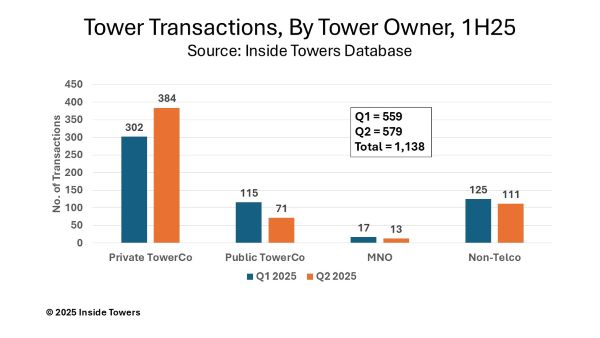

There were 1,138 tower transactions through the first half of 2025, with 559 executed in Q1 and 579 in Q2, according to the Inside Towers Database. These transactions involved four main tower owner (read, buyer) categories: privately held tower companies, public tower companies, mobile network operators and non-telco tower owners. Note that the dollar value of most transactions is not disclosed unless required by public companies.

Understand that transactions in this context are classified in two ways. First, as the sale of a tower from one unrelated party to another. Second, as a reassignment of ownership from one subsidiary or business entity to another within the same organization. For the second category, there are various reasons for moving tower ownership between different entities within the same parent organization – different ownership share and structure among the various entities, towers with different asset valuations allocated to different entities, and tax planning purposes.

The private tower companies were the most active through the first six months, registering 686 transactions or 60 percent of the total for the period. In the first quarter, Vertical Bridge was the big player with 87 transactions including acquisitions from Verizon’s (NYSE: VZ) Alltel and Cellco Partnership entities, AT&T (NYSE: T) entities AT&T Mobility and New Cingular Wireless, Cloud 1 and The Towers. APC Towers had 72 transactions involving transfer of towers to its APC Towers V LLC entity. StratCap Wireless acquired 45 towers from other towercos such as Cloud1, Hemphill, TowerCom and Vogue Towers.

In Q2, Tower Ventures led the private tower companies with 173 transactions, 167 of which were reassignments with its own TVT III, LLC entity. Diamond Communications had 77 transactions with acquisitions from AT&T Mobility and Gateway Tower Holdings. Everest Infrastructure Partners recorded 54 transactions primarily involving 42 acquisitions from Tower Ventures. Vertical Bridge had 45 transactions in Q2 with acquisitions from AT&T Mobility and Verizon Wireless and several of its own entities.

Among the public tower companies, American Tower (NYSE: AMT) was most active in the Q1 with 114 transactions involving a block of 68 towers from APC Towers and another 34 from SBC Towers Holdings with the balance from AT&T Mobility and several regional MNOs. SBA Communications (NASDAQ: SBAC) acquired one tower from CTS Telecom. In Q2, public towerco activity dropped off. American Tower acquired another 67 towers from APC Towers and transferred one to its American Towers LLC entity while SBA picked up a total of three towers from Cellect Towers and ForeSite Towers.

Mobile network operators had 17 transactions in Q1, mainly with AT&T transferring 16 towers to various entities and T-Mobile (NASDAQ: TMUS) executing one tower transaction between its Nextel South Corp and T-Mobile South LLC entities. During Q2, the 13 transactions consisted of AT&T reassigning 12 towers from AT&T Mobility to various other entities and a similar move by T-Mobile involving one tower.

Non-telco organizations were involved with 236 tower transactions through the first half of 2025. Radio and TV broadcasters were the most active with a total of 122 transactions accounting for 52 percent of the total. Utilities and Energy companies engaged in 50 transactions in 1H25 as many of these companies expanded their internal communications and network management operations across their respective operating footprints. Broadband companies acquired 22 towers from various owners in their territory including one tower from AT&T Mobility. The balance of non-telco transactions was a mix of small acquisitions by government agencies, real estate firms, 2-way radio operators, industrial companies and universities.

Reader Interactions