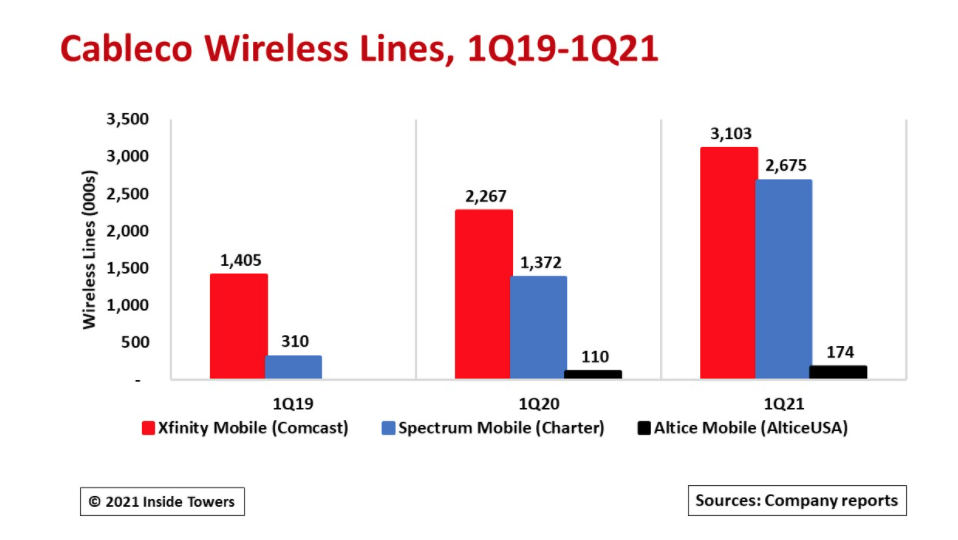

Wireless subscribers are growing among cable companies.

At the end of 1Q21, the Big 3 publicly held cable companies – Comcast (NASDAQ: CMCSA), Charter Communications (NASDAQ: CHTR) and Altice USA (NYSE: ATUS) – collectively reached nearly 6 million wireless customers, up 25 percent from 4.7 million in 1Q20.

Currently, all three offer wireless services as mobile virtual network operators under the national mobile network operators. Comcast’s Xfinity Mobile and Charter’s Spectrum Mobile both ride on the Verizon network. Altice Mobile started out as a Sprint MVNO but has switched to T-Mobile.

As an MVNO, cablecos can offer their subscribers mobile voice and data services with nationwide coverage without owning their own wireless infrastructure.

Still, several cablecos have bigger wireless plans in mind including developing proprietary 5G wireless services within their operating areas.

Seven cablecos participated in FCC Auction 105 for 3.5 GHz CBRS Priority Access Licenses, spending a total of $1.2 billion for 3,218 PALs. By contrast, cablecos passed on the C-band auction.

Comcast, Charter and privately held Cox Communications won big blocks of PALs, mainly in their respective cable operating territories. Together they spent $1.14 billion or 95 percent of the total cableco outlay and garnered 1,510 PALs, almost half of the cableco haul.

These three companies were among the top five CBRS bidders behind leader Verizon which spent $1.9 billion for 557 PALs. Second place DISH Network spent nearly $1 billion but led all bidders with a total of 5,492 PALs, accounting for 27 percent of the total PALs won.

Here’s the question: With their own spectrum, could these cablecos compete with their MNO hosts? Consider the numbers.

As of 1Q21, Comcast Cable passed nearly 60 million homes and businesses in 40 states and had 33.5 million total residential and business paying customers. Of these customer relationships, 3.1 million or 9 percent use Comcast’s Xfinity Mobile service.

Comcast spent $459 million for 830 PALs, the largest number of CBRS licenses among the cablecos. These licenses overlay Comcast’s cable operations around the country.

Similarly, Charter’s cable network passes 53.6 million homes and businesses in 41 states. At the end of 1Q21, the company reported 31.4 million video and internet customers along with 2.7 million Spectrum Mobile customers. The company spent $464 million for 210 PALs within its operating footprint.

Cox has approximately 6.5 million total residential and commercial cable customers on its six systems operating in 18 states. With no current mobile service offering, the company invested $214 million for 470 PALs across its cable markets.

Altice USA did not purchase any spectrum, remaining a T-Mobile MVNO for its 174,000 Altice Mobile customers. Altice in turn leases portions of its fiber network to T-Mobile for cell site backhaul connectivity as needed.

All cablecos have options for wireless service offerings.

They could activate those PALs over time and migrate existing MVNO customers onto their proprietary network. This way cablecos can reduce the wholesale MVNO fees they pay to the MNOs.

Certainly, wireless connectivity is a growth area for the cablecos. Echoing a common sentiment, Charter says it will “use the [PALs] along with unlicensed CBRS [GAA] spectrum to build our own [5G] mobile network which we plan to use in combination with our MVNO and WiFi network to enhance our customer’s experience and improve our cost structure.”

This means that mobile customers could still use their MVNO subscriber status when they venture outside of their home territory. So cablecos avoid establishing roaming agreements with MNOs around the country.

To get better returns on invested capital for 5G RAN and Core elements required to activate those PALs, the cablecos likely will pitch enhanced mobile services to their existing broadband customers who did not sign up for the MVNO service and who already may be MNO subscribers.

Cablecos do not intend to compete head-to-head with MNOs. Instead, they want to offer branded wireless services with their triple-play bundles to drive incremental revenues, lower operating costs and create stickiness with their customers.

Know that the larger cablecos operate mainly in MNOs’ prime urban markets. Siphoning off even a small percentage of cableco customers who are MNO subscribers onto the cablecos’ proprietary networks will show up as MNO subscriber net losses in earnings reports. That could be problematic.

By John Celentano, Inside Towers Business Editor

Reader Interactions