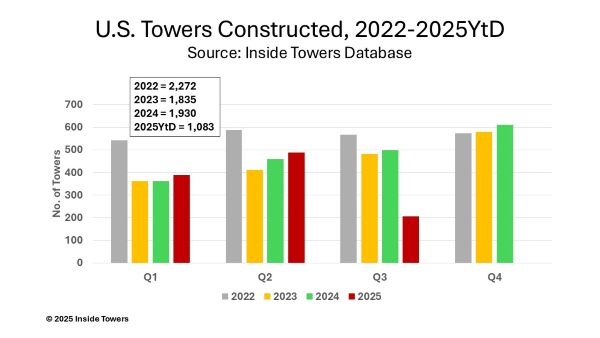

The U.S. wireless market has been supporting an average of over 2,000 new registered towers constructed over the past three years. Activity from the beginning of 2022 through the first half of 2025, suggests the industry is on track to meet or exceed that average again this year.

Since January 1 of 2022 through mid-August 2025, a wide variety of tower companies, network operators and enterprises in vertical markets have constructed a total of 7,120 new registered towers in the U.S., according to the Inside Towers Database. The companies are building these towers for several reasons: for use in their own network; on behalf of a primary tenant such as in a build-to-suit scenario; or, on behalf of another tower company that will establish a master lease agreement with the original tower owner, to be able to lease space on the tower to third-party tenants.

Quarter to quarter, much of the construction activity tends to be back end loaded, both due to weather and budgets. Adverse weather conditions that are prevalent in the winter months in the northern part of the country often slow down tower construction. Activity normally picks up and accelerates through the warmer weather into the end of the year, and generally budget deadlines must be met before year-end.

Companies building towers comprise a wide variety of public and private organizations. Over our coverage period, 126 private tower companies remain most active in building 3,847 new towers out of the total. Tillman Infrastructure led with 905 new builds, followed by Vertical Bridge with 780 and Harmoni Towers with 401. Both TowerCo and TowerCom each built over 100 new towers.

Construction activity among the public tower companies was much more subdued with 313 new towers constructed since 2022. Crown Castle (NYSE: CCI) led with 158 followed by American Tower (NYSE: AMT) with 101, and SBA Communications (NASDAQ: SBAC) with 54 new sites.

Mobile network operators undertook construction of 1,152 new towers where they needed them to expand their network over the past three years. These new builds are generally through subsidiary operations. For instance, Verizon Wireless (NSE: VZ) built 713 towers through entities such as CellCo Partnership, ALLTEL and GTE Mobilenet.

T-Mobile (NASDAQ: TMUS) added 202 towers through its regional operations. AT&T (NYSE: T) garnered 162 new builds through subsidiaries such as New Cingular Wireless and AT&T Mobility Spectrum. UScellular (NYSE: USM) added 73 new towers over the period; the company is now recast as Array Digital Infrastructure (NYSE: AD) in the aftermath of the T-Mobile acquisition, Inside Towers reported.

The non-telco segment of tower operators accounted for 1,808 balance of new towers over the coverage interval. Non-telco segments include state and local governments, utilities and energy companies, railroads, broadcasters, broadband and telephone companies and universities.

By John Celentano, Inside Towers Business Editor

Reader Interactions