SBA Communications (NASDAQ: SBAC) reported 3Q22 results that beat the company’s own estimates. Jeff Stoops, SBA President and CEO comments, “The third quarter exceeded almost all expectations and benefited from the significant level of wireless deployment activity by our carrier customers. Notwithstanding the broader challenging macroeconomic environment, our business was extremely busy, and we were able to again increase our full year outlook across all key metrics.”

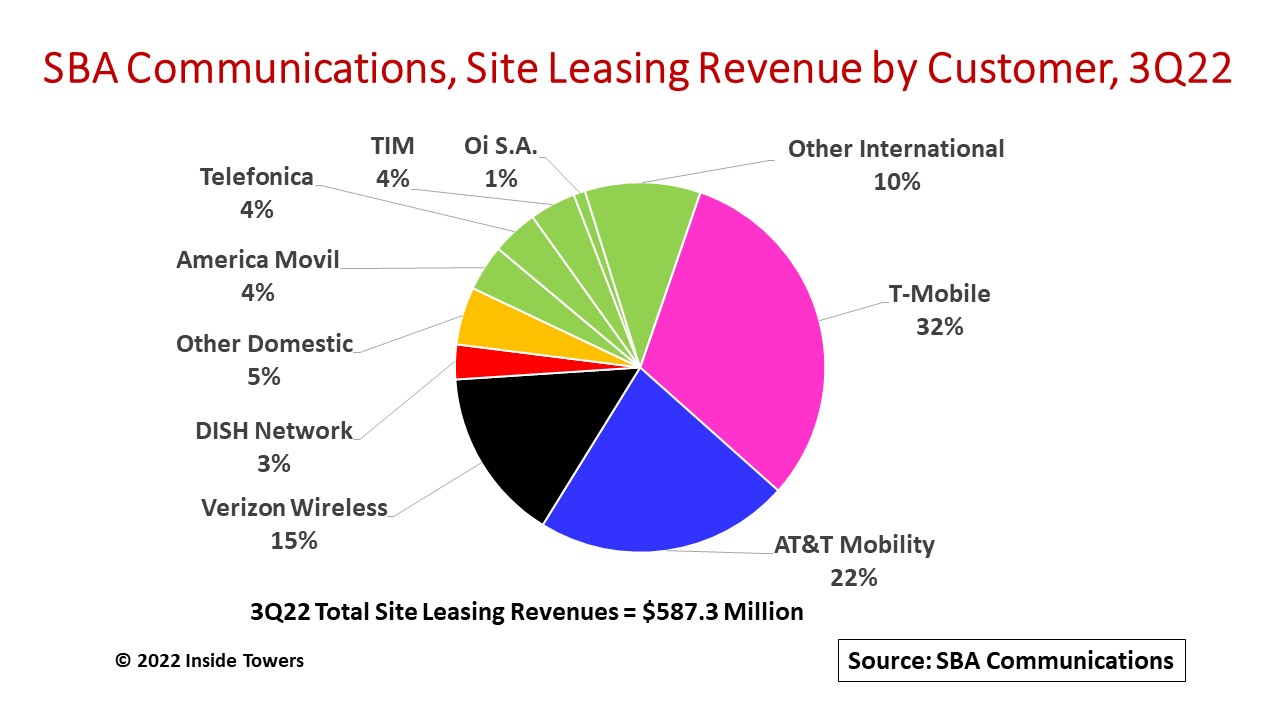

While there was some M&A activity in the quarter, SBA’s customer network deployments are driving its results. Site leasing revenues reached $587.3 million, up 10 percent YoY. The domestic market represents 76 percent of SBA’s total site leasing revenues. The big four carriers – AT&T, T-Mobile, Verizon, and DISH – represented over 94 percent of total incremental domestic leasing revenue signed up during the quarter. T-Mobile, SBA’s single largest customer, accounted for nearly one-third of global site leasing revenues. Part of SBA’s upside is due to less churn than expected with the timing of some of T-Mobile’s merger-related site decommissioning that will shift into 2023.

In the U.S., SBA’s carrier customers remain focused on deploying new mid-band spectrum. T-Mobile was SBA’s most active customer, continuing its nationwide buildout of 2.5 GHz and 600 MHz spectrum. Verizon and AT&T are advancing their C-band and 3.45 GHz mid-band spectrum deployments. DISH was very active in the quarter, with 5G-related new lease and amendment signings. DISH’s focus is getting on air the sites required to meet its June 2023 coverage commitments. SBA expects a new round of leases from DISH once it commences work on its 2025 requirements, as Inside Towers reported. During the third quarter, amendments to existing leases represented 58 percent of domestic bookings, with 42 percent coming from new leases. This trend is expected to carry into 2023.

Internationally, 3Q was SBA’s best organic leasing quarter of the year, with a notable shift toward upgrades at existing sites. Roughly 63 percent of new business signed during the quarter came from amendments to existing leases while 37 percent came from new leases. International leasing activity was highest in Brazil and South Africa, its two largest markets. Brazil, its largest international market, has performed well in 2022. Lease-ups exceeded SBA’s internal expectations for the year, with larger contributions from inflation-indexed escalators even as the Brazilian Real exchange rate was relatively stable.

Carrier deployments are driving SBA’s site development revenues, which jumped 64 percent YoY to $88 million for the quarter. The company expects that high level of site permitting and licensing, and construction activity to carry into 2023.

During 3Q, SBA closed on the previously announced acquisition of 2,632 towers in Brazil from Grupo TorreSur (GTS), acquired another 131 communication sites for $54.9 million in cash and built 113 towers. The GTS sites have 2.1 tenants per tower and offer opportunities for growth, particularly with recent 5G spectrum auctions in Brazil as a driver.

As of September 30, 2022, SBA owned or operated 36,519 communication sites, with 17,401 in the United States and its territories and 19,118 in international markets. In addition, the company spent $9.1 million to purchase land and easements and to extend land lease terms.

SBA sees growth potential in buying more towers, and in constructing new edge facilities. Similar to American Tower’s approach, as Inside Towers reported, SBA says it will pass on tower deals unless the price is right. It believes there is still a gap between seller price expectations and towerco willingness to pay, although SBA acknowledges that prices are trending down.

At the same time, the company has 30 to 40 edge facilities in operation or under construction, though these are not yet materially contributing to revenues. These 6×12- or 10×20-foot shelters are located at towers and are outfitted with HVAC, alarm monitoring and equipment racks. Depending on the size and the scale, these units can cost from $100,000 up to $500,000 in large scale applications. SBA points out that these edge facilities are not being sold on a traditional data center power basis. Rather, they are being used as fiber transmission regeneration sites for cable and fiber companies.

By John Celentano, Inside Towers Business Editor

Reader Interactions