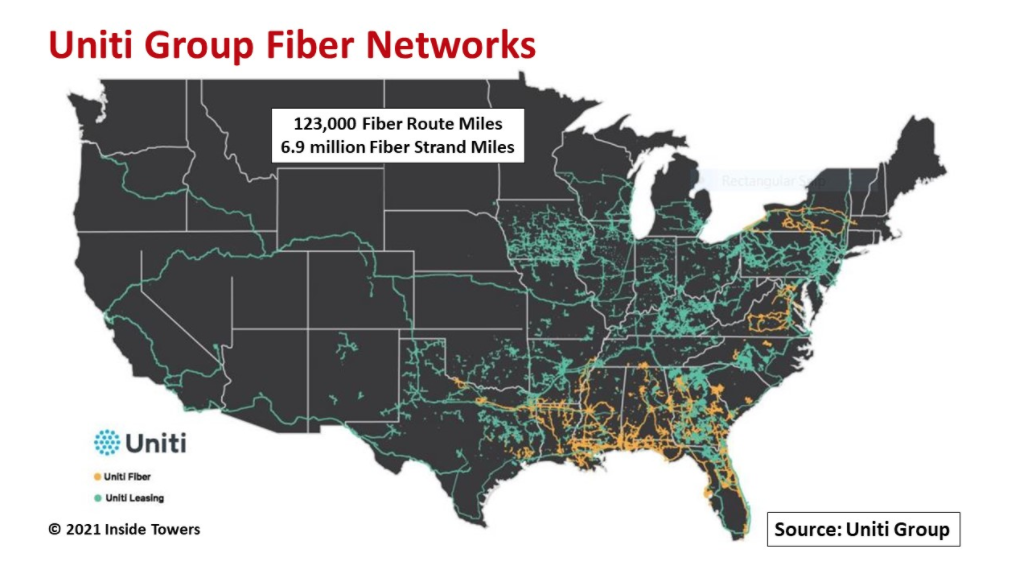

Uniti Group (NASDAQ: UNIT) is among the leading fiber network infrastructure providers in the U.S. The company owns and operates metro and long-haul networks comprising 123,000 fiber route miles and 6.9 million fiber strand miles across 41 states. The network also supports about 2,300 small cells and passes nearly 180,000 buildings that are on, or near, its fiber routes.

UNIT had a productive 2020. The company settled its dispute with Windstream, acquiring large segments of Windstream’s fiber network. With that, it established two long-term MLAs with Windstream’s wireline operations, and entered a long-term fiber growth capital investment (GCI) program that assures UNIT a long revenue runway.

In November, UNIT sold fiber assets in eight northeast states to Everstream Solutions then leased back those fiber properties. Also, in November, UNIT was one of four fiber network providers to sign a supply contract with DISH Network.

The company’s two business units – Uniti Fiber and Uniti Leasing – are complementary but different.

Formed from several acquisitions since UNIT’s 2015 spin-off from Windstream, Uniti Fiber is an active fiber operating company. It designs, deploys and operates both dark fiber and lit services for a range of customers encompassing wireless and wireline carriers, Enterprises, E-Rate program schools and libraries, government agencies, and some branches of the military.

Uniti Fiber’s focus is on its Southeast region that covers about 37,000 route miles and 2.4 million fiber strand miles, and on Tier 2 and Tier 3 markets that tend to be less competitive. Over the last several years, Uniti Fiber built new fiber for anchor customers, mainly wireless carriers, and now leases that anchor-built investment to Enterprises and other customers.

By contrast, Uniti Leasing is a passively managed business with fiber assets acquired from Windstream and Lumen (formerly Centurylink) comprising 86,000 fiber route miles and 4.5 million fiber strand miles. Uniti Leasing focuses on wholesale customers and utilizes different transactions that give it 10–20-year initial terms.

For instance, with indefeasible right to use (IRU) or dark fiber leases, the business unit leases existing owned dark fiber assets on a long-term basis to third parties. With sale-leaseback, Uniti Leasing buys fiber assets from a third party then leases that fiber back to that tenant on a long-term basis.

In an operating company/property company (OpCo/PropCo) transaction such as the Everstream deal, UNIT will enter into two 20-year IRU lease agreements with Everstream on Uniti-owned fiber that spans eight states and covers over 10,000 route miles. At the same time, UNIT agreed to sell to Everstream a portion of Uniti Fiber’s Northeast operations and certain dark fiber IRU contracts acquired as part of the Windstream settlement.

Under the Windstream GCI, UNIT will invest up to $1.75 billion over the next 10 years primarily for fiber and fiber-related assets, though Windstream must first make the investments. UNIT then reviews that investment to ensure it meets the GCI program criteria, that is, certain return thresholds to qualify as real property under REITs.

If the criteria are met, UNIT will acquire that fiber from Windstream, fund the ongoing network investment, and reimburse Windstream for the capex it already invested. On the one-year anniversary of making that investment, UNIT adds that asset to the existing wireline MLAs at an eight percent initial yield, subject to a 0.5 percent annual escalator.

In 2020, the company invested $85 million in the GCI and expects to realize $7 million of annualized revenue. That investment added over 2,500 route miles and 84,000 strand miles of fiber that UNIT now owns.

For 2021, UNIT expects to invest approximately $200 million in the GCI to acquire over 6,000 fiber route miles that will generate for the company an incremental $16 million of annualized revenue when complete. The company believes the GCI program will future-proof its network monetization.

From its 4Q20 earnings call, UNIT is guiding Uniti Fiber’s 2021 revenues at just over $300 million and adjusted EBITDA of about $120 million and Uniti Leasing revenues at roughly $783 million at adjusted EBITDA margins of 98 percent. Total revenues are projected at $1.1 billion with roughly $8 billion under long-term contracts.

UNIT is selectively expanding its network with economically attractive anchor builds and opportunistic M&A deals.

At a recent analyst conference, Bill DiTullio, UNIT VP of Finance & Investor Relations commented, “… there’s definitely a significant amount of tailwinds between 5G, [broadband] wireless, other virtualization trends. The common theme is it all requires fiber, right? Fiber is the connective tissue that makes it all work today and for future technologies. And so, I think that plays well into our strategy, what we’re trying to do, build dense fiber networks …”

By John Celentano, Inside Towers Business Editor

Reader Interactions