Fiber is not a homogeneous business. Rather, fiber network operators serve different customers with different fiber infrastructure. Think about the fiber business in two main categories: access and transport. This is somewhat akin to old telephone company local and long-distance services. Access involves fiber-to-the-home that connects residences and small businesses to the wireline network, or fiber-to-the-antenna in wireless, at connect speeds of 1 gigabit (1G) to 10G. High-speed (read, 100G to 800G), long distance fiber transport networks connect central offices or data centers to each other, domestically and internationally, and is the backhaul (10G to 100G) between the RAN and Core in wireless.

Lumen Technologies (NYSE: LUMN) and Frontier Communications (NASDAQ: FYBR) are two U.S.-based fiber carriers that seem similar but have quite different networks and growth strategies. Lumen is primarily in the long-haul transport business while growing its access business.

Comparatively, Frontier is mainly in the local access business, focused on converting its legacy copper plant to fiber while offering wholesale transport services. Both companies have endured dire financial situations in the past few years but are now righting their ships with stronger financial positions and clear strategic initiatives.

Based in Monroe, LA, Lumen operates one of the largest global fiber networks spanning approximately 400,000 route miles. Its terrestrial and subsea fiber optic long-haul networks connect to domestic and global enterprise customers in over 60 countries throughout North America, Europe, Latin America, and Asia Pacific, although most of its revenues are derived in the U.S.

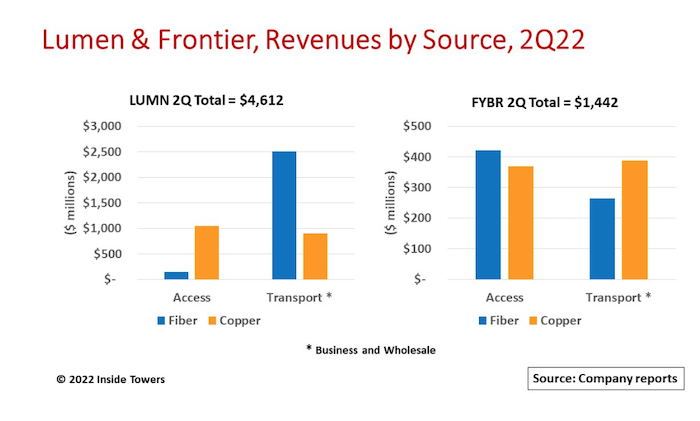

Lumen’s transport business, under its Business and Wholesale unit, accounted for 74 percent of $4.6 billion total 2Q22 revenues. Business customers include about 200 international accounts; large domestic enterprises, government agencies and institutions; and small and medium businesses. Wholesale sells mainly dark fiber to global and regional service providers.

Lumen’s Mass Market access business produced the remaining 26 percent of 2Q22 sales. This unit provides copper- and fiber-based broadband access to 4.6 million subscribers in 16 states in the Pacific Northwest, Mountain states, the Southwest and Florida. It markets gigabit FTTH services under its Quantum Fiber brand and uses the legacy CenturyLink brand for copper-based services. It has 3.1 million fiber passings out of 29 million addressable locations, with 70 percent in urban and suburban areas. Through mid-2022, Lumen is installing Quantum Fiber at a 200,000+ passings per quarter run rate. The company is guiding to midpoint full-year 2022 Adjusted EBITDA of $7.0 billion and capital expenditures of $3.3 billion.

Frontier, headquartered in Norwalk, CT, has operations in 25 upper midwest and northeast, southeast and southwest states. It passes 15.3 million locations, including 4.4 million fiber passings. At the end of 2Q22, Frontier had 3.2 million consumer accounts, of which 1.4 million had fiber broadband connections. Total 2Q22 revenues were nearly $1.5 billion, down 10 percent YoY, from declines in voice, video, and wholesale services.

With a nationwide high-capacity fiber network of 180,000 route-miles, Frontier claims to have 400,000 businesses within 250 feet and 23,000 towers within one mile of that network. In 2021, the company signed a multi-year wholesale deal with AT&T to bring fiber connectivity to large enterprise customers outside of AT&T’s current footprint and for 5G cell site backhaul.

Frontier is upgrading its predominantly copper access plant to fiber in a three-phase strategy. Wave 1 reached 4 million passings at the end of 2021. Wave 2 will reach 10 million passings by the end of 2025 on accelerated FTTH deployments. For 2022, the company expects 1.1-1.2 million fiber builds on $2.5-2.6 billion in capex. Beyond 2025, Frontier says converting the remaining mainly rural 5 million passings to fiber in Wave 3 will be “subsidy-dependent” and will accelerate that conversion, where appropriate.

Lumen and Frontier compete with each other in the transport business but stay in their lanes with access services in their respective local markets. Both companies report their 3Q22 results on November 2.

Reader Interactions