On paper, you might think that DISH Network (NASDAQ: DISH) was underperforming and is in dire straits. In its 2Q22 earnings report, the company showed declines in both its established Pay-TV services and in its fledgling wireless business. Its Wireless Segment consists of two parts – the Retail Wireless business unit that handles its prepaid phone business that is a combination of acquired Boost Mobile, Ting, and Republic Wireless brands; and, the 5G Network Deployment business unit that is handling the company’s new 5G network construction activity.

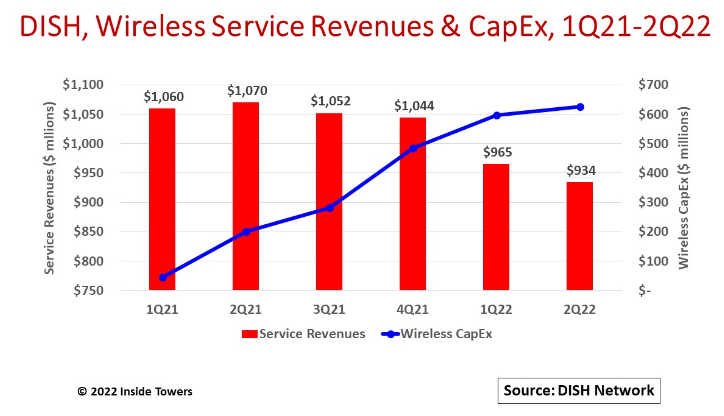

Pay-TV service revenues dropped 1 percent to $3.1 billion from $3.2 billion on a year-over-year basis. Pay-TV subscribers, including both DISH TV and Sling TV, declined 7 percent YoY to 10.2 million. Retail Wireless 2Q22 service revenues of $916 million were down 13 percent from $1.05 billion in 2Q21. Retail Wireless subscribers dropped 12 percent year-over-year from 8.9 million at the end of 1Q21 to 7.9 million, in part related to the T-Mobile 3G CDMA network shutdown, as Inside Towers reported.

Its 5G Network Deployment BU showed a modest gain of 2 percent in equipment sales and other revenue of nearly $18 million in 2Q22, up from $17 million from the same period a year ago. These revenues come from sales of wireless devices and spectrum licensing fees. The company has yet to record service revenues from postpaid subscribers.

DISH activated its 5G network on June 15, as Inside Towers reported. The network went live in 120 cities across the country and DISH met its FCC-mandated requirement to cover 20 percent of the U.S. population by that date. The company did not divulge the number of subscribers only saying that, at present, a small number of subscribers are using the network for mobile data-only applications.

DISH is promising a big uptake of wireless subscribers in the latter half of 2022. There are two main reasons for the delay. First, shipments of new mobile devices that operate on DISH’s Band 70 frequencies will not be received until 3Q22. These phones will then be distributed to consumers commencing in 4Q22 under the company’s new Boost Infinite brand. Boost Infinite offerings will include Android and iOS models from various vendors including DISH partner Samsung as well as SIMs for new users that bring their own phones.

Band 70 is an amalgamation of DISH’s current AWS-4 spectrum (2000-2020 MHz), its H Block downlink spectrum (1995-2000 MHz), and unpaired AWS-3 uplink spectrum (1695-1710 MHz). The company received approval for its Band 70 specifications from international standards body 3GPP in 2016. A formal approval from 3GPP enabled the development of devices and infrastructure supporting Band 70.

Secondly, DISH is still grappling with delivery of quality voice services, dubbed, ‘Voice over 5G New Radio’ or VoNR, over its 5G Open RAN cloud-based network. The company says that VoNR is an advancement over VoLTE in 4G LTE networks. Without such high-quality mobile voice services, however, DISH will have difficulty in signing new subscribers, or enticing subscribers on competitors’ networks to switch.

Despite the paucity of subscribers, the company is forging ahead with its 5G network buildout. DISH claims it already has 5,000 macro cell sites on air and is constructing new cell sites at a 1,000 per month pace. It expects to reach 15,000 cell sites by mid-2023, at which point it must meet another FCC-imposed milestone of 70 percent population coverage. Its longer-term coverage target is 75 percent of the population by mid-2025.

DISH restated its confidence that it can complete its 5G network build and reach that 2025 milestone within its previously announced $10 billion capital expenditure budget. For the quarter, wireless capex was $626 million, up 5 percent from $597 million in 1Q22 and over three times the amount spent in 2Q21. DISH’s full-year 2022 wireless capex is expected to be around $2.4 billion, with an estimated $2.5-3.0 billion to be spent in 2023.

By John Celentano, Inside Towers Business Editor

Reader Interactions