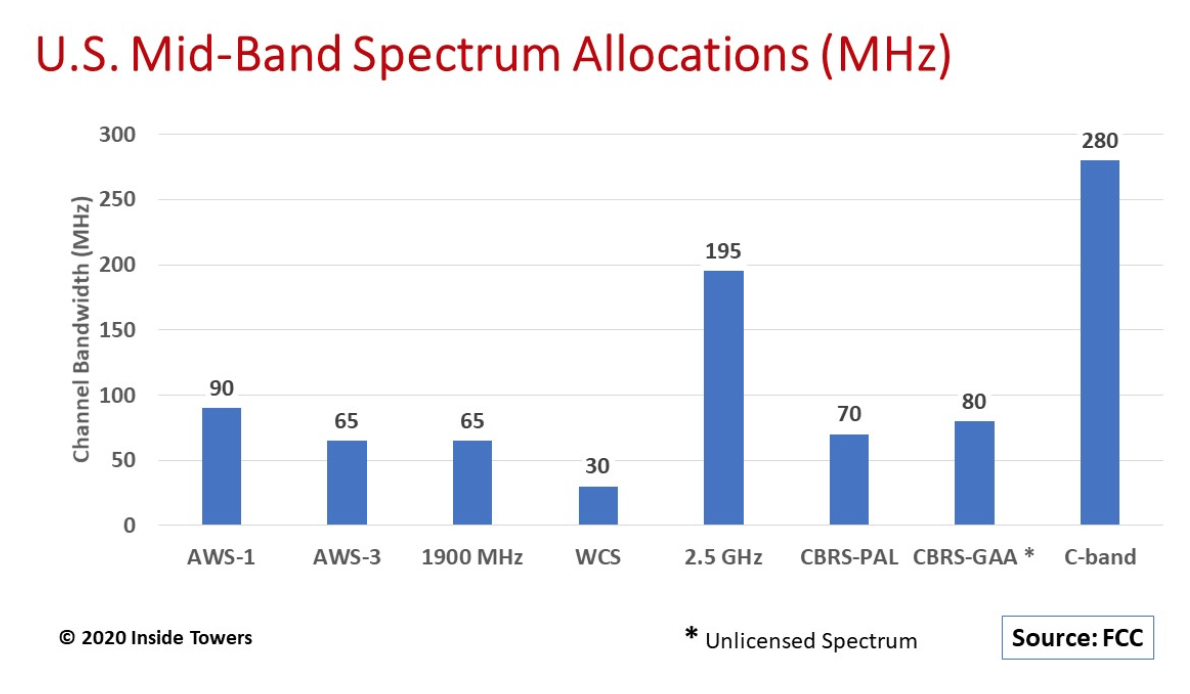

FCC Auction 107, currently underway, will make available 280 MHz of C-band spectrum for widespread 5G commercial use. That allocation is the largest ever by the FCC in the mid-band range. It is intended to spur 5G deployments among U.S. mobile network operators.

Mid-band spectrum in the 1-6 GHz range is limited. The major MNOs already operate a portion of the 65 MHz of 1900 MHz originally used for 3G and AWS (1700/2100 MHz) bands added for 4G LTE applications. AT&T (NYSE: T) owns 20 MHz of 2.3 GHz Wireless Communications Service. As majority owner of that spectrum, T is not likely to see a 5G ecosystem develop in 2.3 GHz any time soon.

T-Mobile (NASDAQ: TMUS) has a major lead in mid-band 5G deployments with 150-160 MHz of the 195 MHz of 2.5 GHz garnered from the Sprint merger.

The C-band auction changes all that with 280 MHz of 3.7-3.98 GHz spectrum. With large spectrum blocks assigned to relatively small coverage areas, MNOs can achieve both coverage and capacity objectives on a nationwide basis, unattainable with today’s low band frequencies and even millimeter wave spectrum.

Low band spectrum has limited throughput capability with channel bandwidths of 10-25 MHz. Propagation distances can be several miles from a macrocell with 600, 700 and 850 MHz low band spectrum used for 4G LTE over wide areas, but low band lacks high-speed data throughput. Peak 4G LTE download speeds typically are less than 50 Mbps.

TMUS is using its 31 MHz of 600 MHz spectrum to lay the “foundation” of its spectrum layer cake as its nationwide 5G strategy. For now, T and Verizon (NYSE: VZ) are leveraging their respective 70 MHz and 21 MHz 4G LTE 700 MHz holdings for nationwide 5G coverage using dynamic spectrum sharing.

Moreover, VZ and T are betting big on their extensive high band mmW spectrum. VZ is deploying thousands of 5G Ultra-wideband small cells in major markets across the country.

While mmW delivers speeds approaching 1 Gbps while utilizing hundreds of MHz per channel bandwidth, propagation distances are short, typically several hundred meters. This means lots of small cells are needed to achieve meaningful coverage, especially in suburban neighborhoods.

This is where the big allocation of upper mid-band spectrum comes in, and why it is so important.

TMUS holds the lion’s share of upper mid-band (2-6 GHz range) with its 150-160 MHz of 195 MHz available spectrum in 2.5 GHz band. Aside from T’s 2.3 GHz spectrum, other MNOs have no access to the upper mid-band spectrum.

TMUS’ experience with 2.5 GHz is telling. The company is leveraging its 2.5 GHz spectrum as a major stepping stone to a full nationwide 5G platform. It plans to use its 1500 MHz of mmW spectrum for 5G services in vertical markets on top of the 2.5 GHz layer.

TMUS’ first 5G sites at 2.5 GHz are utilizing 40-60 MHz. The remaining 100 MHz is still used for 4G LTE on the Sprint legacy network. The company is progressively adding as much as 80 MHz in some areas and up to 100 MHz in key markets.

With 50 MHz at 2.5 GHz, TMUS says it can achieve download speeds averaging 300 Mbps with peaks up to 1 Gbps, compared to 40-45 Mbps on 4G LTE. By year-end 2020, TMUS expects to realize 400 Mbps speeds.

The recent 3.5 GHz CBRS auction added more upper mid-band spectrum with up to 70 MHz of Priority Access License and another 80 MHz of General Authorized Access unlicensed spectrum. VZ was the big winner spending $1.9 billion for 557 PALs across 157 counties. DISH Network (NASDAQ: DISH) spent almost $1 billion for nearly 5,500 PALs in over 3,100 counties. TMUS bought a nominal number of PALs. T was a registered bidder but did not bid.

The C-band (3.7-4.0 GHz) spectrum could prove pivotal to U.S. 5G network builds over the next three to five years. The FCC is freeing up 3.7-3.98 MHz for 5G plus a 20 MHz guard band. The 280 MHz will be available in 5,684 new “flexible-use overlay licenses” that are available in fourteen 20 MHz sub-blocks in each of 406 Partial Economic Areas in the continental U.S.

The C-band transition plan requires incumbent satellite operators delivering TV service and earth stations delivering audio programming to radio stations to clear the 3.7-4.0 GHz band entirely. These operators relocate to the upper 200 MHz of the C-band (4.0-4.2 GHz) in phases. The first phase will clear 120 MHz (3.7-3.82 GHz) by December 5, 2021, with the remaining 160 MHz (3.82-3.98 GHz) cleared by December 5, 2023.

By John Celentano, Inside Towers Business Editor

Reader Interactions