370 million, up by 9 percent and Adjusted Funds From Operations (AFFO) increased by 13 percent to $260 million. In sum, an overall positive SBAC story for the quarter.

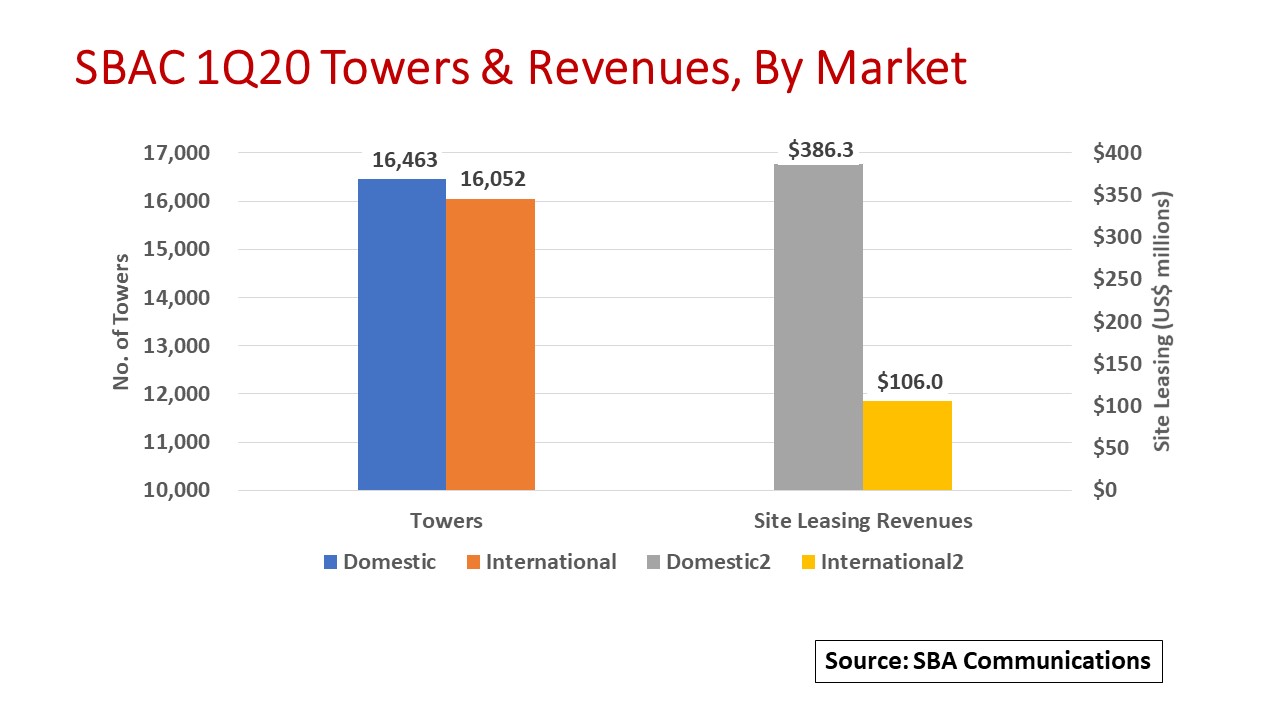

The concentration in SBAC’s business is interesting. Of its total domestic and international base of 32,515 towers, the split is almost 50-50 with a slight edge to the domestic market comprising U.S. states and territories.

The kicker, however, is that SBAC derives 80 percent of its site leasing revenues from the domestic market. U.S. Tier 1 carriers (AT&T Mobility, Verizon Wireless, T-Mobile/Sprint) are the company’s bread-and-butter, together accounting for over 91 percent of 1Q20 domestic revenues.

One might conclude that such concentration poses a significant financial risk if any one of its biggest customers falters. That risk is low, at least manageable, given the size, scope and significance these carriers hold in the U.S. wireless industry. SBAC acknowledged tower activity during the quarter with an unnamed regional carrier, likely US Cellular (see, US Cellular Not Slowing Network Builds) but its work with regional carriers is minimal.

Similarly, just three companies accounted for 61 percent of international site leasing revenue – Oi S.A. of Brazil, and Latin American operations of Spain-based Telefónica and Mexico-based América Móvil. Such concentration may carry a higher risk for SBAC given smaller economies and FX fluctuations.

In 1Q20, SBAC’s tower installed base grew less than 1 percent but with different metrics in each market. Domestically, SBAC acquired 63 towers, built four new ones and decommissioned five sites. By contrast, the company in international markets acquired six sites, built 45 and decommissioned one site for a net total gain of 112 towers.

Like its peers, SBAC sees a ramp in 5G activity in successive quarters. T-Mobile is already building out 5G using the 2.5 GHz spectrum it gained from the Sprint merger starting in Philadelphia with New York to follow. Other big wireless carriers are underway with 5G buildouts in their respective markets using the various low-, mid- and high-band frequencies they own.

When asked if he is confident that DISH Networks will deploy, SBAC President & CEO Jeff Stoops responded that the company was in discussions with DISH. He pointed out that 2020 is a planning year for DISH with buildouts commencing in 2021. DISH is not factored into SBAC’s 2020 guidance. However, Stoops emphasized DISH’s commitment: “Don’t bet against them!”

SBAC’s 1Q20 capital expenditures (capex) were $128.8 million, up 40 percent from $91.7 million in 1Q19. Of that total, discretionary capex (new tower builds, tower augmentations, acquisitions, land and easement purchases) was $119.6 million while $9.2 million went to non-discretionary capex (tower maintenance and general corporate).

Anticipating the ramp, SBAC’s midpoint capex guidance for the year reflects a 40 percent increase to $317 million with $280 million for discretionary investment and $37 million in non-discretionary spends.

By John Celentano, Inside Tower Business Editor

Reader Interactions