The latest FCC auction raised the stakes and prompted questions as to what spectrum is worth if it means the bidder could be saddled with debt for years to come. More importantly, spectrum owners must incur substantial capital expenditures to build out that spectrum by specified deadlines under FCC “use it or lose it” rules.

Over the last 15 years, the U.S. Treasury has collected around $200 billion from FCC spectrum auctions, mainly from mobile network operators that acquired spectrum for 4G and 5G network deployments. The top three bidders, largely the national Tier 1 MNOs, have doled out roughly 88 percent of that total. The balance derives from a mix of regional wireline and wireless service providers, private network users, and investors.

Compiling deep spectrum holdings in low-, mid- and high-band frequencies has come at a steep price. Spectrum winners must invest considerable capex to put this spectrum into play even as MNO service revenues are essentially flat with only low single-digit growth prospects.

To cover their bids, MNOs have raised money by taking on debt or issuing bonds. These transactions add to their already debt-laden balance sheets. While MNOs generate considerable cash flow on an annual basis, it will be some time before they will see the expected return in that spectrum investment.

Auction 66 in 2006 set a new tone for new spectrum acquisition, bringing in nearly $14 billion for Advanced Wireless Services (AWS-1) licenses in the 1.7/2.1 GHz lower mid-band spectrum. T-Mobile led the bids with $4.2 billion followed by Verizon and a cable company consortium.

In 2008, the 700 MHz auction upped the ante, bringing in $19.5 billion, a record at the time. With 700 MHz in hand, the MNOs stepped up their 4G LTE deployments. Verizon scooped the most licenses, spending $9.4 billion while AT&T bid $6.6 billion.

Auction 97 in 2015 significantly raised the bar for spectrum acquisition to $41.3 billion for AWS-3 bands (1695-1710, 1755-1780 and 2155-2180 MHz). Again, AT&T and Verizon led the way, investing nearly $30 billion while DISH Network through its subsidiary companies spent another $10 billion.

Forward Auction 1002 in 2017 for low-band 600 MHz spectrum raised nearly $20 billion with T-Mobile, DISH and Comcast as the top three bidders.

With gross proceeds of just over $700 million, Auction 101 in 2019 created access to high-band 28 GHz millimeter wave spectrum for the first time. Verizon submitted over 70 percent of the bids followed by UScellular and T-Mobile. Later in 2019, Auction 102 for 24 GHz spectrum generated another $2 billion in total bids led by AT&T, T-Mobile and UScellular.

Auction 103 in 2020 that created access to additional mmW frequencies at 37, 39 and 45 GHz brought in another $7.6 billion. Two smaller companies, Straight Path Spectrum and FiberTower Spectrum, were the big winners, collectively investing nearly $7 billion. The two companies soon ran into financial difficulties and were subsequently acquired by Verizon and AT&T, respectively, giving both MNOs sizable swaths of mmW spectrum.

On April 1, 2020, T-Mobile closed its $26 billion acquisition of Sprint. T-Mobile gained Sprint’s 152 MHz of upper mid-band 2.5 GHz spectrum. Together with its 600 MHz and mmW holdings, T-Mobile is deploying 5G using its ‘layer cake’ combination of low-, mid- and high-band frequencies.

Auction 105 offered Citizens Broadband Radio Service (CBRS) Priority Access Licenses in the upper mid-band 3.5 GHz frequency range. The auction attracted widespread interest from 228 bidders who won a total of 20,625 licenses with $4.6 billion in gross bids. Lacking mid-band spectrum, Verizon led all bidders with nearly $2.0 billion followed by DISH with close to $1.0 billion.

The blockbuster came in the just-completed Auction 107 for C-band spectrum. This upper mid-band 3.7 GHz spectrum is so highly valued that bids reached a record $81.1 billion, nearly double the previous high set in the AWS-3 auction. Having already garnered low-band and mmW spectrum, Verizon bidding $45.5 billion, scooping C-band blocks across the country. In a similar situation, AT&T bid $23.4 billion followed by T-Mobile and UScellular that together bid $9.3 billion.

