With the T-Mobile US-Sprint merger a done deal, the New T-mobile, now just calling itself T-Mobile (NASDAQ: TMUS), is anxious to forge ahead with amalgamating the two networks and building out newly acquired frequency bands for 5G. It is interesting to look at the quarterly capital expenditure (capex) pattern of the combined company going back two years and then weighing optimistic and pessimistic scenarios for its 2020 capex, especially with the COVID-19 cloud hanging over us.

To put into perspective, T-Mobile US has invested an average of $5.0-5.5 billion a year in its networks from 2015 through 2019. Comparatively, Sprint spent $3.0-3.5 billion a year to build out its network. By contrast, AT&T Mobility’s and Verizon Wireless’ annual capex averaged $9 billion and $10 billion, respectively, over that 5-year period.

Clearly, one impetus for the merger was to create an organization with financial resources of size and scale to compete with AT&T and Verizon. With guidance provided by the companies on December 31, 2019, the 2020 cumulative capex projection rolls up to the $9-11 billion range. With that budget, T-Mobile plans to deploy 5G using large swaths of new spectrum that it now controls in low-band 600 MHz, Sprint’s mid-band 2.5 GHz and high-band 24/28 GHz millimeter wave (mmW) while upgrading existing cellular and 4G LTE services.

The real question is: How will that capex be spooled out quarter-to-quarter? Certainly, infrastructure equipment suppliers, installation contractors and tower climbing companies all want to know. Capex is the lifeblood of this industry. It is how carriers pay for their network infrastructure and the labor to install and test it. More important, capex-funded contracts allow these infrastructure companies to better plan and manage their material procurements and manpower resources.

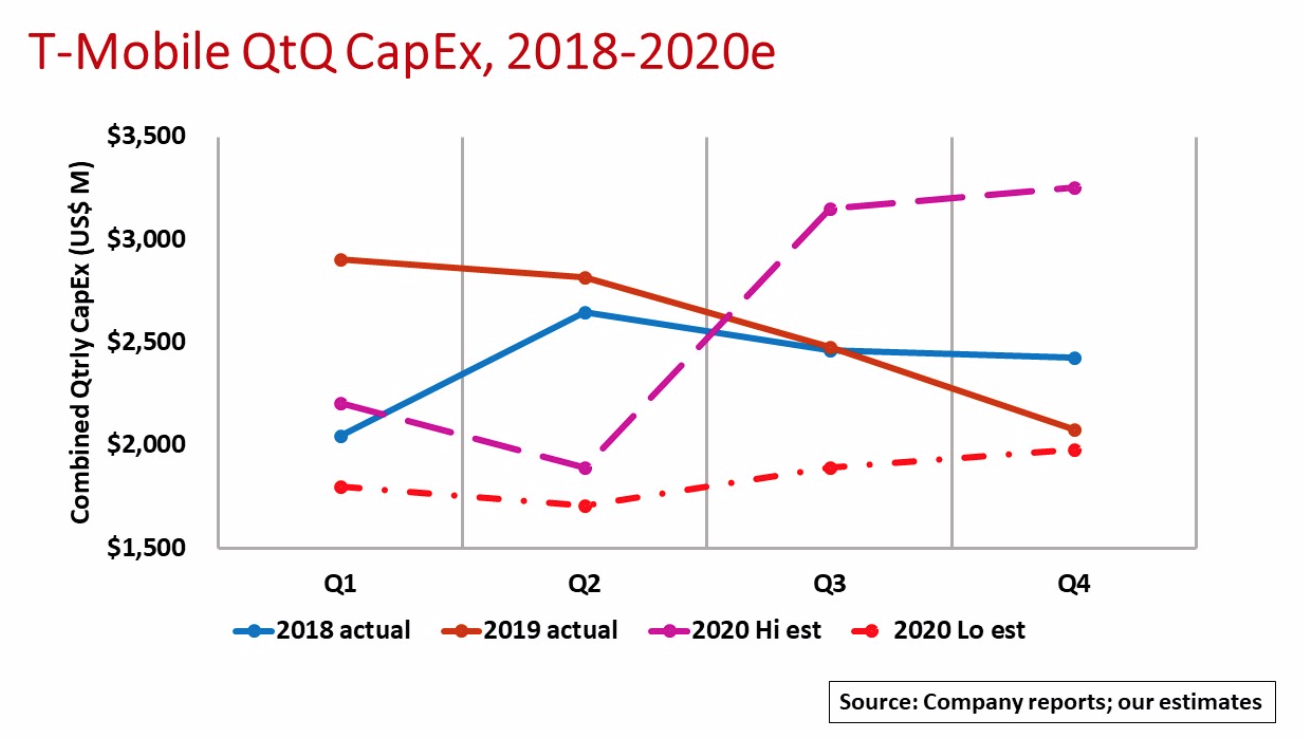

Forecasting the carrier’s quarterly spending is near impossible, however; there are just too many variables. Historically, quarterly capex follows a cyclical pattern: 1Q capex starts off slow, around 20-22 percent of the full-year budget, largely due to winter weather conditions in the northern half of the U.S.; 2Q spending ramps up above 25 percent of the annual budget as weather conditions improve and network construction activity picks up; 3Q capex often dips below the 25 percent level with a general industry slow down in the summer months; 4Q often reflects a flurry of network activity, sometimes accounting for one-third or more of the total as carriers complete projects and close out budgets.

Combining T-Mobile US’s and Sprint’s reported quarterly capex shows atypical spending for 2018 and 2019. 1Q18 came in at $2.1 billion or 21 percent of the full-year guidance followed by a nice 2Q ramp to $2.7 billion or 28 percent of the total. Sprint’s portion followed the historical spending pattern through the year-end 2018 but the larger T-Mobile US portion leveled out mid-year in the aftermath of the proposed merger announcement as the company began to regroup.

Combined capex shot up in 1H19 with early 5G deployments and 4G LTE enhancements. Spending for the first six months accounted for 55 percent of the full-year budget. With growing opposition to the merger, though, T-Mobile stopped many new sites builds while awaiting approval and redirected capital towards mmW spectrum acquisition.

Wireless network construction in 1Q20 started in line with normal activity and then quickly was no longer normal as the coronavirus spread across the country. Even with many cities and states on lockdown, work in wireless continues, albeit at a slower-than-normal pace, to maintain wireless services as an essential service. March has been a tough month so it will be interesting to see the company’s 1Q results.

If lockdowns extend through 2Q, spending levels likely will stay down. Under an optimistic scenario, restrictions are eased and T-Mobile’s network expansion activity ramps up sharply to year-end, trending toward the high end of the guidance range. In a pessimistic scenario, extended restrictions drag down capex through year-end 2020, to well below the low end of the guidance range.

Only time will tell!

By John Celentano, Inside Towers Business Editor

Reader Interactions