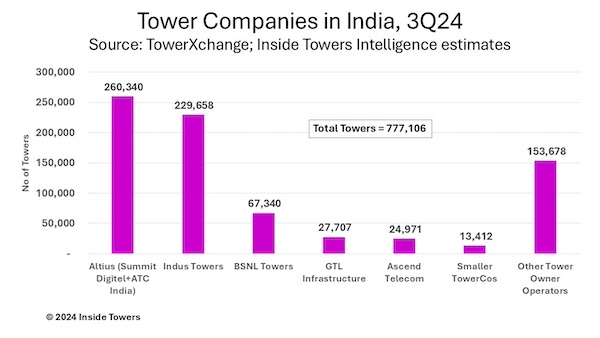

The size and scale of the mobile communications market in India is staggering. India is the most populated country in the world with over 1.45 billion people, according to the U.N. Population Division. Of the total population, there are approximately 1.15 billion mobile subscribers served by publicly held mobile network operators, Reliance Jio, Bharti Airtel and Vodafone Idea along with state-owned Bharat Sanchar Nigam Limited (BSNL). The total base of towers in India tallied 777,106 at the end of September, only lagging state-owned China Tower which has nearly 2.1 million towers in service, according to Inside Towers Intelligence. By comparison, the Inside Towers Database shows a total of about 235,000 communications towers operational in the U.S.

American Tower officially exited its operations in India in September 2024, selling its 77,712 sites for $2.5 billion to Brookfield Infrastructure Partners (NYSE: BIP), Inside Towers reported. Brookfield then combined its existing operations in Summit Digitel, Crest Digitel and Roam Digitel with the acquired ATC India sites, under a new brand name, Altius, to become the leading independent towerco in India and worldwide with 260,340 towers.

Indus Towers (NSE: INDUSTOWERS), originally formed from a merger with Bharti Infra and operating only in India, had been the leading towerco in India and the second largest independent towerco in the world behind American Tower (NYSE: AMT), according to Inside Towers Intelligence. With the ATC India transaction now closed, Indus Towers is the second largest towerco in the world behind Altius, with 229,658 macro towers across India’s 22 telecom circles at the end of the quarter.

In the past 12 months, Indus Towers reported that it added 25,446 towers to its portfolio to reach the latest tally. The towerco also grew colocations by 7 percent YoY to reach 379,236. Average tower tenancy of 1.66 at the end of 3Q24 was down 5 percent from 1.74 in 3Q23 as the company expanded its tower base faster than adding new tenants.

For the quarter, the company reported revenue of $896 million, up 5 percent YoY. It is noteworthy that Indus Towers has managed its operating costs closely over the past year. EBITDA for 3Q24 was $589 million, up 42 percent YoY. AFFO jumped 58 percent YoY to $452 million, while capex dropped by 34 percent YoY to $182 million in the quarter.

The telecommunications tower company business in India has experienced rapid growth, driven by the country’s burgeoning digital economy with increasing mobile data consumption, and the rollout of 4G and 5G services, particularly with expansion into rural areas.

India’s tower business is increasingly consolidated among a few large towercos with Altius and Indus Towers together commanding a 63 percent market share. The Big 3 MNOs – Reliance Jio, Airtel, and Vodafone Idea – rely heavily on these towercos for shared infrastructure as these MNOs focus on operational efficiency and avoid high capex investments in tower assets.

The shift toward 5G is also shaping the industry’s future, with towercos enhancing their infrastructure to support higher data speeds and capacity. This trend is expected to drive further collaboration between towercos and MNOs, with a strong focus on fiberization and densification of networks in urban regions to accommodate new technologies.

By John Celentano, Inside Towers Business Editor

Reader Interactions