Verizon (NYSE: VZ) has a dilemma. Its wireless service revenues have remained flat for five years. The company is projecting 2020 service revenues to grow by two percent year-to-year. However, that rate is down from the three percent achieved in 2019, taking into account the COVID-19 impact through mid-year 2020. Despite recent upticks, VZ’s total wireless service revenues declined at a 1.5 percent CAGR since 2015.

VZ’s hopes to achieve “GDP-plus” growth rates by augmenting its robust national network with next generation technologies to drive revenues in multiple vertical applications.

The company believes that its ‘network-as-a-service at scale’ strategy will maximize growth in a networked economy. Importantly, it has world-class partnerships to help accelerate that scale.

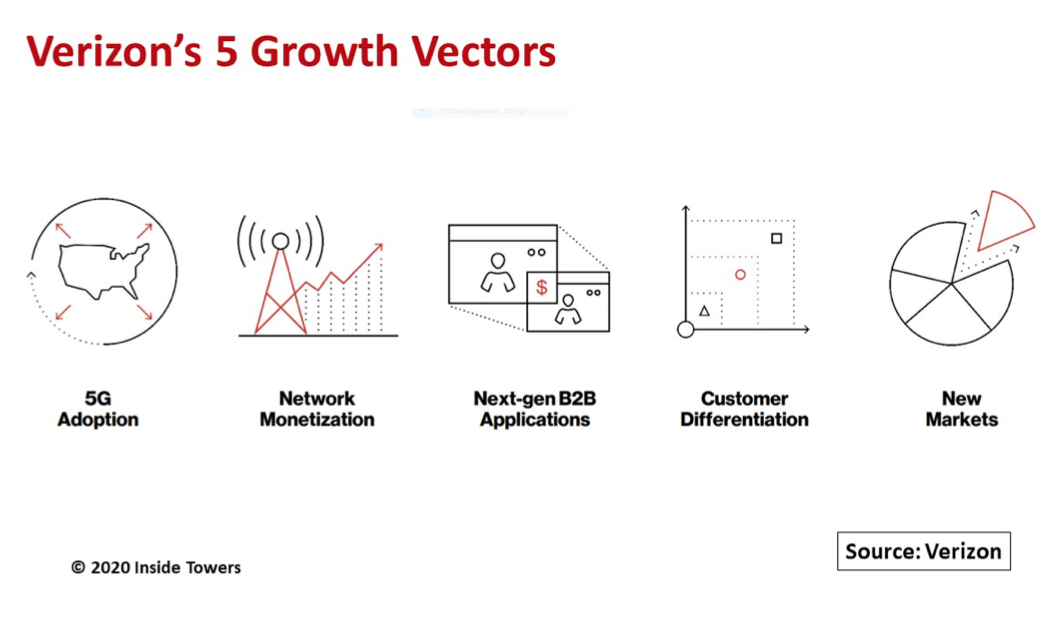

VZ is executing growth across five vectors that include: 5G adoption, network monetization, next-generation business-to-business applications, customer differentiation, and new markets.

5G adoption as the first vector offers the greatest potential for new revenue streams on multiple fronts. 5G Ultra-Wideband uses VZ’s extensive millimeter wave spectrum for network densification with small cells in major metro markets and their surrounding suburbs, building in areas that represent a high percentage of peak hour usage. VZ expects to reach 60 5G UWB cities by year-end 2020, deploying five times as many 5G UWB small cells in 2020 than it did in 2019.

In October, the company launched 5G Nationwide using dynamic spectrum sharing technology on its 4G LTE network, covering more than 200 million POPs in 1,800 cities. VZ says 5G Nationwide is performing as expected, on par or better than its 4G LTE. Starting in 2021, VZ will use newly acquired mid-band 3.5 GHz CBRS priority access licenses to add 5G network capacity.

The iPhone 12 introduction was an important catalyst to enhance the customer 5G UWB experience. VZ is working with partners to develop new mobile applications on 5G devices. Furthermore, the company is relaunching 5G Home UWB fixed wireless access with an ecosystem of next generation customer premise equipment and expects to activate 10 5G Home cities this year.

Network monetization is the second growth driver. The company is leveraging its long-term cable company MVNO agreements with Comcast’s Xfinity Mobile and Charter Communications’ Spectrum Mobile. (see, Cableco’s Growing Wireless Play). These two MVNOs bring over 4 million subscribers to VZ’s network. However, with both cablecos having their own 3.5 GHz CBRS PALs, the extent to which they will remain VZ MVNOs is unclear.

The third vector is next-generation business-to-business applications primarily in 5G mobile edge computing. VZ launched public 5G MEC with Amazon Web Services with the goal of monetizing public sector applications such as remote work, distance learning and telehealth. The company expects 10 AWS sites to be online by year-end 2020.

MEC is a brand-new market for VZ with opportunities to generate incremental revenues. The company announced a separate agreement with Microsoft Azure for 5G MEC in private sector and Enterprise applications. VZ thinks it has a market lead in the MEC space with meaningful revenues expected in 2022.

Customer differentiation, as the fourth vector, is how VZ differentiates itself from competitors. The goal is to foster deeper and broader customer relationships. As one of the first mobile network operators to offer unlimited calling plans, VZ’s customers gain new benefits and experiences with 5G and bundled Disney+ and Apple Music streaming services. The company says take rates for unlimited plans are up and more expensive premium unlimited demand is growing. Customers can mix and match services to create their own unique experience, something that VZ says no one else offers.

Addressing new markets is the fifth vector. Services such as Visible, Yahoo Mobile, and LTE Home Internet position VZ for new growth opportunities. Moreover, the pending TracFone acquisition gives VZ a much stronger position in the prepaid subscriber segment. (see, Puzzling Over Verizon’s Tracfone Deal)

VZ CEO Hans Vestberg comments, “All in all, these five segments, on top of our core business is, of course, the base for us believing that we can do GDP-plus growth over time. And we are executing on all of these this year.”

By John Celentano, Inside Towers Business Editor

Reader Interactions