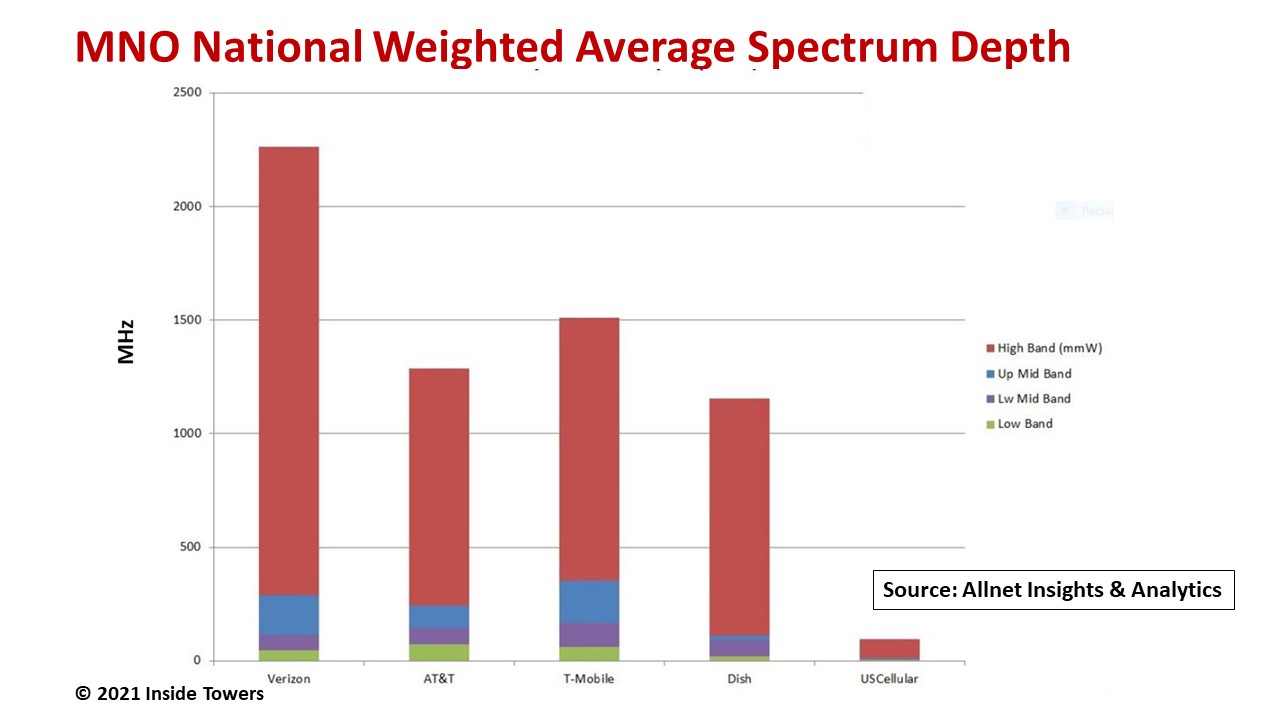

The leading U.S. carriers have assembled a strategic portfolio of low-, mid- and high-band spectrum assets that positions them to address a myriad of 5G use cases.

On a national weighted average, Verizon has a total spectrum depth of about 2250 MHz, T-Mobile with roughly 1500 MHz, AT&T with 1250 MHz and DISH with about 1130 MHz. UScellular has close to 700 MHz in spectrum holdings in its 21-state operating area but about 125 MHz on a national weighted average.

What will it cost to activate that spectrum?

Take C-band. On top of the spectrum costs, Verizon will add $10 billion over the next three years to its planned $18 billion a year total capex. AT&T expects to spend an incremental $6-8 billion to build out its C-band licenses, mainly in the 2022-2024 timeframe. T-Mobile will incorporate its C-band deployment costs into its planned $9-10 billion a year capex through 2026.

By John Celentano, Inside Towers Business Editor

Reader Interactions