Verizon (NYSE: VZ) reported in its 1Q20 earnings call that its wireless network is performing very well in the COVID-19 environment. At the same time, the company is not slowing its 5G buildout. More importantly, the company reiterated its guidance for its 2020 capital expenditures (capex) at $17.5-18.5 billion even as it withdrew guidance for revenues and indicated lower earnings per share (EPS). Note that on March 12, Verizon revised upward its overall capex by an incremental $500 million.

VZ allocates roughly $10 billion or about 55 percent of its total annual capex budget to wireless infrastructure, new builds and expansion. For 1Q20, Verizon Wireless (VZW) invested an estimated $2.8 billion in capex on service revenues of $16.4 billion. 1Q20 capex was up 7 percent sequentially from $2.6 billion in 4Q19 and up 33 percent over the $2.1 billion in 1Q19. The company did acknowledge that its wireless capex for 2020 would be “front-end loaded,” cautioning the market to expect a slower spending pace through 2H20. Total wireless connections at end-1Q20 were 119.6 million, essentially flat with 4Q19.

VZW’s annual capex figure does not include what the company invests to acquire spectrum such as its $1.8 billion bid for 38 GHz licenses in the recent FCC Auction 103. With that win to shore up its spectrum portfolio, VZW now holds roughly 2200 MHz of spectrum on a national weighted spectrum depth basis. Over 2000 MHz of that total is in high-band millimeter wave (mmW) frequencies at 28 GHz and 38 GHz. It is in those mmW bands that VZW is focusing its 5G build efforts. The primary targets are dense urban centers where VZW delivers high-speed connections over relatively short distances in small areas to many simultaneous users.

The company says its Ultra Wideband (UWB) mmW service now is live in 34 cities to date and is on track to meet its 2020 buildout plan. That plan includes the commitment to deploy five times the number of small cells in 2020 than it did in 2019 although the company did not quantify the number. When asked if VZW might shift its buildout priorities more toward serving suburban markets longer term using mid-band spectrum given the current environment, VZ CEO Hans Vestberg basically said that the company was sticking with its mmW deployment strategy.

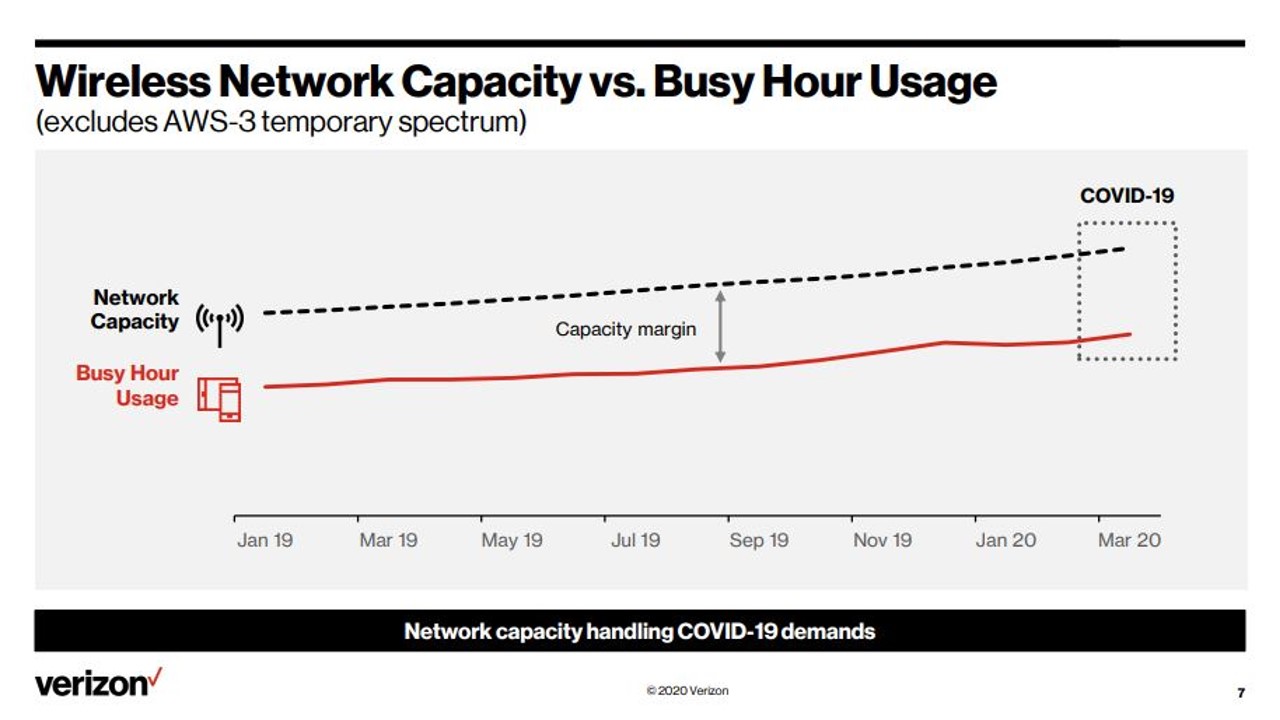

In its presentation, VZ showed the current network capacity of its combined wireless and fiber networks (see, 5G Fiber-rich Networks) already had a sufficient operating margin and is more than adequate to handle the increased COVID-19 load that working from home has added. The company points out the capacity calculation does not include the AWS-3 (1.7/2.1 GHz) mid-band spectrum that was loaned to VZW by DISH network-related entities, Northstar Wireless and SNR Wireless LicenseCo under a special temporary authority (STA) granted by the FCC. The STA allows VZW to use that spectrum for 60 days at no cost, Inside Towers reported.

Vestberg demurred when asked whether leasing or renting spectrum might be a part of VZW’s strategy in future. At this stage, the company believes that owning its own infrastructure gives it the control it needs to deliver high-speed connectivity where and when it is needed. Vestberg did emphasize that the company has been testing dynamic spectrum sharing (DSS) technology that allows both 5G New Radio (NR) and LTE to operate simultaneously on the same frequencies currently used for 4G LTE such as VZW’s 700 MHz. DSS allows carriers like VZW to launch 5G in bands currently used for 4G in a shorter timeframe and at a lower total cost of ownership (TCO) than building standalone 5G infrastructure. VZW’s primary radio vendor, Ericsson, is a leading developer of DSS technology.

By John Celentano, Inside Towers Business Editor

Reader Interactions