By John Celentano, Inside Towers Business Editor

On the surface, DISH Network (NASDAQ: DISH) is not showing much progress on its 5G network build. In fact, the company has installed just one site to date.

DISH will tell you, however, that it is running fast internally, assembling its wireless team, finding key locations, getting cell sites permits approved, and signing up network equipment vendor partners.

DISH invested more than $11 billion in the past decade acquiring significant blocks of low-, mid- and high-band spectrum. The company must put these spectrum holdings into service as stipulated by the FCC or lose the licenses, incur significant default penalties, or both.

DISH will deploy 5G in four major frequency bands: low-band 600 MHz and Lower 700 MHz E Block, and mid-band AWS-4 and AWS H Block.

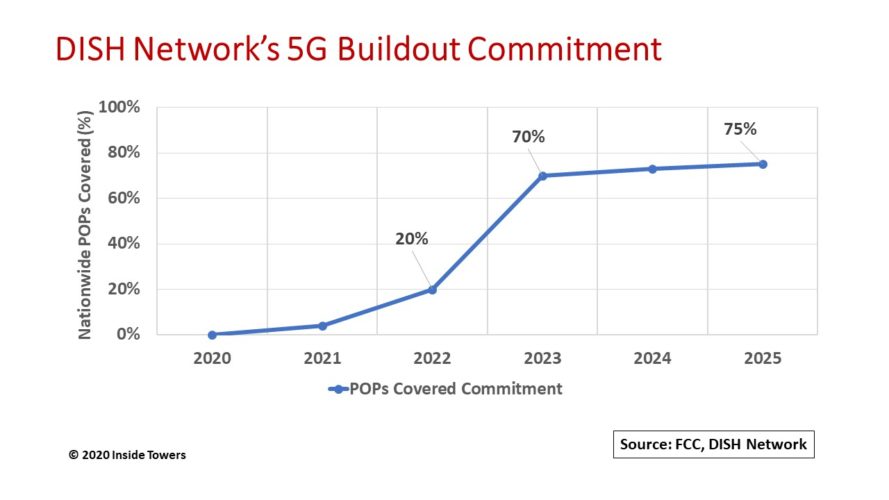

For the 600 MHz licenses, DISH must offer 5G broadband service to at least 70% of the U.S. population and have deployed a core network no later than June 14, 2023. In addition, it must offer 5G broadband service to at least 75% of the population in each FCC-defined Partial Economic Area no later than June 14, 2025.

For licenses in the Lower 700 MHz E Block, AWS-4, and AWS H Block bands, DISH must offer 5G broadband service to at least 20% of the U.S. population and have deployed a core network no later than June 14, 2022 and offer 5G broadband service to at least 70% of the U.S. population no later than June 14, 2023.

A big part of the build out is dependent on locating suitable sites and installing radio equipment in a timely manner.

DISH acknowledged that it is looking at sites that could become available as T-Mobile integrates its network with Sprint and decommissions thousands of Sprint sites (see, T-Mobile Powers Up in 3Q20). DISH expects to have roughly 15,000 sites on the air by the June 2023 deadline and anticipates exceeding that number.

Fujitsu of Japan is DISH’s primary radio equipment vendor. Fujitsu will deliver the first programmable Open RAN radio units starting in 2H21. These RUs are designed to work in all of DISH’s designated frequency bands. In addition, the Fujitsu RUs will operate in the 3.5 GHz CBRS band in which DISH paid nearly $1 billion for 5,500 Priority Access Licenses in FCC Auction 105.

With other vendors including Mavenir, Intel and VMware, DISH is constructing the nation’s first virtualized 5G mobile network.

Because the network is predominantly software-controlled and cloud-native in its operation and management, DISH points out that site installations are the least time-consuming step in the overall plan-and-build cycle. As such, the company is confident in meeting the buildout timelines once site construction gets underway.

Moreover, DISH sees the programmable nature of its network helping to defray capital expenditures. From its original capex estimate of $10 billion in three years, DISH now believes that $10 billion can be spread over seven years. For 2020, the company’s capex will be about $50 million for network planning and engineering.

Importantly, the software-intensive nature of the network allows DISH to flexibly offer slices of the network to different target customer groups. For instance, the company can sell various mobile services packages to consumers and at the same time, offer tailored private network configurations to Enterprises and government agencies.

DISH sees significant opportunity in private network applications in Enterprise markets. In this scenario, DISH owns and operates the network while giving proprietary network access to the Enterprise and its staff. The company acknowledged that its recent response to the Department of Defense Request for Information considered a private network for DoD on DISH’s 5G platform.

DISH reports its results in two operating segments: Pay-TV and Wireless. For 3Q20, total consolidated revenue was $4.5 billion, up nearly $1.4 billion or 43 percent compared to 3Q19.

Pay-TV revenues were $3.2 billion essentially flat on a year-to-year basis. At the end of 3Q20, DISH had 11.42 million Pay-TV customers including 8.96 million DISH TV and 2.46 million SLING TV subscribers.

The $1.3 billion revenue increase in the quarter resulted from the July 1 completion of the Boost Mobile acquisition. DISH currently operates its Boost Mobile prepaid wireless business as a mobile virtual network operator (MVNO) using the T-Mobile network. DISH closed the quarter with 9.42 million retail wireless subscribers.

Reader Interactions