U.S. Cellular (NYSE: USM) laid out an ambitious network expansion plan at the end of 2019. Judging by its 1Q20 performance, the company is not tapping the brakes on these plans even as it works around COVID-19 impacts. USM maintained its full-year guidance for service revenues and capital expenditures (capex) while lowering profit expectations.

To level set, USM provides wireless services to customers with 4.9 million connections in 20 states covering a total of 31 million POPs. Going forward, USM is sticking to its strategic priorities to attract and retain wireless customers, grow revenue through competitive offers tailored to the local market backed by outstanding customer service, maintain expense discipline and advance the network.

Even with COVID-19 impacts through March, total connections at the end of 1Q20 held at 4.9 million, down just 1 percent from 1Q19. USM reported 1Q20 service revenues of $741 million, flat with 4Q19 and up 3 percent from 1Q19. Connection declines were offset by increases in average revenue per user (ARPU) and average revenue per account (ARPA) due to increased smartphone usage and greater demand for connected devices such as hotspots and routers as customers adhered to stay-at-home orders. Net income attributable to USM shareholders was $71 million for the quarter, up 30 percent YtY.

USM’s 1Q20 capex was $236 million, down 3 percent from 4Q19 but up 131 percent over the $102 million spent in 1Q19. The company acknowledged slower build activity in some markets because of dependencies on permitting and attachment approvals from municipalities and utilities that have many staffers working from home.

USM maintained full-year 2020 midpoint capex guidance at $900 million; that’s up 27 percent from the $710 million in FY2019 even as it projects 2020 service revenues to remain flat with 2019. This means the capital intensity (that is, capex divided by service revenues), also referred to as capital efficiency, will rise from 25 percent in 1Q20 to 30 percent for FY2020. These numbers portray rapid network expansion and reinforce USM’s strategic initiatives to overlay its existing 4G LTE network with new capabilities such as VoLTE and to modernize its network to 5G with both mobile and fixed wireless broadband (FWB) services on a market-by-market basis.

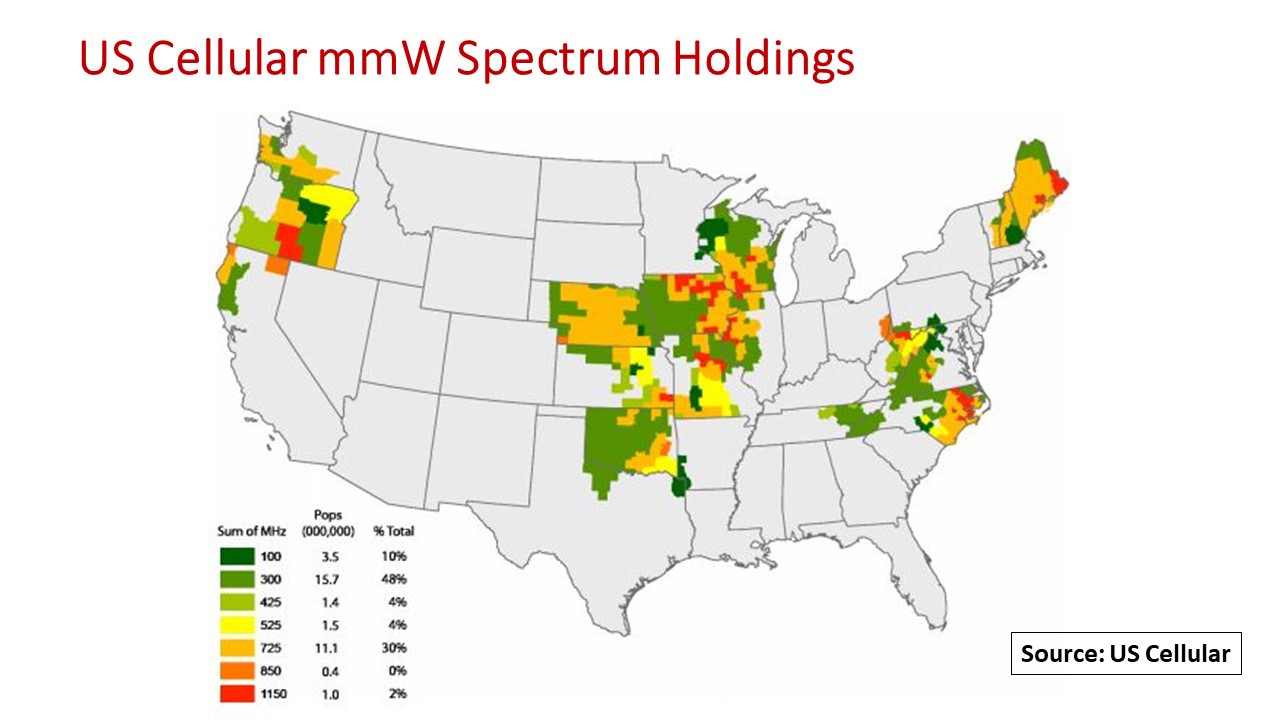

The company has extensive spectrum assets in low-, mid- and high-band frequencies on which to build in its regional markets. Although its aggregate spectrum amounts to about 100 MHz in national weighted average spectrum depth, USM has significant bandwidth in each of its regional markets. Its 4G LTE network operates on 700 MHz and AWS (1.7/2.1 GHz) for both mobility and fixed wireless access (FWA) services. USM’s initial 5G deployments will utilize the 20 MHz of “clean” 600 MHz spectrum that it owns to give it coverage in the small town and rural markets that it serves.

As radio equipment becomes available later this year, the company will commence 5G deployments utilizing its large swaths of millimeter (mmW) spectrum. USM holds nearly 700 licenses in 24 and 28 GHz bands, and 237 licenses in 37/39/47 GHz bands that it acquired in Auction 103. FWB will be a primary use case for mmW. The company has not yet confirmed its interest in mid-band spectrum that will be offered in upcoming citizens broadband radio service (CBRS) and C-band auctions.

Of the total 2020 capex budget of $900 million, an estimated 60 percent will apply to 4G LTE network upgrades and modernization. The other 40 percent will go toward 5G builds, with roughly three-quarters in 600 MHz and the balance in mmW.

At this juncture, USM sees no major disruptions to its network expansion plans. All systems are go!

By John Celentano, Inside Towers Business Editor

Reader Interactions